As most estate planners know, intrafamily loans, including loans to intentionally defective grantor trusts (IDGTs), offer a straightforward and efficient way to transfer wealth within a family. There are several benefits to such loans, not least that they can be extended at what are effectively below-market interest rates. Intrafamily loans are also versatile in terms of structure. They allow, for example, interest-only balloon payments at the end of the loan term, amortization of principal and interest over the term or lump-sum repayments at the loan’s maturity. As transactions between family members are subject to heightened scrutiny and presumed to be gifts,1 any intrafamily loan should be documented and treated in a manner consistent with a bona fide debtor-creditor relationship.2 In addition, the loan documents should be drafted to avoid the application of Internal Revenue Code Section 7872, which treats below-market loans as gifts for gift tax purposes.3

Most planners, whose “mastery of this area often begins and ends with ... keeping a loan from being characterized as below-market under section 7872,”4 rely almost exclusively on the applicable federal rate (AFR) and therefore on the fixed rates provided under IRC Section 1274 to avoid any adverse tax consequences from intrafamily loans. As discussed in more detail below, to maximize estate planning and tax benefits, taxpayers using intrafamily term loans will generally opt for the lowest possible AFR for the longest available term.5 Unfortunately, the lowest AFR is typically associated with the shortest loan term length, while the highest rates are typically reserved for those loans with longer time horizons, usually putting an ideal loan arrangement—one that charges the lowest rate for the longest time horizon— seemingly out of reach.

Variable rate term loans, not typically one of the techniques in a planner’s toolbox, may place such ideal loans within reach. As explained below, they allow the lender to charge what’s typically the lowest rate (the short-term AFR) for the longest available time horizon (more than nine years). Proposed regulations (proposed regs) interpreting Section 7872, now nearly 40 years old, provide a framework for achieving this intrafamily loan nirvana. Using data analysis, we show that a variable rate term loan structure would have been the most tax-efficient choice for most of the last 40 years, though recent changes to the interest rate environment have somewhat complicated this analysis. We conclude by outlining considerations for which loan type—fixed or variable—to choose for clients going forward.

Section 7872

Before 1984, the value of a promissory note for gift tax purposes was based on all facts and circumstances, including whether the interest rate charged on the note was similar to the going market rate for similar loans.6 Thus, if a parent made a term loan to a child and failed to charge a fair market interest rate, the value of the note received by the parent was deemed less than the amount lent to the child. As the gift tax applies to exchanges for less than full and adequate consideration in money or money’s worth,7 the difference between what the parent transferred and the value of the note received in exchange was treated as a taxable gift. Put another way, intrafamily loans were treated like any other exchange between family members (other than those made in the ordinary course of business8): If not made for full and adequate consideration, they constituted gifts.

Surprisingly, Congress intervened in 1984 and enacted Section 7872, which partially displaces the fair market value methodology for determining the value of a term note issued in exchange for an intrafamily loan. Section 7872 was introduced in the wake of the U.S. Supreme Court’s decision in Dickman v. Commissioner,9 which held that the use of a lender’s money is a “valuable property right” that’s considered to be transferred for gift tax purposes when a lender makes a demand loan for no interest. Dickman didn’t address the gift tax consequences of term loans; indeed, the parties in Dickman, as in prior cases addressing the gift tax consequences of interest-free demand loans,10 apparently agreed that a zero interest term loan would be a gift.11

Nevertheless, Congress chose in Section 7872 to address the treatment of all “gift loans” (as well as other categories of loans12), including both demand loans, which were at issue in Dickman, and term loans, whose treatment had been well-settled both before and after Dickman. In the case of a term loan, Section 7872 codifies the principle, already established by case law,13 that a term loan is a gift to the extent that the amount lent exceeds the present value of the payments required to be made under the terms of the loan.14 At the same time, Section 7872 breaks from traditional valuation principles and provides that present value shall be determined using a discount rate equal not to prevailing fair market rates of interest but rather the AFR.15 As the Joint Committee on Taxation observed, Section 7872, for the first time, permitted taxpayers to make term loans and charge interest at a rate—namely, the AFR—that’s below market.16 Case law subsequently confirmed that Section 7872 effectively permits family lenders to charge the AFR on a term loan without being considered to have made a gift.17 Ironically, the IRS’ reward for its impressive victory in Dickman was a statute permitting family members to make loans to each other and charge below-market interest.18

A year after the enactment of Section 7872, Treasury issued proposed regs interpreting its provisions.19 Forty years later, these regulations have yet to be finalized. Nevertheless, they should be considered binding on the IRS.20 The proposed regs generally provide that when a loan provides “sufficient stated interest,” there won’t be imputed gift or income tax consequences for the loan.21 As long as the loan provides for interest on the outstanding loan balance at a rate no lower than the AFR, based on a compounding period appropriate for that loan, the loan will be treated as having sufficient stated interest.22 Thus, a below-market “gift loan” is one in which interest is charged at a rate below the appropriate AFR. In the case of a below-market gift loan that’s also a term loan, Section 7872 treats the lender as making a gift equal to the face amount of the loan, less the present value of the payments due under the loan.23 Section 7872 may apply to individuals or entities, doesn’t distinguish between related or unrelated parties and applies whether the loan is direct or indirect.24

Crucial to determining whether a loan falls under Section 7872 is the AFR, which serves as the minimum rate of interest chargeable on intrafamily loans to avoid the application of Section 7872. The AFR isn’t the mandated rate; often, a higher interest rate might be charged in various scenarios, such as demand loans, self-canceling installment notes or to mitigate the “burn” of grantor trust status. The IRS publishes the AFR monthly, based on the average yield for certain treasuries. Several different rates are published, broken down by the length of the loan and how frequently the interest is compounded. For term loans of three years or less, Section 1274(d) requires the short-term rate; for term loans of more than three years and up to nine years, the mid-term rate is required; and for term loans of greater than nine years, the long-term rate is required. In most economic environments, the short-term rate will be lower than the mid-term rate, which will be lower than the long-term rate.25 Each of those rates is subdivided further depending on whether the interest is compounded annually, semiannually, quarterly or monthly, with more frequently compounded interest yielding lower rates.

In the estate-planning context, if the assets that a family member or trust acquires with loan proceeds produce income and appreciation at a rate above the stated interest rate on the note, the difference or arbitrage is the amount of wealth that can be transferred without gift tax consequences. Because the AFR is the minimum rate of interest that can be charged without triggering Section 7872, the chosen AFR rate is effectively the hurdle rate for a successful wealth transfer. Thus, a lower AFR provides a greater chance that the invested loan proceeds will beat the hurdle rate and transfer wealth to family or trusts for their benefit. In addition, unlike its cousin, the grantor retained annuity trust (GRAT), which typically uses a shorter time period to capture upswings of a market cycle, an intrafamily loan often uses a longer period to allow the income and appreciation to eclipse the hurdle rate and produce a tax-free transfer of wealth to the borrower.

Herein, though, lies a conundrum for planners and clients when trying to maximize the benefits of an intrafamily loan. An ideal loan structure would provide the lowest rate for the longest term. In the intrafamily context, the lender and borrower generally prefer lower rates. The borrower prefers to keep as much of the loan proceeds for as long as possible to maximize the amount available for gift tax-free wealth transfers; thus, borrowers generally prefer lower rates to prevent depletion of the borrower’s assets (often referred to as “leakage”). The lender similarly usually prefers a lower rate in an intrafamily loan because the lender will want to minimize both the income tax (outside of the IDGT context) and estate tax burdens associated with interest payments.

Unfortunately, however, choosing a lower rate generally means choosing a shorter loan term.26 For instance, in January 2003, the semiannually compounded short-term rate was 1.8%, the mid-term rate was 3.4%, and the long-term rate was 4.84%. But the short-term rate generally only allows the borrower up to three years to accumulate gains with the loan proceeds, while the longest term typically requires charging a substantially higher rate (more than 250% higher in this case). Estate planners often solve this conundrum by splitting the difference and choosing a loan term of nine years, allowing them to use the mid-term rate. This compromise allows the borrower to charge a rate that isn’t the highest published AFR and gives the lender a moderately long term (up to nine years) to accumulate gains on their books. However, this strategy generally sacrifices the best rate and a longer term to achieve this middle ground. As discussed below, variable rate term loans may be a way to achieve the best of both worlds.

Variable Rate Term Loans

Variable rate term loans may achieve intrafamily note nirvana by combining the lowest possible rates with the longest possible terms. Section 7872 doesn’t mandate that intrafamily loans must exclusively use fixed AFR rates; indeed, the proposed regs under that section even anticipate using variable rates. These regs suggest that loans with interest pegged to an objective market index rate will be seen as having sufficient stated interest—that is, Section 7872 doesn’t apply to the loan27—provided the rate isn’t lower than the AFR when the loan originates.28

The proposed regs give five examples of objective indices: prime rate, AFR, the average yield on government securities as reflected in the weekly Treasury bill rate, the Treasury constant maturity series and the London Inter-Bank Offered Rate.29 That is, as long as the chosen variable rate—at its inception—is equal to or exceeds the AFR, such loans won’t run afoul of Section 7872. For example, a loan that charges a variable rate equal to the prime rate at Bank XYZ will be treated as having sufficient stated interest if the prime rate at Bank XYZ is equal to or higher than the AFR in effect when the loan was implemented. Presumably, although it didn’t exist at the time of the proposed regs, the now widely used secured overnight financing rate would also qualify as an objective index.

To determine which AFR is used to test the initial variable rate, the regulations require looking at the frequency at which the loan’s interest rate, if variable, is reset according to its benchmark index. Variable rates tied to a specific index will naturally fluctuate over time, and the interest rate applied to the loan must be adjusted accordingly to reflect the changes in the index over time. Thus, variable loans typically include specific adjustment periods to reflect the most recent changes to the specific index to which it’s tied. For example, if a loan’s interest is linked to the prime rate, the loan agreement must specify how regularly the rate will adjust to the current prime rate. This could be annually, biennially or on another specified schedule. Thus, a loan might be designed to update its interest rate based on the prime rate on the first day of each year or it may recalibrate to the then-current prime rate every other year or at another predetermined frequency.

The proposed regs provide that, for variable rate term loans, the appropriate AFR used to determine whether the loan has sufficient stated interest is determined by the interval between rate recalculations, not by the loan’s maturity date. The regs treat the term of the loan as equal to the longest period that exists between the dates that, under the loan agreement, the interest rate charged on the loan must be recomputed.30 An example provided in the regs illustrates this rule:

In the case of a 10-year term loan that charges interest at a variable rate equal to a rate two points above the prime rate and that requires that the interest rate be adjusted every 18 months to reflect any changes in the prime rate, the AFR is determined by treating the loan as having a term of 18 months rather than a term of 10 years. Accordingly, the short-term AFR rather than the long-term AFR shall apply.31

That is, even if the note term is longer than nine years and would require a long-term AFR if the rate were fixed, because the variable rate requires that interest be recomputed more frequently than every three years, the short-term rate is the applicable rate for determining whether there’s sufficient stated interest, no matter the stated length of the loan.

These rules open the door for more optimal intrafamily loan strategies, permitting long-term loans to enjoy the benefits of the usually lower, short-term AFR. Because the AFR is one of the objective indices to which a variable rate can be tied, a variable loan could be linked to the short-term AFR, provided that the interest on the loan is recomputed at intervals not exceeding three years.32 Such a loan would have sufficient stated interest, because the rate charged on the loan would never be lower than itself on the loan origination date. Even if the length of the note exceeds nine years, the short-term AFR is the applicable rate to determine whether there’s sufficient stated interest, because the variable rate is recomputed based on the then-applicable short-term AFR every three years or less.

Consider an example to showcase the potential benefits of a variable rate intrafamily loan. Assume Borrower executes a promissory note that requires the repayment of interest using a variable rate based on the then-applicable short-term AFR, recomputed every year until the note matures in Year 15. To determine whether there’s sufficient stated interest, the proposed regs require that the rate of interest be based in whole or in part on an objective index, including the AFR, and that the rate fixed by the index is no lower than the AFR on the date the loan is made. Here, the rate is based on the short-term AFR. Because the loan requires recomputing the interest every year, the appropriate AFR is the short-term AFR; therefore, this loan has sufficient stated interest, because the variable rate—that is, the short-term AFR—by definition, can’t be lower than itself when the loan is implemented. Under this structure, Borrower can effectively use the loan for arbitrage opportunities, benefiting from the interest rate being anchored to the short-term AFR rather than the typically higher long-term AFR. In effect, the parties have created a long-term loan with a short-term rate.

A retrospective analysis reveals the financial and tax benefits of choosing a variable rate approach over a traditional fixed rate. For example, assume the loan, established 15 years ago, was settled in March this year. In March 2009, the short-term AFR stood at 0.72%, compared to the long-term rate of 3.49%. Under a long-term fixed rate, Borrower would have incurred $523,500 in interest per $1 million borrowed over the 15 years. Contrast this with interest of just $161,500 per $1 million borrowed on the variable rate loan structure. The savings here scale linearly, so for a $10 million principal note, more than $3.3 million of leakage would have been avoided over the term of the loan if the variable structure was chosen, potentially saving Lender $1.44 million in estate taxes.

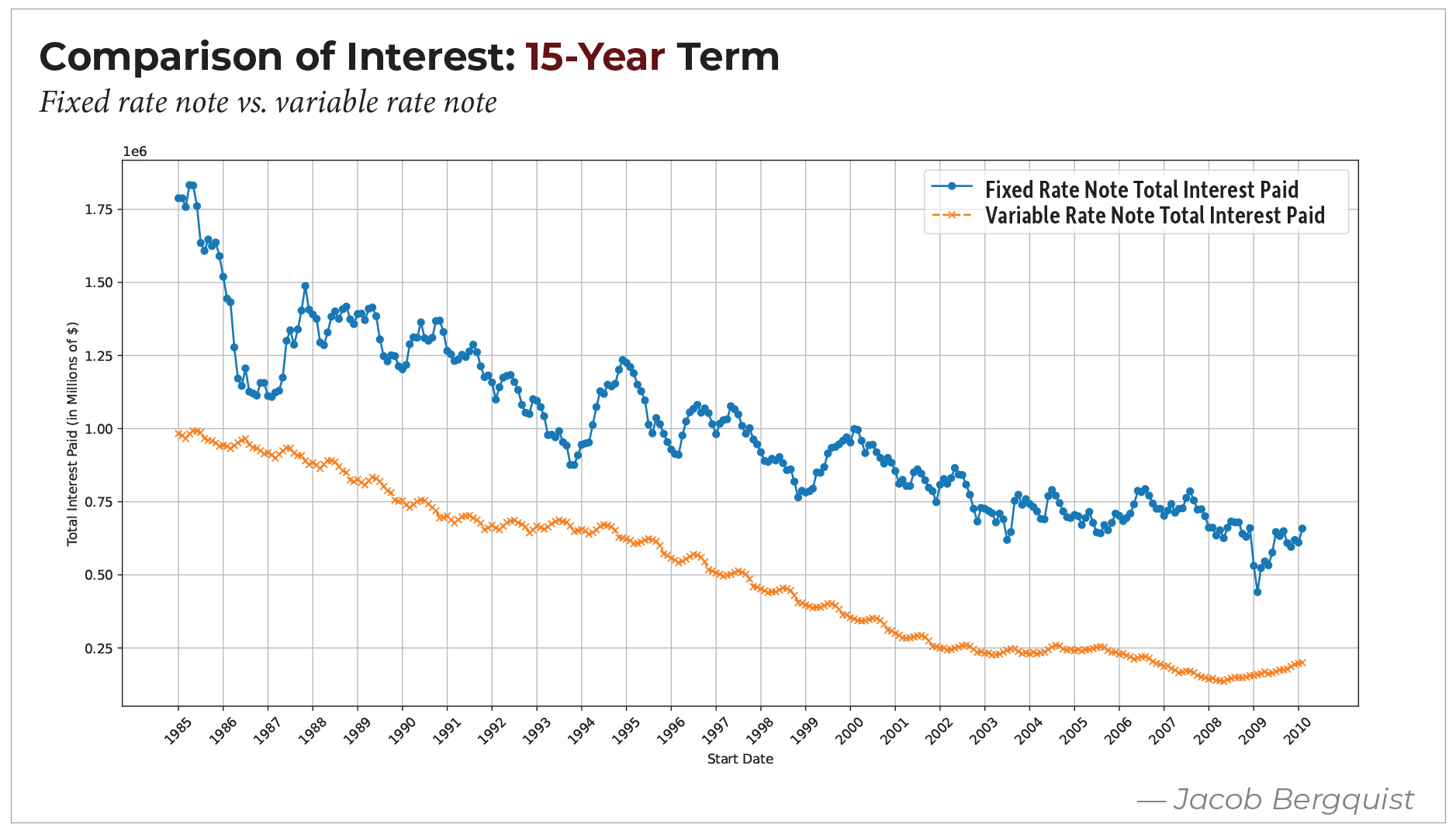

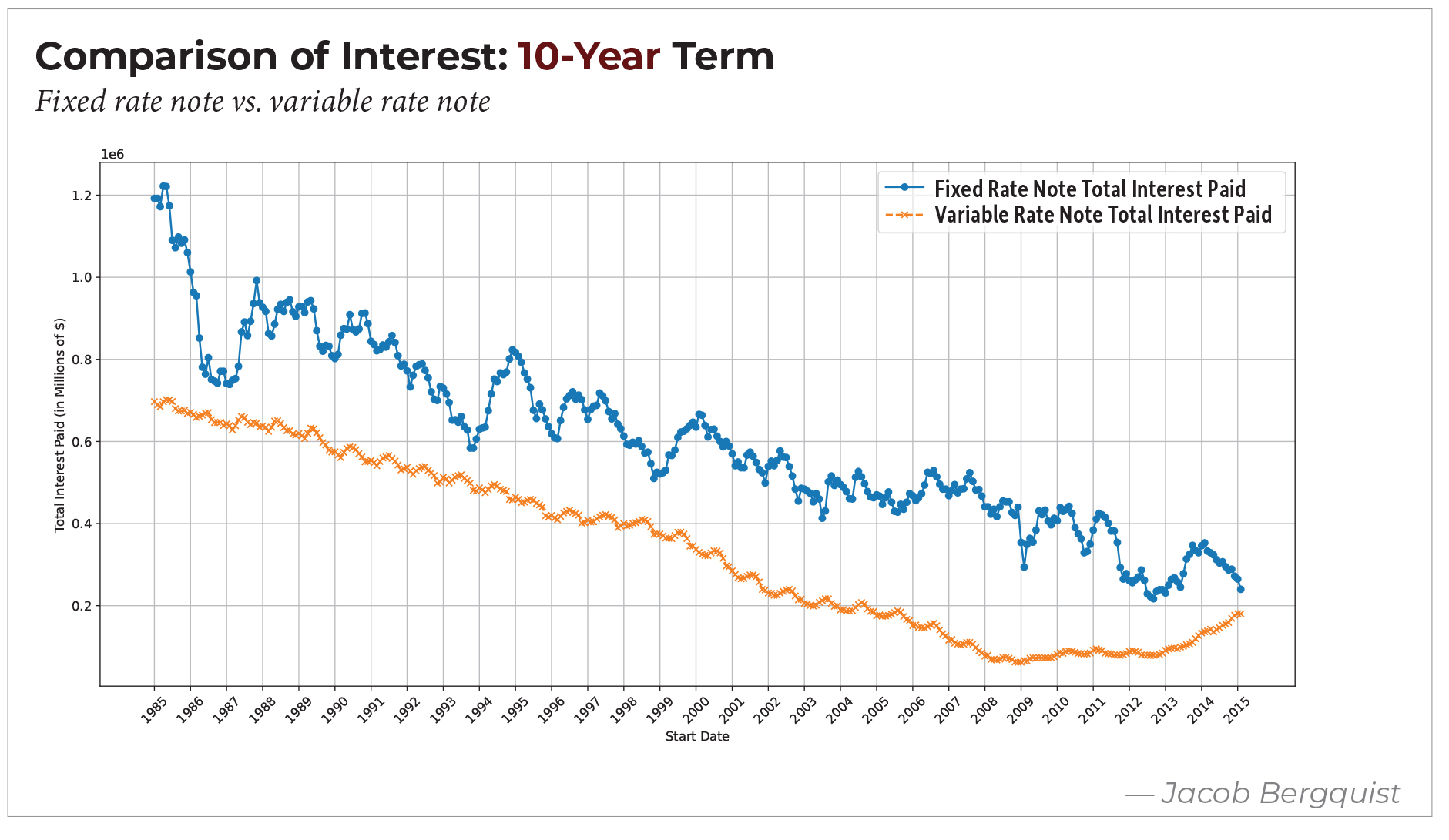

Indeed, as seen in “Comparison of Interest: 15-Year Term,” this page, all 15-year variable rate term loans tied to the short-term AFR and implemented between January 1985 (when the AFR began) and February 2010 would have prevented substantial leakage. “Comparison of Interest: 15-Year Term” looks back in time and implements two different loans at the start of every month from January 1985 to February 2010, one using the fixed long-term and another using a variable rate that computes the interest using the short-term AFR each year. The chart compares the total interest paid between those two loans during the full 15-year term. For example, in January 2000, a borrower who executed a promissory note with a 15-year term using the fixed long-term AFR would have paid $952,500 of interest on a $1 million principal note. Contrast this result with a borrower who executes a promissory note with a 15-year term using a variable rate tied to the short-term AFR that computes the interest each year. That borrower would have paid only $353,600 of interest on a $1 million principal note. The gap between the blue and orange lines is the savings a borrower would yield between these two loan structures on $1 million principal notes. No matter when the loans were implemented during this period, the variable loan would always yield savings for the borrower (and thus the lender). This is similar for 10-year term loans (See “Comparison of Interest: 10-Year Term,” this page).

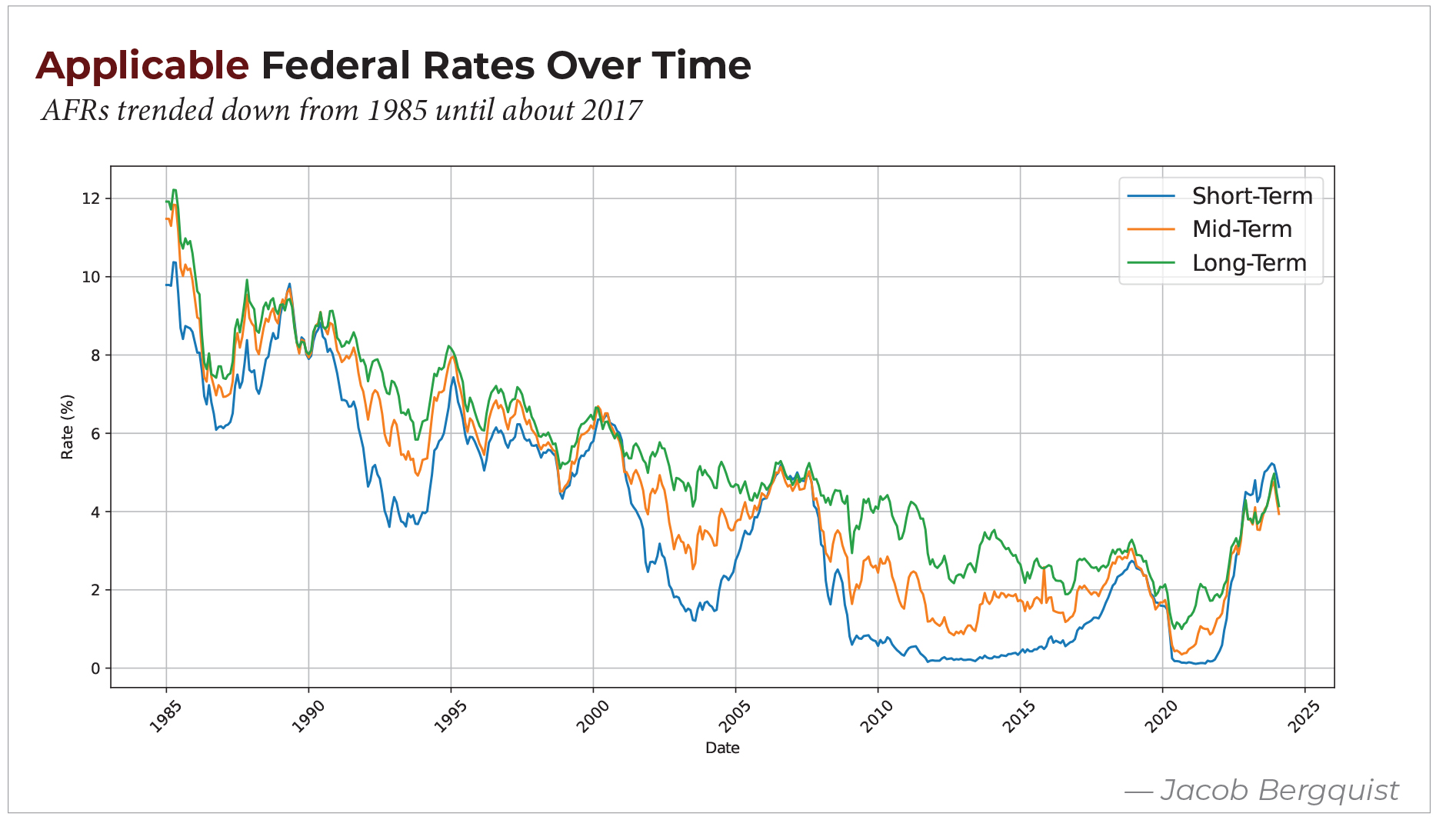

The charts in “Comparison of Interest: 15-Year Term” and “Comparison of Interest: 10-Year Term” depict the total interest paid over the entire term of the loans. Consequently, certain data gaps exist due to the availability of interest rate information. For instance, we don’t include data for a 15-year loan initiated in 2010 as interest rate data for the remainder of 2024 and 2025 aren’t yet available. Similarly, data for a 10-year loan initiated after 2014 is incomplete. Although the data through 2014 demonstrate the superiority of variable rate term loans over fixed rate loans, this trend likely won’t remain as rosy for all of the last decade in the same way as it had in the decades before. From 1985 until about 2017, AFR rates trended down (see “Applicable Federal Rates Over Time” p. 22), so that over a 10- or 15-year cycle, opting into a decreasing short-term AFR rather than a fixed, higher long-term AFR would always provide a better outcome (that is, less interest paid by a borrower to a lender). For example, in January 1985, the semiannual, long-term AFR was 11.58%, and the short-term AFR was 9.56%. Implementing a 15-year loan at the fixed 11.58% would have locked the parties into that rate until the note matured at the end of 1999. However, the long-term AFR dramatically declined during that time, and the parties couldn’t otherwise take advantage of this decline without refinancing the note. Meanwhile, the short-term rate also substantially declined over that period. The variable rate structure takes advantage of this decline by recomputing the interest every year at the then-applicable short-term rate, effectively allowing a contractual refinancing of the note on better terms every year.

As rates decline, the variable rate structure works best, because the interest rate on the loan declines with overall rates. As rates rise, however, the inverse may be true. Using a fixed rate in a rising rate environment may yield better results than a variable rate tied to an increasing rate in a rising rate environment. For example, in September 2020, AFRs were the lowest they had ever been. The semiannual short-term rate was just 0.14%, and the long-term rate was just 1%. Because rates have risen substantially since then, with the semiannual short- and long-term rates sitting at 4.91% and 4.5%, respectively, as of May 2024, locking in the ultra-low long-term AFR at 1% would have been superior to choosing a variable rate that rose from 0.14% to 4.91% today, at least for the beginning of the loan term.33

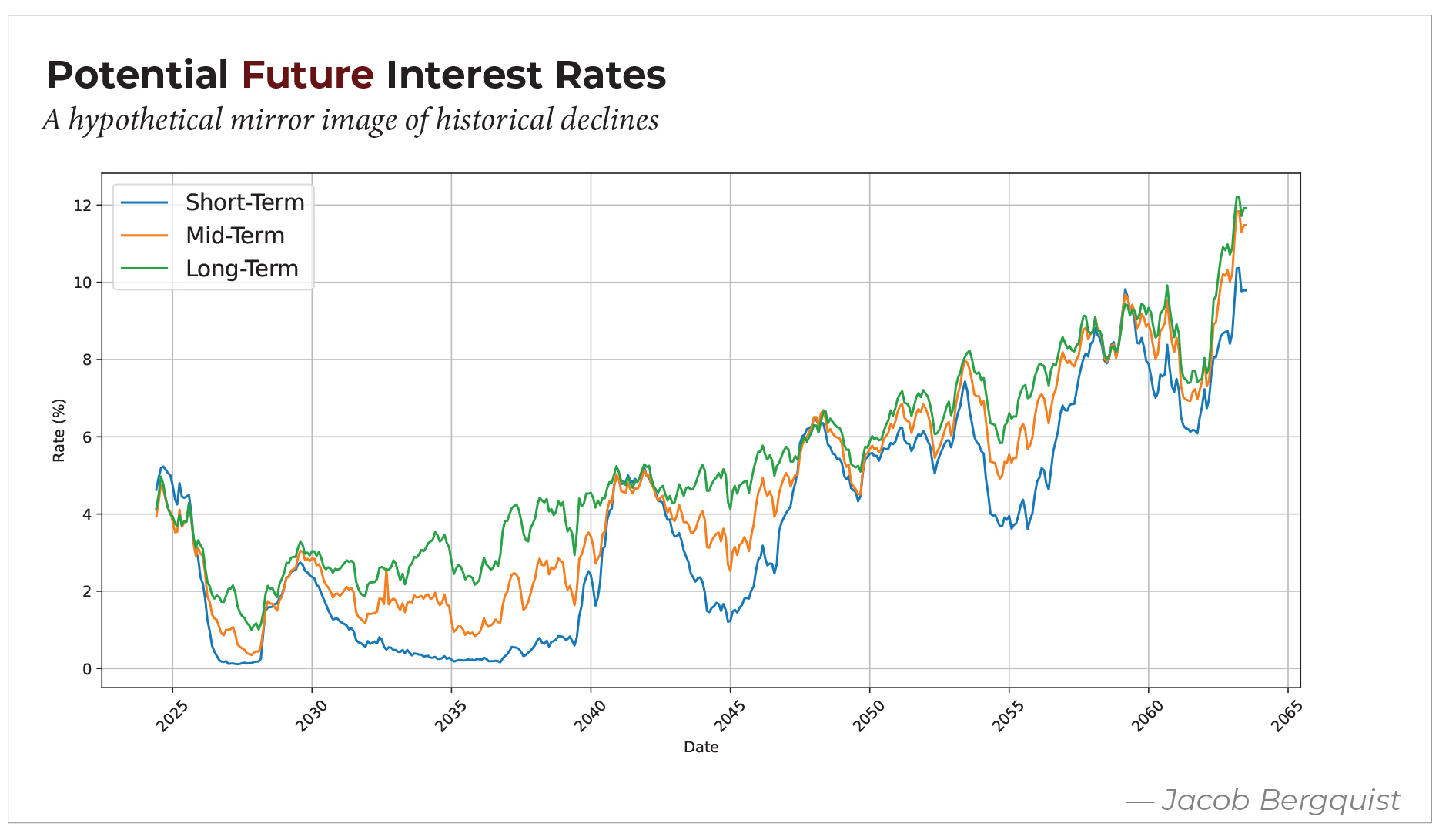

Ideally, we could compare the total interest paid between variable and fixed rate loans in a rising rate environment as we’ve done in the falling rate environment; unfortunately, there’s no historical data on which to run a similar retrospective analysis, because rates have consistently fallen since the AFR was first introduced into the law. Moreover, forecasting interest rates over many years is difficult due to economic uncertainty, frequent policy changes by central banks, volatile market dynamics and the limitations of forecasting models. These factors compound over time, making long-term predictions increasingly unreliable. However, one methodological approach for rate projections is to mirror the past prospectively, such that we assume the AFR of the last month occurs in the first month in the future, the AFR from 10 years ago occurs 10 years into the future and so on. Consequently, “Potential Future Interest Rates,” p. 23, the exact inverse of “Applicable Federal Rate Over Time,” illustrates generally rising rates over the next 40 years.

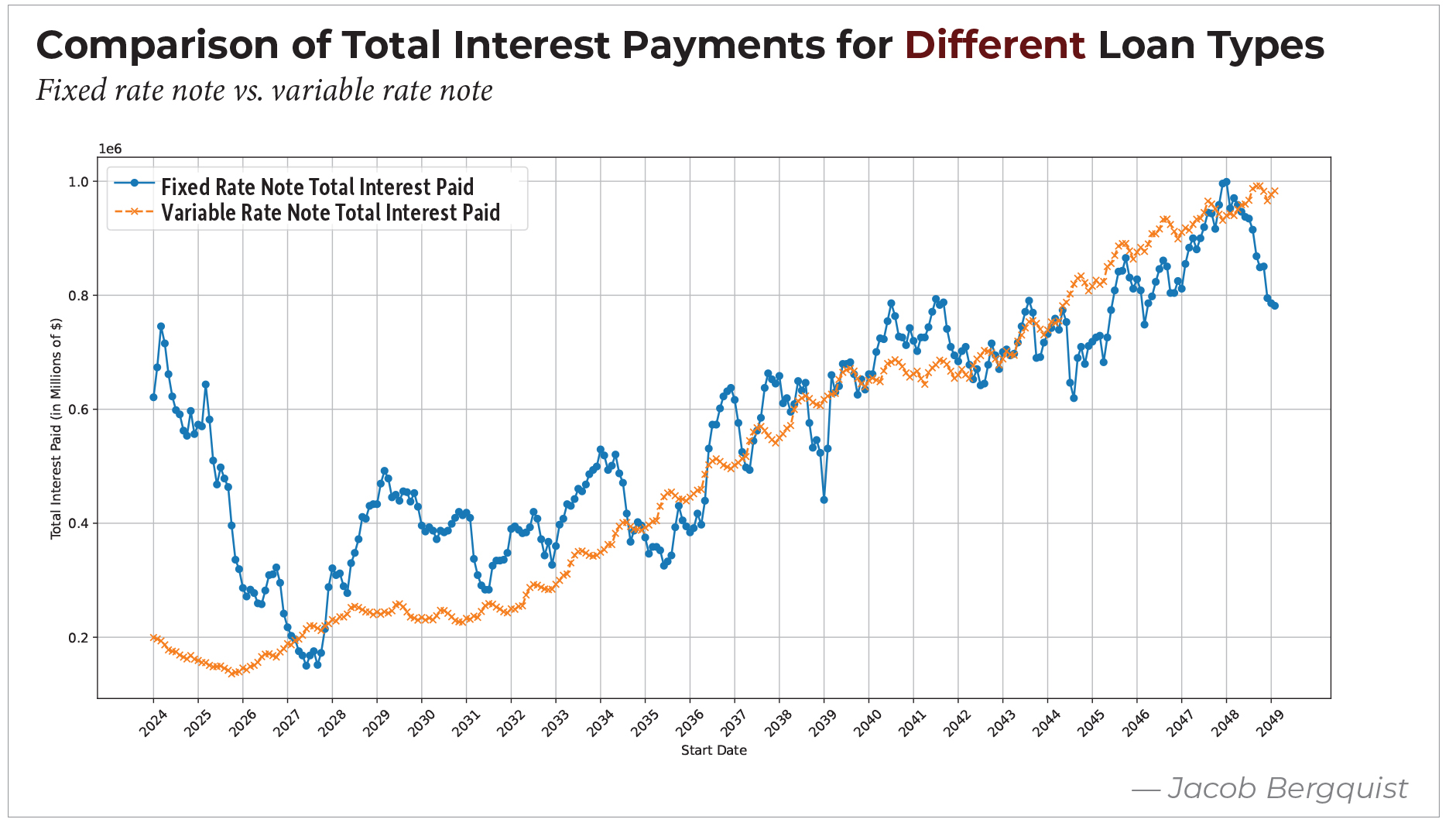

This projection isn’t an attempt to predict future AFRs but to facilitate an analysis comparing variable and fixed rates, assuming that rates will rise over the next four decades as precisely as they’ve fallen in the past four. “Comparison of Total Interest Payments for Different Loan Types,” p. 24, illustrates this “past is inverse prologue,” where two types of loans are initiated at the start of every month through 2048 (15 years until the end of the projected 40 years)—one with a fixed long-term rate and another with a variable rate recalculated annually using the short-term AFR. Surprisingly, the results from “Comparison of Total Interest Payments for Different Loan Types” show that over a 15-year term, using a fixed long-term rate results in higher total interest payments 65% of the time across the 40-year period.34 These results indicate a significant advantage in structuring intrafamily notes with variable interest rates no matter the expected rate environment.

Fixed vs. Variable

For a traditional commercial loan, such as a mortgage, there are often several factors to consider when choosing between a fixed or variable rate loan. In the intrafamily context, however, the driving consideration will be whether the client or their investment advisors believe that rates will stay flat, rise or fall in the future. As we’ve showcased, in falling rate environments, variable rates are a winning strategy, resulting in less interest being paid by the borrower. Conversely, fixed rate loans may be preferable if rates are expected to rise over the long term, although this isn’t always the case. Even when rates remain flat, the variable loan structure would likely be superior, because it allows the lender to charge the short-term rate over a longer time horizon. If the client chooses the variable rate structure but rates start to rise, the parties can always refinance the note;35 indeed, giving the borrower the right to refinance the loan at various intervals could also be included in the promissory note terms so that if rates rise dramatically, the borrower could choose to exercise the power to refinance, in which case, a fixed rate could be substituted for the variable rate.36

In addition, variable rate term loans may not yield the best results when the short-term AFR is higher than the long-term AFR. On occasion, short-term Treasuries have higher yields than long-term Treasuries, which has the effect of inverting the AFR rates in a similar manner. In 2024, the short-term AFRs have been consistently higher than the long-term AFRs. Though this rarely occurs, when it does, choosing a variable rate that follows the short-term AFR won’t yield the best results, because the short-term rates will be higher than longer term AFRs. Such inversions typically don’t last long, though we’re in unprecedented economic times; as of this writing, the yield curve has been inverted for a year and a half, the longest period in history by far. For context, in the last 470 months, there have been only 40 months when the rates have been inverted, nearly half of which includes the last 18 consecutive months.37 It may be prudent to wait until the short-term AFR provides the lowest rates to implement a variable rate loan unless clients or their advisors believe rates will soon fall.

In an ideal world, planners would have insight into where rates are headed; because we don’t, we must work with our clients and their financial advisors to determine whether a fixed or variable rate makes the most sense for each client. Both fixed and variable rates come with their own risks, after all. While choosing a variable rate comes with the risk that rates may increase beyond the medium or long-term rates on the date the loan was originated, fixed rate loans entail similar risks; namely, fixing the rate just before rates precipitously fall will similarly result in both higher interest payments for the borrower and augmenting the lender’s estate as larger payments are made to the lender. Both risks could potentially be mitigated by structuring the loan to allow refinancing. Moreover, historically, as rates generally came down over the last several decades, variable rate term loans would have yielded better results for longer term intrafamily loans the vast majority of the time. Only as rates came off their near-zero lows in the last couple of years did fixed rate loans start making more economic sense for borrowers and lenders. Now that rates have come up, there’s room for them to fall; indeed, most economists expect rates to fall in the near to mid-term.38 Now might, therefore, be a great time to consider a variable rate loan for your clients.

Endnotes

1. See, e.g., Harwood v. Commissioner, 82 T.C. 239, 259 (1984)(“Transactions within a family group are subject to special scrutiny, and the presumption is that a transfer between family members is a gift.”) In the case of a purported loan, the presumption can be rebutted by an affirmative showing that at the time of the transfer, the transferor had a real expectation of repayment and an intention to enforce the debt. Estate of Lois Lockett v. Comm’r, T.C. Memo. 2012-123, citing Estate of Van Anda v. Comm’r, 12 T.C. 1158 (1949), aff’d per curiam, 192 F.2d 391 (2d Cir. 1951).

2. Courts apply at least nine factors to distinguish between a gift and a loan. Intrafamily loans should, among other things, be documented in writing, charge interest, include a repayment schedule and have a definite maturity date. Estate of Bolles v. Comm’r, T.C. Memo. 2020-71, aff’d Docket No. 22-70192 (9th Cir. 2024).

3. Foregone interest is deemed, for income tax purposes, to be paid annually by the borrower to the lender. Internal Revenue Code Section 7872(a). This article will focus on the gift tax consequences.

4. Stephen R. Akers and Philip J. Hayes, “Estate Planning Issues with Intra-Family Loans and Notes,” 38 ACTEC Law J. 2, 71 (September 2012).

5. Taxpayers may also make demand loans. However, demand loans have several downsides compared to term loans. First, the computation of interest in compliance with IRC Section 7872’s methodology is significantly more complex. See Proposed Regulations (Prop. Regs) Section 1.7872-13. Second, if a demand loan, under state law, becomes unenforceable from lapse of time, the lapse is treated as a taxable gift. Revenue Ruling 81-264. Third, especially when a note is issued in exchange for property, a demand loan, because it’s less common in a commercial context, may be more vulnerable to being recharacterized as a gift.

6. Blackburn v. Comm’r, 20 T.C. 204 (1953); Lundquist v. U.S., 83 A.F.T.R.2d 99-1471 (N.D.N.Y. 1999); Krabbenhoft v. Comm’r, 939 F.2d 529 (8th Cir. 1991); Schusterman v. U.S., 63 F.3d 986 (10th Cir. 1995); see also Rev. Rul. 73-61 (“[The] rate of interest that would represent full and adequate consideration may vary, depending upon the actual circumstances pertaining to the transaction”); Rev. Rul. 81-286 (“In valuing a note, a comparison should be made between the interest rate on the note and the prevailing rate of interest for similar transactions in the market place”).

7. Treasury Regulations Section 25.2512-8.

8. An exchange is considered to be in the ordinary course of business if it’s bona fide, at arm’s length and free of donative intent. Although relatively rare, it’s possible for an intrafamily transaction to satisfy the ordinary course exception to the gift tax. See, e.g., Estate of Redstone v. Comm’r, 145 T.C. 259 (2015); In re King, 545 F.2d 700 (10th Cir. 1976).

9. Dickman v. Comm’r, 465 U.S. 330 (1984).

10. Crown v. Comm’r, 585 F.2d 234 (7th Cir. 1978) (“The [taxpayer] has conceded that had the interest-free loans been made for a definite term, a taxable gift might have occurred”).

11. The taxpayers in Dickman didn’t apparently dispute that, as the U.S. Court of Appeals for the 11th Circuit put it, “gift taxation [results] when a non-interest-bearing term note is used to secure a loan.” Dickman v. Comm’r, 690 F.2d 812 (11th Cir. 1982), aff’d 465 U.S. 330 (1984). They instead argued that as a factual matter, all of the loans in question were demand loans. Like the 11th Circuit, the Tax Court in Dickman, which held for the taxpayers, observed in dicta that any zero interest term loans would be gifts. Dickman v. Comm’r, T.C. Memo. 1980-575.

12. Section 7872 applies not only to gift loans but also to compensation loans, shareholder loans, tax avoidance loans and certain other below-market loans to the extent provided by regulation. Section 7872(c)(1).

13. Estate of Berkman v. Comm’r, T.C. Memo. 1979-46; Blackburn v. Comm’r, 20 T.C. 204 (1953); Mason v. U.S., 513 F.2d 25 (7th Cir. 1975).

14. Section 7872(d)(2).

15. Section 7872(f)(1)(B).

16. Joint Committee on Taxation, General Explanation of the Revenue Provisions of the Deficit Reduction Act of 1984 (“[T]he amount of the gift [in the case of a gift loan] is to be determined under section 7872 ... even if the applicable Federal rate is less than a fair market rate”); Estate of True v. Comm’r, T.C. Memo. 2001-167 (“[P]resent value under

section 7872 [is] contrary to the traditional fair market value approach”).

17. Frazee v. Comm’r, 98 T.C. 554, 589 (1992) (“[T]he application of section 7872 ... is more favorable to the taxpayer than the traditional fair market value approach, but we heartily welcome the concept”).

18. Confusingly and ironically, a loan that charges the appropriate applicable federal rate (AFR) isn’t a “below-market” loan for purposes of Section 7872, yet often is a below-market loan in the real world.

19. Prop. Regs. Section 1.7872-1 et seq.

20. Cf. Rauenhorst v. Comm’r, 119 T.C. 157 (2002).

21. Prop. Regs. Section 1.7872-3(c)(1).

22. Ibid.

23. See supra note 14. For income tax purposes, however, foregone interest is deemed to be paid annually by the borrower to the lender. Section 7872(a).

24. Supra note 4, at p. 70.

25. There are rare situations in which the long-term rate can be lower than the mid-term rate, which can be lower than the short-term rate. This occurs when the rate on longer term Treasuries is lower than the rate on short-term Treasuries. There are several economic factors that contribute to such an inverted rate structure, but a discussion of those factors is beyond the scope of this article.

26. As noted, the Treasury “yield curve” can become inverted, which can cause the long-term AFR to be lower than the short-term AFR; when this happens, it can be a great time to lock in a longer term AFR at the lowest rate; however, an inverted yield curve is a rare environment historically. Only 40 out of the last 470 months have had such an inversion of the rates, though nearly half of those have been in the last two years.

27. Once a loan escapes classification as a below-market loan under Section 7872, the interest charged must be deemed to be a market rate of interest. If instead, the traditional fair market value (FMV) methodology were revived outside Section 7872 safe harbor, taxpayers could continue to avoid FMV methodology by charging interest that’s ever-so-slightly less than the AFR and thereby invoking Section 7872’s protection (and reporting de minimis gifts). There’s no need, however, to resort to such devices. As the Internal Revenue Service has itself concluded, by avoiding below-market loan status, a lender also avoids being considered to have made a taxable gift. Private Letter

Ruling 9535026 (May 31, 1995); PLR 9408018 (Nov. 29, 1993).

28. Prop. Regs. Section 1.7872-3(e)(1)(i). These rules apply to term loans; there are separate rules for demand loans.

29. Ibid.

30. Prop. Regs. Section 1.7872-3(e)(2)(ii).

31. Ibid.

32. Of course, the variable rate could be tied to other objective market indices, such as the prime rate or other rates listed in the proposed regulations; here, however, we focus on what’s almost always the lowest available index—the short-term AFR.

33. A subsequent and consistent decline in rates could mean that the variable rate strategy yields a better outcome still.

34. Variable rates tethered to the short-term AFR work best in two situations: when rates are declining and when there’s a spread between the short-term and long-term AFRs. Both aren’t required for a positive result. The results from “Comparison of Total Interest Payments for Different Loan Types,” p. 24, don’t benefit from declining rates; they do still, however, benefit from the spread between the low and high AFRs, so that the borrower benefits from the lower rate over the long time horizon, even when rates are generally increasing. We might expect to see less favorable results if there was a sharper rise in interest rates, compared to the steady rise from the hypothetical data provided in “Potential Future Interest Rates,” p. 23.”

35. A gift shouldn’t be considered to have been made when promissory notes are refinanced at lower, then-prevailing AFRs. Jonathan Blattmachr, et al., “How Low Can You Go? Some Consequences of Substituting a Lower AFR Note for a Higher AFR Note,” 109 J. Tax’n 22 (2008). The IRS hasn’t released any guidance to date on this topic, though note refinancings are generally consistent with Treasury regulations. Ibid., at p. 30.

36. Including a refinancing provision in fixed rate promissory notes may be wise, as well, because the parties may want to eventually turn the fixed rate into a variable rate if economic indicators suggest overall rates will decline.

37. These numbers are all as of this writing and are subject to change.