Personalized financial advice, goals-based planning and behavioral coaching are key areas that investors value in their advisors, according to a new research study from Morningstar.

The report, put together by some of Morningstar’s behavioral researchers, compiles findings from several separate studies the group has undertaken in recent years. In a pair of surveys fielded in 2018 and 2024, Morningstar asked investors to rank common advisor attributes, from most valuable to least valuable. Additionally, the firm asked clients how much they would be willing to pay an advisor for different potential services. Lastly, it compiled answers on why investors hired and retained their advisors.

“Each study is shining a different light on what clients value and trying to uncover the full truth,” said Samantha Lamis, a senior behavioral researcher with Morningstar and one of the study’s primary authors. “We wanted to give advisors the language to understand what investors value. Advisors know clients want peace of mind, but do they know what that entails?”

The 2018 and 2024 studies on advisor attributes both found that reaching personal financial goals topped investors’ lists, followed by maximizing returns and advisors having “relevant skills and knowledge” among the 15 attributes respondents could rank. Overall, the findings from the two studies were consistent in the two studies.

“The rankings study is helpful in that it gives us what is top of mind,” added Danielle Labotka, a behavioral scientist with Morningstar, and another of the report’s primary authors. “As we bring in these other pieces, we get deeper into the picture in a way that we wouldn’t get in one study alone.”

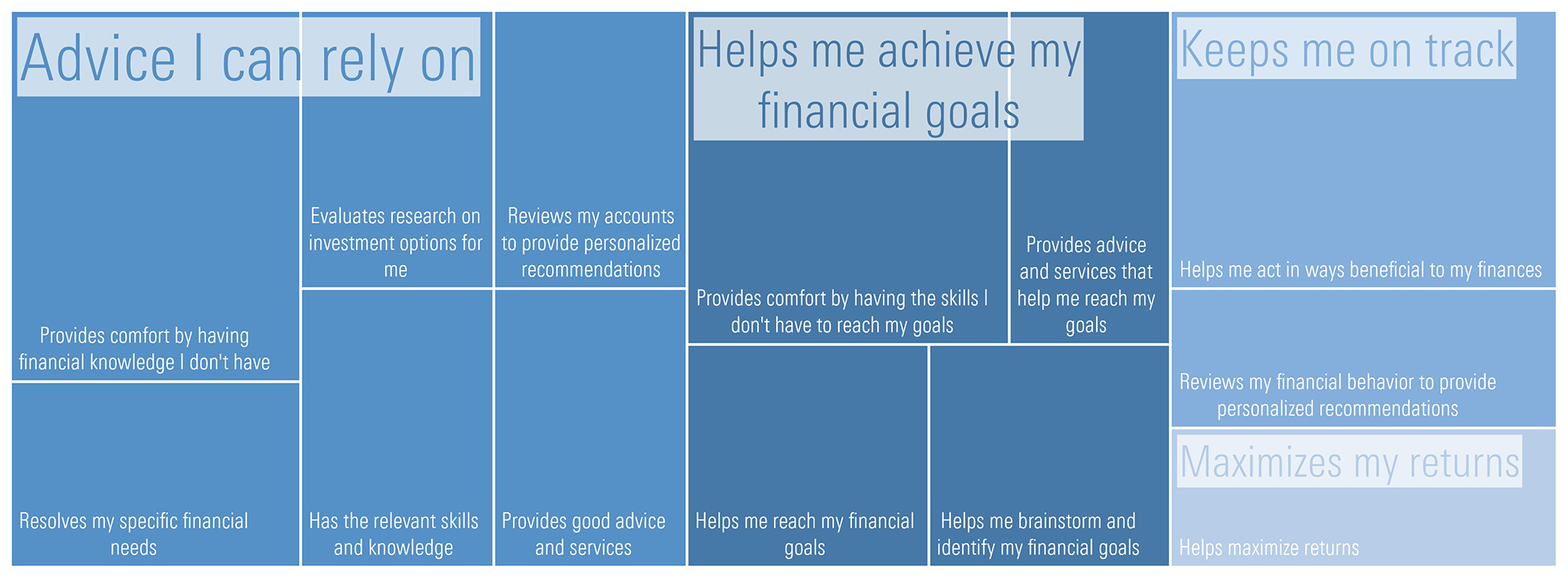

After incorporating the other research, Morningstar produced a “mind map” of how clients think about the value of their advisors.

In terms of practical advice, Lamas and Labotka said the studies underscore the importance of providing personalized financial planning structured around life goals (and not just financial thresholds). Part of that is making clear to clients a breakdown of how the plan is catered to individuals so they don’t feel like they are just being given boilerplate suggestions.

“Clients oftentimes, if they don’t see how you are creating a plan, they are not going to understand that it’s something intended and tailored to them,” Lamas said. “You have to give clients a chance to understand what you considered in their financial plan and their portfolio. It will help them see this is something they can trust and not something you just grabbed off the shelf and said, ‘This should be good enough for you.’”

One of the trickier aspects of the advisor/client relationship is behavioral coaching, especially when it comes to things like risk tolerance or reacting to market turbulence. However, clients can also bristle at coaching that they perceive as criticism.

“People don’t like it if it’s implied that they are making mistakes. They don’t like to hear negative things about themselves. We all want to believe we are the heroes of our own stories,” Lamas said.

Lamas and Labotka said that using tools or suggesting processes can be forms of behavioral coaching. For example, advisors can suggest trading rules, such as waiting a set number of days before making a move, to avoid overreacting to market dips or chasing trendy assets. It’s also easier to get buy-in by providing concrete examples of what’s working with other clients.

“Sometimes people may need to take on more risk then they want,” Labotka said. “Are they going to be able to handle that? There are a lot of different places where clients struggle because they don’t know how to be prepared for things like volatility and risk. Advisors can talk to clients and give guidance on how to handle those situations.”

Another area where clients may need to focus on setting expectations is on returns.

“It’s important to set expectations early on in the relationship,” Lamas said. “There are also cases when reaching goals is not about returns. But if you have a client that’s persistent in focusing on returns, it might be a good example of that client not being a good fit.”