Despite cap rate compression over the last 24 months, cap rate spreads over 10-year U.S. Treasuries have actually been increasing since the middle of 2011. Does this mean markets are reflecting rising risk in commercial real estate investing?

The spread between cap rates and Treasury rates reflect the premium demanded by investors from investing in a relatively risky asset like commercial real estate, vis-à-vis keeping their money in risk-free assets like bonds backed by the U.S. government. Increasing spreads therefore reflect heightened risk. (The recent global downturn has, of course, redefined the term “risk-free assets,” particularly when applied to sovereign debt, given heightened perceptions of default risk.)

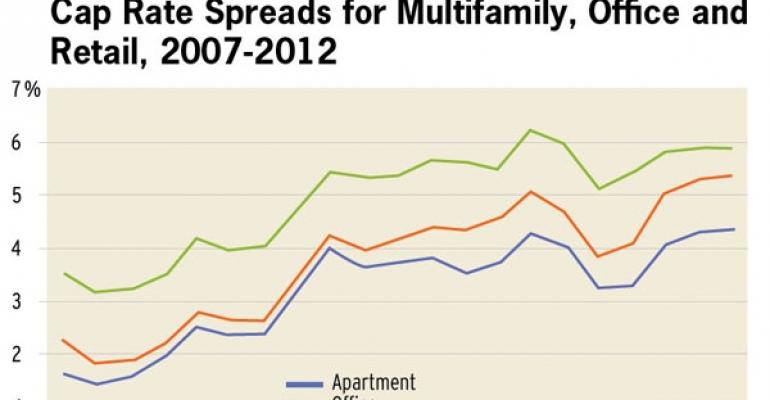

This chart shows trends in cap rate spreads for apartment, office and retail transactions over the last five years, calculated as the difference between the 12-month rolling cap rates and the 10-year Treasury yield. What was driving the multiple inflection points during this period? (From this point forward, we refer to “Treasury yields” and “interest rates” interchangeably.)

Spreads started out relatively tight (170 to 360 basis points) in early 2007, but began rising as the realization of the full effect of the 2006 housing crash dawned and credit markets began to tighten.

In the wake of the fall of Lehman Bros. in late 2008, spreads expanded dramatically at first, and then more gradually throughout the remainder of the recession and the initial stages of the economic recovery. Risky assets such as real estate experienced tremendous declines in value during the recession, faster than the decline in NOIs, which pushed cap rates upward. At the same time, there was a flight to quality, liquidity and safety that pushed interest rates substantially downward. These factors caused spreads to increase.

During the latter half of 2010, spreads began to decline as appetite for commercial real estate re-emerged. Transaction volume was thin compared to the boom years from 2005 to 2007, but for properties that did transact, cap rates began compressing, falling at a faster rate than interest rates. Interest rates were already low by the time cap rates began compressing.

However, since the middle of 2011, spreads have once again been expanding. Most of the trend makes sense, but recent developments appear to be a bit of a conundrum. What can explain this recent expansion? The flight to quality in real estate that we have observed in recent years has not ended, nor has real estate risk been repriced in any significant form over the last 12 months.

Generally, cap rates have been trending downward, even though they have been flattening as of late, signaling continued interest from investors.

The upward trend in spreads is being driven by the continued declines in Treasury yields. As the debt and banking crisis in Europe has continued, the flight to quality and safety in global capital markets has caused Treasury yields to continue to fall, even after the downgrade of U.S. sovereign debt last summer.

With cap rate compression slowing in recent quarters as investors have apparently become a bit leery of expensive prices in the market, the decline in Treasury rates has caused spreads to rise. The recent increase in spreads does not intimate that investing in commercial real estate has gotten riskier. The continued low cap rates and interest in high-quality assets attests to this.

Spreads are being pushed upward because the flight to quality is a global phenomenon—investors are shunning many other low-risk assets for the perceived safety of U.S. Treasuries. One should not expect risky assets such as real estate to participate in such a flight to safety because real estate is an inherently risky asset class.

The expansion in spreads really owes itself to the unique position that Treasuries occupy in the hierarchy of global investments, not a change in attitude toward real estate and real estate risk. This is emblematic of the complex relationship between cap rates and interest rates and a stark reminder that the relationship between the two is not as straightforward as we sometimes think it should be.

Victor Calanog is head of research and economics and Ryan Severino is senior economist,for New York-based research firm Reis.