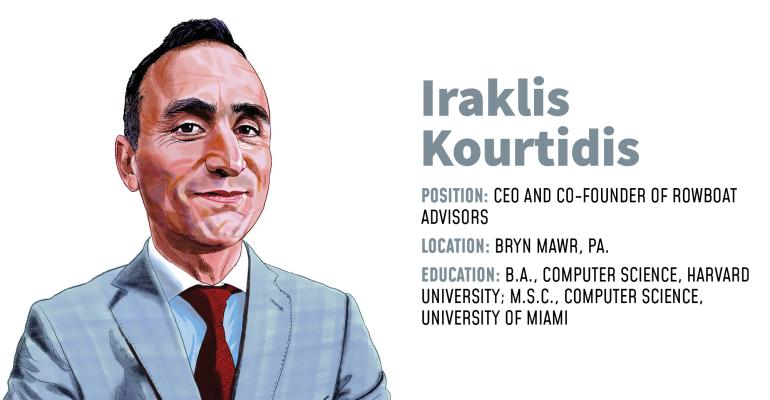

Iraklis Kourtidis, CEO and co-founder of Rowboat Advisors, is used to standing out. For one thing, he was born in Greece.

“I’m very different … because any time I go to these [industry] events, there aren’t many people with an accent,” he said.

Kourtidis first arrived in America at the age of 18 on a scholarship to Harvard University. Even among his peers at the school from overseas, he was an exception.

Kourtidis first arrived in America at the age of 18 on a scholarship to Harvard University. Even among his peers at the school from overseas, he was an exception.

“Most foreign students here are from some upper-class background,” he said. “I’m not that.” He attended an average public high school and his father worked for an American-owned chemical plant, often the night shift; “it was dangerous and unhealthy,” Kourtidis said.

“My getting into Harvard was a complete fluke—my dad’s American boss at the chemical plant showed me how to apply because his son was at MIT—and at the time, I thought Harvard was in England,” he said, adding that he was not not trying to sound like some sort of victim, rather that the journey from where he started to where he is now required a lot of perseverance and goal-setting.

“I try to carry this ethic over to the work I do for Rowboat Advisors,” he said.

After concluding his higher education, Kourtidis served as a software engineer for Microsoft, Oracle, CoVia Technologies and CrossBorder Solutions. He then worked as a trading strategist for the options market-making desk at UBS, leader of the U.S. single shares strategist organization at Goldman Sachs, head of the in-house automated options market-making business at the Cutler Group and a developer of trading strategies at KCG Holdings.

From there, he joined the automated investment platform Wealthfront as a developer of investment products. It was in this role he cultivated the idea that would once again set him apart from the crowd: He built Wealthfront’s direct indexing capability in 2013.

“That’s when I realized, ‘Oh, my God. There’s huge potential in this,’” he said. “Some financial advisor in some normal place, you’re not going to be able to beat the market. The only thing you can sell is maybe diversification and tax alpha.”

Though he said he doesn’t consider himself a natural businessman, Kourtidis quit Wealthfront in 2016 to start Rowboat Advisors.

“Silicon Valley people brag about being serial entrepreneurs,” he said. “I’m not even a one-off entrepreneur. I’m not a business-starting guy. What I tell people is, ‘If even somebody like me can start a company, this must mean there is opportunity.’”

Kourtidis said it took a while for the idea to mature and catch on with investors.

“We could have been too early … but, thankfully, I didn’t have the problem of running out of money, which is the No. 1 killer of companies,” he said.

Building Rowboat Advisors was a bootstrapped effort with Kourtidis working on code for about 18 months before his co-founder, Steve Anderson, joined. And about 90% of the code, according to Kourtidis, was written by himself, much of it while in self-isolation aboard his old 38-foot sailing catamaran docked in Redwood City, Calif.

It was only around 2020, he said, that “the market wised up to direct indexing … which helped us.” Other companies have jumped on the direct indexing bandwagon in the intervening years.

Kourtidis, however, said he was determined, once again, to to stand out by focusing on performance, speed, tax efficiency and the ability to handle held-away assets.

“In some cases, there’s an opportunity and you must take it. It shifts everything you do for the rest of your life because now you’re one level above,” he said.