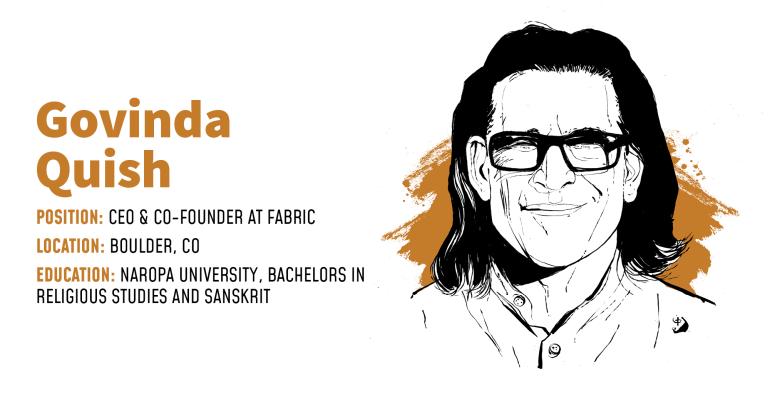

Govinda Quish’s career journey took an unusual turn, from religious studies to working for hedge funds and family offices around the world.

He is now back in the United States where he started, in Boulder, Colo., where he co-founded a risk modeling platform for financial advisors called Fabric, meant to help them better illustrate long-term portfolio outcomes and probabilities for clients.

Quish, 49, started the company with Rick Bookstaber, a Wall Street veteran who held risk management roles at Morgan Stanley and Solomon Brothers, as well as tenures at the Securities and Exchange Commission and the U.S. Treasury. Quish considers Bookstaber a mentor.

“I have no academic background in finance and was planning to become an academic. I had almost completed my masters and thought I was on a path to get a PhD in religious studies,” Quish said. He attended Naropa University, a Colorado college founded by Tibetan Buddhists in 1974 and famously the one-time home of beat-era writers like Allen Ginsberg and Jack Kerouac.

Then his mother fell ill with Lou Gehrig’s disease, and came to live with Quish as he took on the role of caregiver.

He says the experience of watching his mother die from such a terrible disease led him not deeper into religious contemplation, but to see the value of money and its importance when it comes to protecting one’s family, especially in difficult times.

While he never had a professional interest in finance, he did have an affinity for mathematics and began researching the industry, just at the time that quantitative financial models were coming into prominence as tools for asset managers and investors.

“Right around 1999 or 2000, I came across hedge funds and began learning about the careers of Stanley Druckenmiller, Louis Bacon, George Soros and others,” said Quish. “And I got myself a job with a New York-based family office.”

In 2007, he moved to Zurich, Switzerland, to lead research for Aeris Capital, AG, the family office of one of the founders of SAP.

A position in Hong Kong followed before Quish returned to the US and joined Bookstaber in the public sector as an Investment Fellow and senior risk manager with the University of California, overseeing the university system’s pension fund for two years. After more than a decade helping mitigate the investment risks for some of the wealthiest families, he quickly saw how the same system could fail the merely affluent.

“When financial crises happen, the people that end up most hurt are everyday people, those that can least afford it,” Quish said.

Spending time with Bookstaber in California, he said they both realized that the direction they wanted to go was not back to hedge funds but to work with asset owners, and that the best way to achieve that was to work inside the wealth management community.

“And that’s when we decided to build Fabric,” he said.

Both had seen data and computing power grow exponentially and recognized the potential for machine learning to be applied to finance.

“So, we asked ourselves could we develop technology that was the same institutional caliber as that created after the 2008 crisis for those building quantitative models, but make it not for quants,” he said. “Could we bridge the gap and make it available to wealth advisors?”

They spent two years interviewing hundreds of financial advisors, studying their processes and building dozens of wireframes before arriving at the current iteration of Fabric, which launched at the end of last year.

It is based on MSCI’s factor model data to uncover the market returns of qualities like size, value, growth and volatility.

Unlike many other risk analytics platforms that rely on historical returns, Fabric uses the data to create forward-looking models, Quish said. An intuitive and modern interface lets advisors collaborate with clients to demonstrate how the factors will influence their investment returns over time.

Fabric already has integrations with Black Diamond, Orion and Addepar, and others are in the pipeline, Quish says.