Sponsored by DAFgiving360

Sponsored by DAFgiving360

When discussing what your clients might donate to charity, consider appreciated non-cash assets. Your client can always contribute cash, but appreciated non-cash assets held more than a year can help them achieve maximum philanthropic impact and help reduce their taxes.

How can your clients have more to give to charity?

If your clients itemize deductions on their tax returns instead of taking the standard deduction, donating non-cash assets can help them unlock additional funds for charity in two ways.

First, it potentially eliminates the capital gains tax that would be incurred if a client sold the assets themselves and donated the proceeds, which may increase the amount available for charity by up to 20%.

Second, they may claim a fair market value charitable deduction for the tax year in which the gift is made and may choose to pass on that savings in the form of more giving.

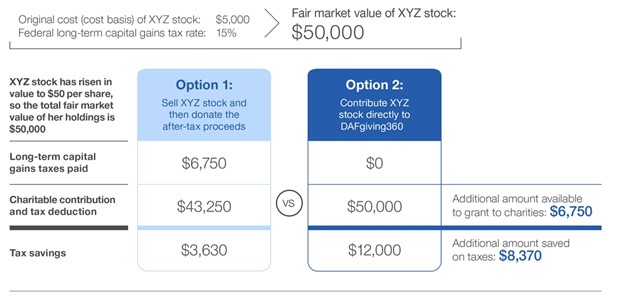

Let's say your client owns XYZ stock with a current fair market value of $50,000. The stock has gained $45,000 in value over the years since it was purchased it for $5,000. A direct contribution of the stock to a donor-advised fund or other charity (option 2), in comparison to a sale and donation of after-tax proceeds (option 1), may free up an additional $6,750 to grant to charities and potentially provide additional tax savings of $8,370.

This hypothetical example is only for illustrative purposes.

The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor's income tax rate (24% in this example), minus the long-term capital gains taxes paid.

Are your clients interested in a specific type of non-cash asset?

Share our overview article or any of the choices below to see asset-specific guidelines.

- Publicly traded securities Learn more

- Restricted stock Learn more

- Privately held business interests Learn more

- Real estate Learn more

- Cryptocurrency Learn more

- Fine art and collectibles Learn more

- Life insurance Learn more

- Equity compensation awards Learn more

- Post-IPO stock Learn more

- Private equity fund interests Learn more

Please be aware that gifts of appreciated non-cash assets can involve complicated tax analysis and advanced planning.

A donor's ability to claim itemized deductions is subject to a variety of limitations depending on the donor's specific tax situation. Consult a tax advisor for more information.

Contributions of certain real estate, private equity, or other illiquid assets may be accepted via a charitable intermediary, with proceeds transferred to a donor-advised fund (DAF) account upon liquidation. Call DAFgiving360 for more information at 800-746-6216.

DAFgiving360™ is the name used for the combined programs and services of Donor Advised Charitable Giving, Inc., an independent nonprofit organization which has entered into service agreements with certain subsidiaries of The Charles Schwab Corporation. DAFgiving360 is a tax-exempt public charity as described in Sections 501(c)(3), 509(a)(1), and 170(b)(1)(A)(vi) of the Internal Revenue Code.

Contributions made to DAFgiving360 are considered an irrevocable gift and are not refundable. Once contributed, DAFgiving360 has exclusive legal control over the contributed assets.

DAFgiving360 does not provide legal or tax advice. Please consult a qualified legal or tax advisor where such advice is necessary or appropriate.

© 2025 Donor Advised Charitable Giving, Inc. All rights reserved. (0125-GHWN)