2025 is set up to be an interesting year for financial markets. Equities have had a stellar 2-year run, Trump 2.0 commences, global central banks are cutting interest rates, and the U.S. economy remains resilient. Despite the positive momentum and tailwinds, 2025 is sure to provide some surprises, uncertainty and volatility, which will make it important to try and balance return opportunities and risk.

Here are five pressing questions that will help determine how financial markets fare in 2025.

1. How Will the Fed Handle Inflation in 2025?

The direction of inflation will continue to be a hot topic in 2025. Prices have come down sharply in the past two years. However, the journey to 2% has stalled and will be bumpy and uncertain. The biggest question regarding monetary policy will be the Federal Reserves’ (Fed) policy regarding inflation - will the Fed risk letting inflation run above its 2% target while continuing its rate-cutting cycle? Or will the Fed risk slowing the economy by halting its cutting cycle early in its quest to bring inflation down to 2%? Also playing a role in the direction of inflation is the Republican-controlled White House and Congress.

If Trump is able to quickly implement his pro-growth policy initiatives of cutting taxes, implementing trade tariffs, reduced immigration and slash government regulations, it will make the Fed’s job of reaching 2% inflation more difficult. In addition to boosting economic growth, the policies are likely to push interest rates higher.

Due to Trump’s initiatives, a solid labor market and relatively healthy consumer, I believe the economy will continue to stay resilient in 2025. The positive economic growth combined with additional inflationary pressures and fiscal spending will result in the Fed halting its rate cutting policy early. After cutting interest rates by a full percentage point from its peak, (at the time of this writing the fed funds rate sat at 4.25% – 4.50%), the Fed is forecasting two more 25 bps cuts in 2025 which is a big pull back from previous Fed projections of four more cuts. The Fed is now forecasting 2.5% inflation (PCE inflation) in 2025 which is much higher than most were expecting. I believe the economy will remain stable and inflationary pressures to remain elevated due to the items listed above. The primary risk is that inflation heats up again, which is why I believe the Fed will remain cautious and halt its rate cutting cycle earlier than expected and only cut rates, at most, two more times in 2025.

2. Can Equities Continue Their Streak of +20% Returns in 2025?

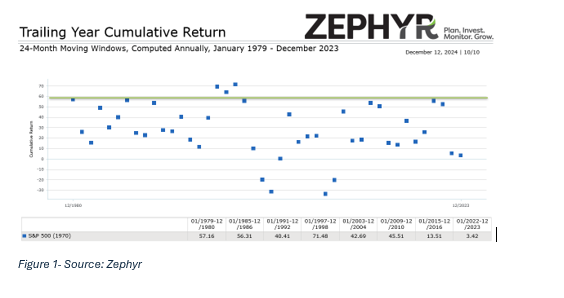

Equities have had a very strong 2-year run, and prior to the recent December selloff the S&P 500 index was on the cusp of producing a +60% cumulative return during the 2-years, 2023 and 2024. If the index does rally, a cumulative 2-year return of +60% is not out of the question and will mark just the fourth time since 1970 that the S&P 500 index produced a +60% cumulative return during consecutive years (Figure 1).

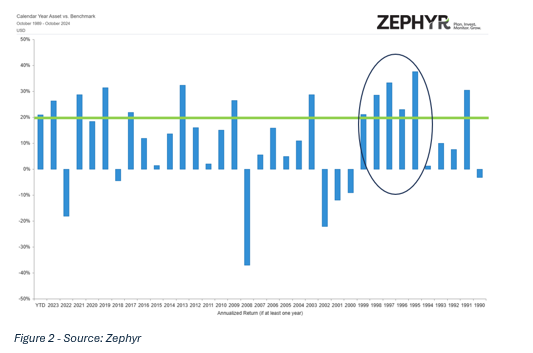

The last time equities produced this strong of back-to-back calendar year returns were during the late 90s when the S&P 500 index posted five consecutive years of +20% returns (1995, 1996, 1997, 1998, 1999) (Figure 2).

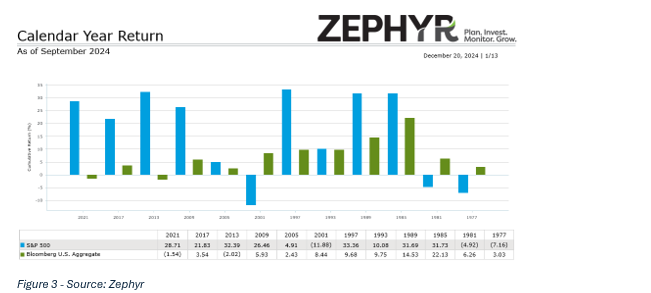

Additionally, equities tend to perform well during inauguration years, regardless of what party is in control. In fact, the S&P 500 index posted returns of over 20% during the last four inauguration years (2021, 2017, 2013 and 2009). Furthermore, there have been 12 inaugurations since 1977, in which four of those inauguration years resulted in over 30% returns for the S&P 500 index (2013, 1997, 1989, 1985). The last time we had an inauguration for the newly elected Donald Trump, the S&P 500 index subsequently posted a +21.8% return (2017) (Figure 3).

While history shows that 2025 should be a good year for equities, there are some reasons to tamper expectations for another year of +20% returns. While Trump’s pro-business policies could boost economic growth and result in higher equity prices; these policies could result in inflationary pressures like higher wages and pushing yields higher. These policies could also result in the U.S. federal debt advancing well above its current $36 trillion level and pushing interest rates higher.

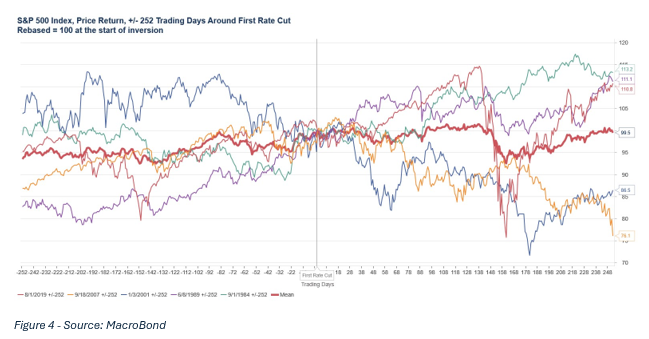

The other primary driver to equity performance is monetary policy. Equity performance during a rate cutting cycle is mixed and largely depends on the health of the economy. During the last five rate cutting cycles, the average return for the S&P 500 index was slightly negative during the 12 months following the first rate cut (Figure 4). Meanwhile, stocks typically perform well during a non-recessionary rate-cutting cycle while underperforming during a recessionary cutting cycle. The current fall in interest rates has been driven by the fall in inflation rather than a recession, which has been positive for stocks. However, an environment where rates fall further due to recessionary pressures, or if inflation starts to climb, stocks will be negatively impacted.

Pro-growth fiscal policies, easing monetary policies and broadened corporate earnings growth will be positive for equities. However, stretched equity valuations, uncertainty around implementation of fiscal policies, potential for a Fed mistake, inflation and yield volatility will make it unlikely equities achieve +20% returns for a third straight year. With that being said, the biggest risk for equities is a Fed mistake and changing messages as it continues its fight against inflation.

3. Who Wins the Fixed Income Tug-of-War

2025 will provide opportunities for fixed income investors, however, it won’t be without some turbulence. Normalized interest rates, tight spreads, attractive yields and a positively sloped yield curve will be a positive for fixed income investors. However, interest rate risk will be the biggest risk to fixed income in 2025 and one that financial advisors must try and balance.

While credit risk and duration are the primary drivers of bond performance, 2025 performance will be driven by duration, or interest rates. Bonds perform well during inauguration years and rate cutting cycles; however, Trump’s policies are likely to offset some of the tailwinds bond prices may gain from falling interest rates.

Despite the expectations for a higher federal deficit and increased inflationary pressures due to the above-mentioned policies under President Trump, I think 10-year Treasury yields will continue to be volatile but settle near 4%. Adding to yield volatility will be uncertainty and fluid forecasts from the Fed. However, the volatility will provide investors with an opportunity to capitalize on duration. Most importantly, it will be important for financial advisors to be able to balance the ability to capitalize on lower rates while also protecting against the potential for economic and credit volatility.

4. Will the Gap Between the “Haves” and “Have Nots” Narrow?

It has been well-reported that the technology sector has been the primary contributor to S&P 500 returns. In fact, the information technology sector contributed 38% of the S&P 500 index’s YTD return of 28.07% through November 29. More specifically, the magnificent 7 contributed 12.5% of the 28.07% total return. The gap between the “haves” and “have nots” was even more pronounced in 2023, when the information technology sector contributed over 55% to the S&P 500 index’s 26.3% return (Source: S&P Global). This top-heavy performance attribution hasn’t hurt the overall market; however, the health and stability of the market will benefit from an increase in market breadth and inclusion.

Markets are expecting S&P 500 corporate earnings to increase by 15% in 2025, while forecasters are expecting the strong earnings for the mega-tech companies to slow some. Lower borrowing costs will benefit a wider swath of companies and will result in more capital expenditure which will benefit materials and industrial sectors. Financials should also receive a boost from the steepening of the yield curve, deregulation and increased loans. This broadening of earnings, combined with solid economic fundamentals, and easing monetary policies will help increase the breadth of market leaders.

Lastly, I expect value-oriented names to benefit from lower bond yields as the income from dividend paying value stocks become more attractive to income seeking investors. While I do believe the breadth of the equity market will increase resulting in a more stable market, tech stocks, particularly AI centered names and mega-tech stocks will remain popular.

5. Should We Worry About Asset Allocation in 2025?

Diversification typically comes under fire during times of financial crisis, exactly when diversification is needed most, as all investors run for the exits. Diversification has also come under fire since the COVID pandemic as stocks have outperformed bonds, growth over value, and domestic over international. The steep 2023 sell off in bonds also resulted in the so-called “death” of the 60-40 portfolio.

Due to monetary policy uncertainty and the potential for a Fed mistake, the red wave that is poised to take over Washington, and the normalizing financial market backdrop, I expect the benefits of asset allocation will win in 2025.

While some investors may be able to achieve their financial goals by overweighting the winners like mega tech stocks or AI related companies. It will be important for financial advisors to re-evaluate their client’s risk tolerances, objectives and goals in 2025. Building diversified asset allocations will help improve the probability of client’s achieving their goals in a less turbulent manner.

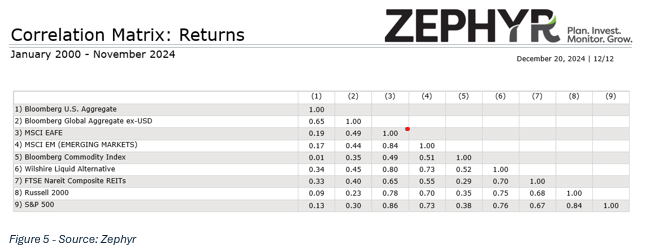

The benefits of asset allocation will be maximized as interest rates bounce around on their way to settling into their neutral levels, increased breadth of equity winners, and asset class correlations reverting to their long-term averages (Figure 5). Bonds will regain their important role as an investment portfolio diversifier and shock absorber to equity volatility. The increased accessibility to alternatives through SMAs, ETFs and interval funds will help make diversified asset allocations more achievable for retail investors, resulting in less turbulence during a very uncertain year.

In closing, 2025 is building up to be a very interesting year with a lot of uncertainty due to a new political landscape and monetary policy. Regardless of what your expectations or forecasts are, it’s important to focus on asset allocation and your clients’ long-term goals and objectives. While 2025 could end up being a solid year for investors, it’s not time to make big wagers, but rather stay aligned with your client’s investment objectives.

Ryan Nauman is the Market Strategist at Zephyr