Canadian-based asset and wealth manager CI Financial announced its second deal this year—this time acquiring New York-based Barrett Asset Management, a registered investment advisor with $2.5 billion in assets.

This marks CI’s 15th deal since entering the U.S. RIA market in January 2020, bringing its total U.S. assets to about $50 billion. The deal follows CI’s acquisition of Chicago-based Segall Bryant & Hamill, an investment and wealth management firm with $23 billion in assets under management, the company's largest deal yet, in January.

CI Financial CEO Kurt MacAlpine said the Barrett acquisition adds to its presence in New York, where it now has nearly $6 billion in client assets. In addition, Barrett has an average client size north of $10 million, so this also pushes CI further into the ultra-high-net-worth space.

In addition, Barrett manages two in-house mutual funds, and MacAlpine said the firm may help them on the distribution front.

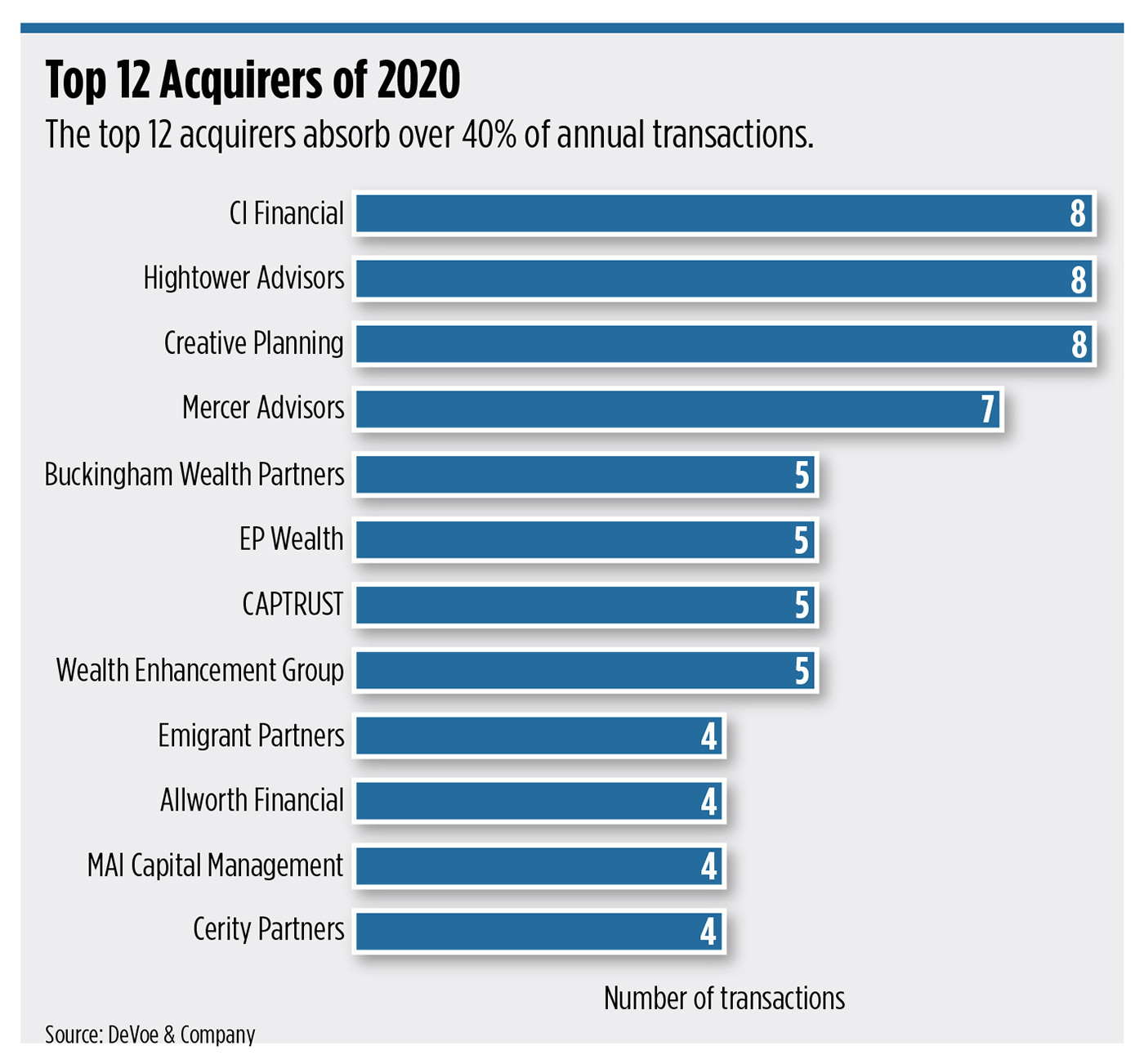

CI Financial is using the U.S. RIA market to carry out its plans to globalize. Last year, the firm was the most active acquirer in the U.S. RIA space, according to DeVoe & Company. In November 2020, CI began trading on the New York Stock Exchange under the ticker CIXX. The firm issued its first bond in the U.S. in December of last year.

MacAlpine was quick to say they’re not building an “aggregator” model; the firm is not forcing these RIAs to change immediately. But, rather, the plan is to “empower them to naturally put these businesses together over time.”

MacAlpine was quick to say they’re not building an “aggregator” model; the firm is not forcing these RIAs to change immediately. But, rather, the plan is to “empower them to naturally put these businesses together over time.”

“I would hate for it to be framed as an aggregation model, because it’s not—it’s an integration over an extended period of time,” he said.

Currently, there are a number of synergies that these wealth management firms can tap into, including the negotiating power that comes from being part of a large organization. CI’s RIA partners can also access its corporate services, similar to what you’d get at a wirehouse, for instance. That includes marketing, strategy, finance, human resources, legal, payroll and benefits, MacAlpine said.

These RIAs can also benefit from cross-border referrals.

“Today we’re the primary financial advisor for 330,000 Canadian families,” he said. “When Canadians who fit those affluent spans hit retirement, a lot of them spend a disproportionate amount of their time in the U.S. Prior to us entering the space last year, we had no ability to service clients south of the border. Now we have a very robust cross-border referral program in place, where our Canadian colleagues and advisors can refer their clients who have U.S. relationships to somebody else in the CI family.”

CI’s RIA partners also have access to broader specialized expertise, via other financial advisors within the company. The firm has businesses focused on corporate executives, small businesses, athletes, entertainers, professional services, retirees and divorcees, to name a few.

“They immediately have access to all of these expanded capabilities and partners they can tap into to better drive client service and client engagement,” he said.

MacAlpine says the RIA firms CI acquired grew 9% organically in 2020, excluding mergers and acquisitions and market appreciation.