For advisors, billing clients is the kind of day-to-day business process that should be straightforward, and even a little boring. It is often anything but.

Many advisors, it turns out, are bad at charging their clients. Even those that have the process down often miss some of the subtle differences between what they tell their clients they charge, and what the client ends up paying. It’s often an unintentional oversight but can lead to unhappy clients and regulatory headaches.

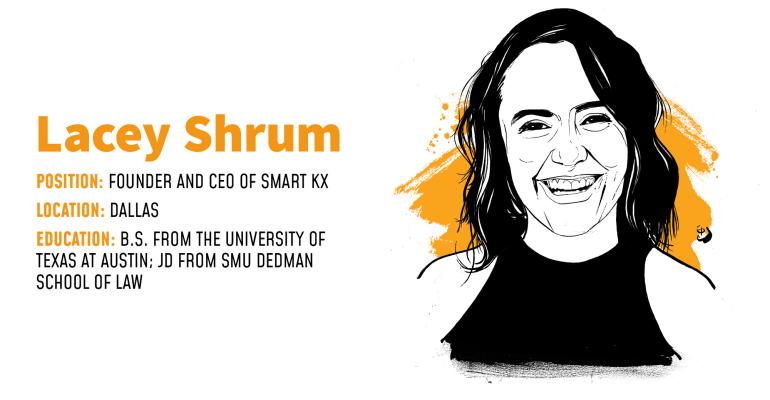

The Dallas-based founder and CEO of Smart Kx (short for “contract”), Lacey Shrum, has built a cloud-based billing platform that helps registered investment advisors make sure that the agreed-upon client fees are documented correctly and calculated exactly as client engagement documents describe—and does it clearly and automatically without manual processes or risk exposure.

Right out of college, Shrum worked as an associate at a wealth management firm but soon after applied to and attended law school while continuing to work. After graduating, she became legal counsel and chief compliance officer for an RIA, which is where she really got to see how the sausage was made in terms of client billing and how easily it can run afoul of compliance.

“Advisors are odd,” and quite human, said Shrum.

She is unapologetic in pointing out the things that both flummox and entertain her with RIA clients and why her service is very much needed.

“The biggest thing we see are all these ad hoc fee adjustments,” she said, describing the process of analyzing an advisory firm’s fee schedules and client billing agreements.

“It is often just natural to say, ‘Oh we’re not going to charge you, we’ll take 50% off your bill this time.’ Anyone running a business wants to keep their clients happy. But we will ask the advisors why, and they say, ‘just because,’” Shrum said.

Those on-the-fly adjustments add complexity to her firm’s task of trying to understand the advisor’s billing.

Then there are the many advisors who don’t know what is on their own ADVs when it comes to fees. Some tell Shrum they took the document to their lawyers to get an answer on a discrepancy and were told the lawyers just say to leave it alone. “And they will leave it,” she said.

With the SEC increasing scrutiny and disclosure requirements for advisory fees, it is important for advisors to demonstrate transparency in how they bill. The norm for many fee-based advisors is to bill quarterly, in advance, based on the last business day of the previous business quarter, according to Shrum.

A firm’s Form ADV lays out its billing methodology. Then the individual client’s fee disclosure statement is supposed to provide any further detail necessary to that individual client.

“[Anyone] should be able to look at those two documents and compute the fee schedule,” said Shrum, “If you can’t, then there are levels of detail missing from one of them.”

Smart Kx attempts to smooth out the disconnect between the stated price tags in the Form ADV and the clients’ actual bill, reconcile the two, allow for any changes or exceptions made on an advisors’ system and update future bills on an ongoing basis.

It’s not a particularly difficult problem to solve—if advisors can be made aware that there is indeed a problem to solve in the first place.

“One of the biggest struggles is that the RIAs have this pain, but it is like this dull headache that gets deeper and deeper,” she said. “But there is no trigger that says, ‘call Smart Kx.’”

Until something breaks, that is.