I’ve been in the industry a long time. After graduating from college in 1985, I went to Wall Street in 1986. I traded stocks for a hedge fund. After leaving, I became a pastry chef for some fantastic restaurants. When I got divorced, I came back into finance. I wound up starting at a broker/dealer.

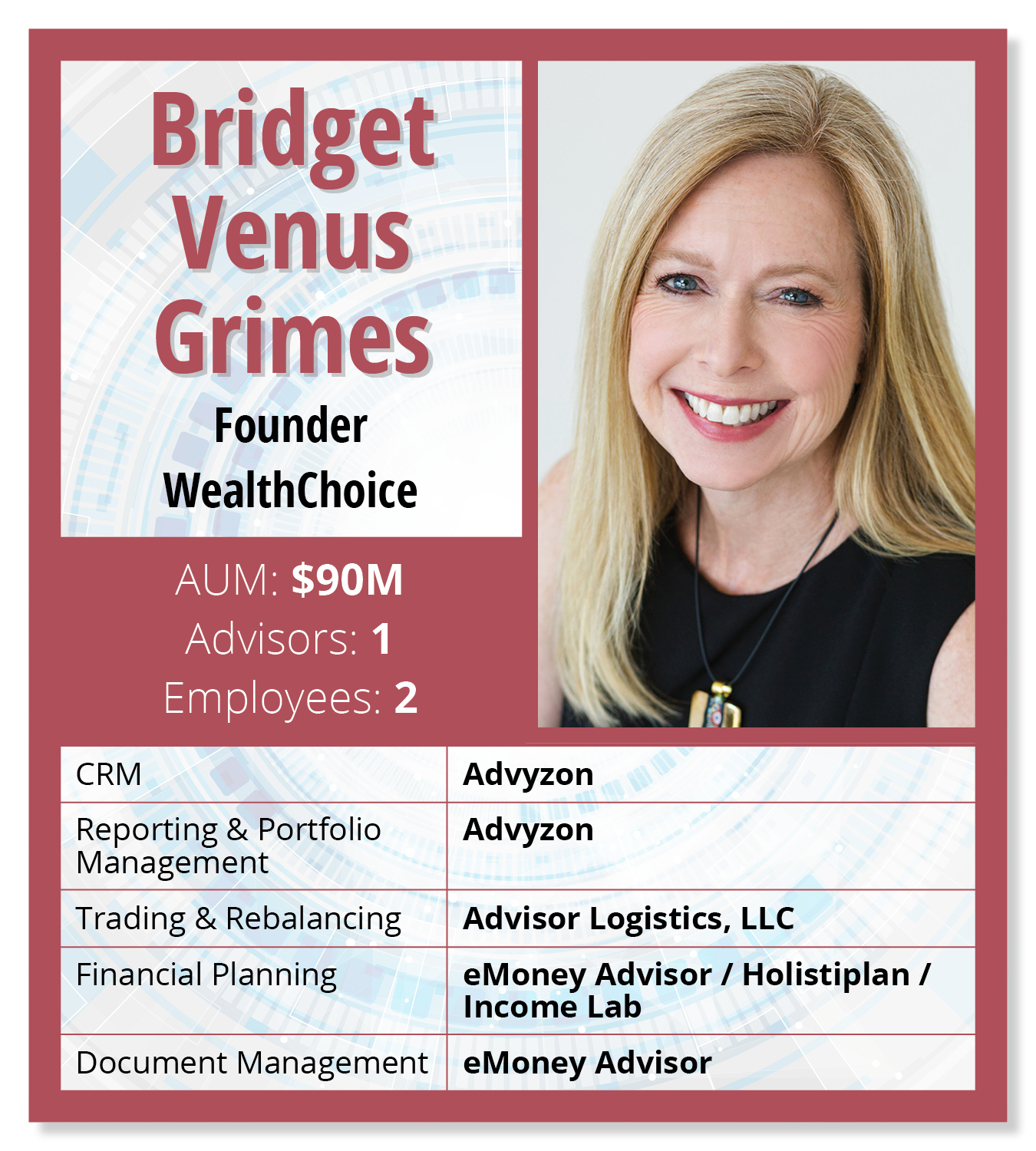

Almost eight years ago, I left a larger RIA to launch WealthChoice. I was vastly underpaid relative to my peers, and I was told I was too ambitious. I wanted to serve the women in my world how I knew they were best served. It wasn’t about bringing in as many people as humanly possible into a firm for revenue but spending time with them on financial planning. I launched my practice from zero.

I came to financial planning to help women who looked like me and had a lot on their plates and no time to plan. We have a specific niche of serving breadwinner women. For the families we serve, the women primarily drive the bus financially. We do a lot of work around the challenges, or “de-railers,” professional women have. We help them get set up for the life that they want to lead. Many of our clients are women tech workers, attorneys, founders and business owners.

I came to financial planning to help women who looked like me and had a lot on their plates and no time to plan. We have a specific niche of serving breadwinner women. For the families we serve, the women primarily drive the bus financially. We do a lot of work around the challenges, or “de-railers,” professional women have. We help them get set up for the life that they want to lead. Many of our clients are women tech workers, attorneys, founders and business owners.

The way I built my business was all me doing everything for a while. I can do everything, as most solos can, but you cannot do everything if you want to scale. This is where Equita Financial Network comes in. My partner in Equita, Katie Burke, also runs her own firm, Method Financial. We knew each other through business. We were buddies. We would say, “Hey, how are you solving this problem?” We were our own tribe. Because when you run your own business, you’re out there by yourself. We realized that it would be cheaper if we joined forces and shared the cost of all the resources. We set out to formalize a platform for our firms. We created Equita in May 2018 as the overarching umbrella that housed everything you needed to do for a financial planning firm except serve the clients. It allowed you to grow.

CRM, Reporting & Portfolio Management: Advyzon

I used to use AdvisorEngine, which was formerly Junxure Cloud for CRM, but then I got rid of them because it was overkill.

We had been using Advyzon for a while for reporting and portfolio management. It was only when Advyzon started focusing on being a CRM resource that I also moved over to that for CRM. It’s a terrific and always-evolving platform.

We were early adopters of Advyzon because we had previously used Envestnet | Tamarac and SS&C Black Diamond Wealth Platform. We knew what we didn’t like. We wanted partners who were open to making changes and growing with us. Advyzon has gotten so big, but it’s stayed focused on how to help firms like ours that aren’t huge. There are a lot of other great resources that would work better with big firms. That’s not who we are. That’s not who we ever want to be. I want to know if I have people I can call. I have the support that is there. They are invested in our future and success.

Trading & Rebalancing: Advisor Logistics

Advisor Logistics is our trading partner. They are amazing. East Bay Investment Solutions [an outsourced chief investment officer or OCIO] create models for us. They’ll coordinate with our trading team if we need to make any model changes or equivalents because every client has different portfolios. We wanted to make clear that we needed a trading team that could accommodate those models, but also would be able to customize. When you have a new client, there are nuances to how they’re invested. It’s super user-friendly. Everything is custom for us, but it helps us scale.

Financial Planning: eMoney / Holistiplan / Income Lab

I had used MoneyGuidePro for a long time. Then, I was using both MoneyGuidePro and eMoney. I found that MoneyGuidePro was great for people who are more in retirement, but that’s not my demographic. I wanted a cash flow-based tool. So, I transferred to eMoney around six or seven years ago.

I love Holistiplan. My clients told me that tax planning was essential to them.

We were early adopters of Income Lab. We were next to them at a conference, where we met. It’s fantastic for things like Roth IRA conversions.

Document Management: eMoney

eMoney has a vault that is terrific and easy for clients to use. I use eMoney as my client interface. Every client has a portal. I have them upload everything to their vault and keep all the documents there.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Rob Burgess at [email protected].