Empirical research has found that at moderate levels debt can improve growth, but at high levels (thresholds somewhere between 75% and 100%) it can become damaging (if the high ratio isn’t addressed and becomes persistent)—the debt becomes a drag on economic growth. (See the 2011 study “The Real Effects of Debt,” the 2013 study “Does High Public Debt Consistently Stifle Economic Growth?” the 2020 study “Debt and Growth: A Decade of Studies” and the 2021 studies “The Impact of Public Debt on Economic Growth” and “Public Debt and Economic Growth: Panel Data Evidence for Asian Countries.”)

The explanations for the negative economic impact include: higher interest rates (investors, particularly foreign investors, may demand an increased risk premium), higher taxes (which lower incomes), restraints on the future ability to provide countercyclical fiscal policy to fight recessions (leading to greater economic volatility), the crowding out of private sector investment (reducing innovation and productivity) and growing interest payments consuming an increasing portion of the federal budget, leaving lesser amounts of public investment for research and development, infrastructure and education.

The Congressional Budget Office (an independent agency created in 1974) estimates the U.S. debt-to-GDP ratio sitting at 98% at year-end 2023 and projected to reach 181% in 30 years. With these prognostications in mind, Roberto Cram, Howard Kung and Hanno Lustig, authors of the September 2023 study “Can U.S. Treasury Markets Add and Subtract,” analyzed all (15,533) CBO cost releases for all bills introduced by Congress from 1997 to 2022. Their objective was to determine the impact of spending increases on interest rates. Following is a summary of their key findings:

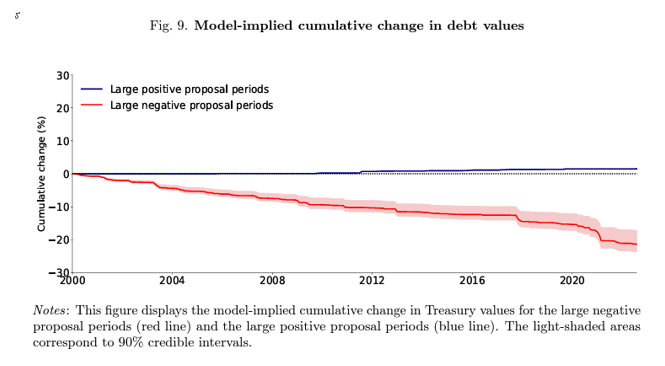

- Cost releases with large negative cash flow projections have lowered the valuation of all outstanding Treasurys by more than 20% between 1997 and 2022. Cost releases enabled investors to learn about the negative drift in the surplus policy. The large negative cost releases generated significant revisions in expectations, leading to systematic negative Treasury value responses.

Consistent with John Cochrane’s The Fiscal Theory of the Price Level, market expectations of inflation also increased across horizons in daily event windows around large negative proposal days, particularly at long horizons.

The Treasury valuation effects of adverse fiscal news were concentrated at longer maturities, with an overall increase of 4% in long-term nominal yields. The increase was driven by an increase in term premia and inflation expectations and a drop in convenience yield (the value investors assign to the liquidity and safety attributes) of Treasury securities.

The authors noted: “Over their sample period, Fed policy imputed a secular downward drift to long-term bond yields. Over the same sample period, the cumulative change of the 10-year nominal yield on FOMC meeting days is -3.18%. The FOMC announcements effectively offset the entire effect of the cost releases.”

Their findings led the authors to conclude: “In daily event windows, we find that cost releases of large proposals expected to increase future deficits significantly lower the Treasury valuations.”

Using their estimated model, they inferred that a 1 percentage point surprise increase in the supply of Treasurys, expressed as a fraction of GDP, corresponds to an increase of the 10-year nominal yield of 31 basis points and a drop in the convenience yield of 7.5 basis points. With the CBO estimating that there will be an 83 percentage point increase (from 98% to 181%) in the debt-to-GDP ratio, there would be a dramatic increase in the cost of government debt with an equally dramatic negative impact on economic growth.

Investor Takeaway

The CBO’s cost projections about future deficits contain valuable budgetary news, allowing bond investors to learn about the trajectory of the debt-to-GDP ratio. The takeaway for investors is that their financial plans should consider a possible negative impact on economic growth caused by rising debt and that it could lead to lower equity returns. Lower potential economic growth along with the risk of increased inflation, when combined with historically high valuations of U.S. stocks as represented by the S&P 500, should at least raise concerns. Prudent investors plan for these risks. For example, they adjust forecasts of future returns to reflect current valuations and yields (as opposed to relying on historical returns). They may also consider increasing allocations to fixed-income assets that are less susceptible to inflation shocks (such as TIPS and floating rate debt) and rising discount rates on Treasurys. They may also consider increasing exposure to risk assets that are less correlated with economic growth and inflation risks—such as reinsurance (using interval funds such as SRRIX and XILSX) and long-short factor strategies (such as AQR’s QSPRX and QRPRX).

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Partners, LLC.

For informational and educational purposes and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. The opinions expressed here are their own and may not accurately reflect those of Buckingham Strategic Wealth, LLC or Buckingham Strategic Partners, LLC, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-617