Demand for international equity ETFs climbed in 2021. In 2020, U.S. equity ETFs received $165 billion of net inflows, higher than $74 billion for global funds, according to our First Bridge ETF data. However, the trend reversed since the start of 2021 with non-U.S. focused funds’ $43 billion out-gathering domestic peers by $15 billion. Global factor and thematic ETFs, such as ARK Innovation ETF (ARKK) and iShares Global Clean Energy ETF (ICLN), have been consistently popular in the past year; however, since January, broad/regional international ETFs and country-specific ones gained traction.

In 2020, broad/regional international equity ETFs gathered $19 billion of new money according to CFRA but has nearly eclipsed that to start the year with $15 billion in the approximately six weeks. To start 2021, iShares Core MSCI Emerging Markets ETF (IEMG) and alongside Vanguard FTSE Developed Markets ETF (VEA) received net inflows of $2.5 billion and $1.3 billion, respectively.

Meanwhile, country-specific ETFs received $2.5 billion of new money since January after approximately $400 million of outflows in 2020. JPMorgan BetaBuilders Japan ETF (BBJP) pulled in the most with $1.6 billion in 2021, but iShares MSCI Taiwan ETF (EWT), iShares MSCI Canada (EWC), and X-trackers Harvest CSI 300 China A Shares (ASHR) were among the other country-specific funds to incur net inflows in 2021.

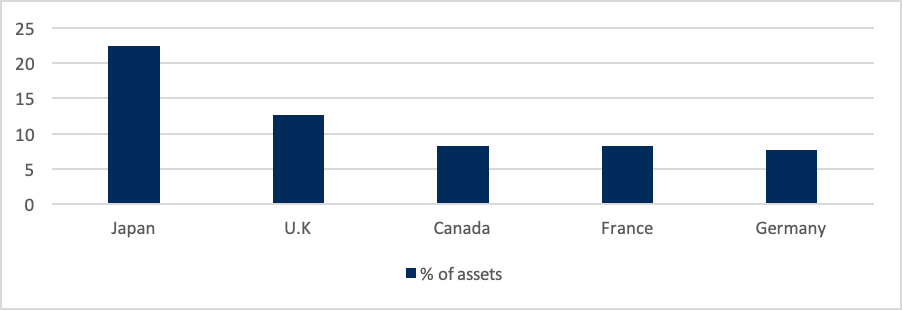

Before using country-specific ETFs, investors should understand how they fit in. For example, Japan represented 23% of VEA’s assets at year end, more than double the size of the next two largest markets, U.K. (13%) and Canada (8.3%). CFRA thinks BBJP offers an appealing risk and reward combination, aided by holdings like CFRA Buy recommended Softbank and Sony, with modest ETF costs. However, combining this with VEA requires a comfort to elevate the portfolio’s existing exposure to Japan.

Meanwhile, Taiwan represented 14% of IEMG assets, making it the second largest country after China (38% of assets). CFRA has a one-star rating on EWT due to our unfavorable view of the ETF’s relatively high costs and low reward potential compared to the broader equity category.

Chart 1: VEA’s Country Breakdown

CFRA’s First Bridge ETF Data. As of December 31, 2020

Investors need to also understand how ETF trading works with international funds. When buying or selling an ETF, investors pay a market price, which can often deviate from the net asset value (NAV) of the fund assets. With a mutual fund, investors pay the NAV. For example, IEMG closed on Feb. 9 at a 0.92% premium to its NAV that was consistent with 100 basis point differential that was common in 2020 although the spread regularly flipped from premium to discount. IEMG invests mostly in shares trading in the local market of China, India, Taiwan and others that stopped trading before the ETF begins trading in the United States.

Furthermore, IEMG and ASHR will continue trading this week and next even though the Chinese stock markets will be closed for the Lunar New Year holiday. Investors can expect premiums and discounts as the NAV will be stale and need to catch up once the holiday ends.

Conclusion

CFRA expects the strong demand for non-U.S. ETFs to persist in the year ahead, but thinks investors need to go beyond the fund’s name or expense ratio in fund selection. We have ratings on approximately 1,900 equity and fixed income ETFs including many targeted overseas markets.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.