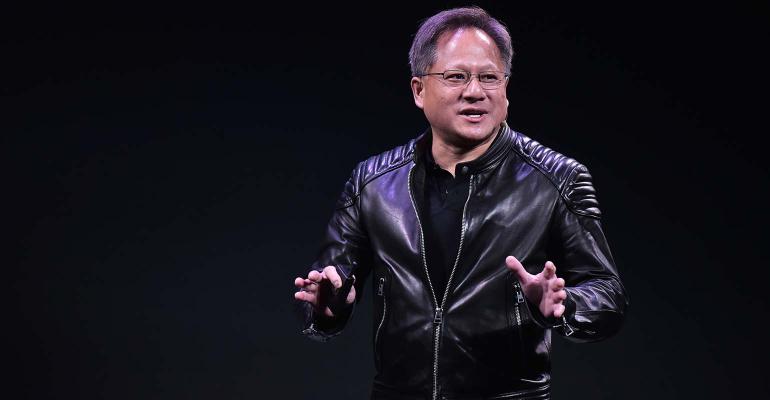

Insatiable demand for artificial intelligence investments has made chipmaker Nvidia Corp. the best-performing stock on the S&P 500 this year. It’s also given the fortune of Chief Executive Officer Jensen Huang a major boost.

Huang’s wealth has grown 98% this year to $27.3 billion, making him the biggest gainer among US and global tech billionaires, according to the Bloomberg Billionaires Index.

Nearly all of Huang’s fortune is in Nvidia shares and options, which have surged in value on expectations the company will be a key beneficiary from the success of OpenAI’s ChatGPT and other advancements in artificial intelligence. It’s a rapid reversal from last year, when Huang’s wealth fell by nearly half amid a rout in technology stocks.

The percentage increase in Huang’s net worth since January eclipses that of Mark Zuckerberg, whose wealth rose 94% to $88.7 billion as sales at Meta Platforms Inc. rebounded in the first quarter.

Investors are drawn to Nvidia because it’s seen as a key supplier that will meet AI’s need for computing power, with billionaires from Stanley Druckenmiller to David Tepper loading up on the stock in the first quarter.

Nvidia declined to comment for this story.

The AI exuberance has overshadowed less positive developments in China, where sales tumbled about 20% in Nvidia’s most recent fiscal year after the US government stopped the firm from selling its high-tech wares to Beijing.

The China challenge puts Huang in an unusual spot. The mogul, who lived in Taiwan until he moved to Thailand at age 9 before studying in the US, faces the possibility that growing US-China tensions may upend his ability to lean on China for growth going forward.

Nvidia’s two biggest markets during the pandemic were China and Taiwan, which between them accounted for more than half of the company’s revenue in fiscal 2022. Then, in September, the US stopped Nvidia from selling some of its most advanced chips to China, which could cost the firm $400 million per quarter, it said. It has since introduced dumbed-down versions that limit connection speed with the US government’s tacit support, according to Wedbush Securities analyst Matthew Bryson.

It also plans to shift its research and development and supply and distribution operations out of China so it can provide customers with products that aren’t subject to export restrictions.

Huang, for his part, has expressed hope that the US and China can one day ease their tensions, calling the relationship between the two countries “beneficial to the world.”

In the meantime, demand is so high for Nvidia’s chips that there’s a “struggle” between tech firms for access, said Chris Miller, author of Chip War: The Fight for the World’s Most Critical Technology.

“The China restrictions will be a bigger problem in the longer run, but this year the AI boom is more than compensating,” Miller said.

--With assistance from Jack Witzig.

To contact the author of this story:

Blake Schmidt in New York at [email protected]