In the past two decades, technology has become the primary engine of growth for our national economy. Companies like Amazon have transformed how we consume information, goods and services. It’s easy to forget about technologies that were supposed to change everything, and instead just…flopped.

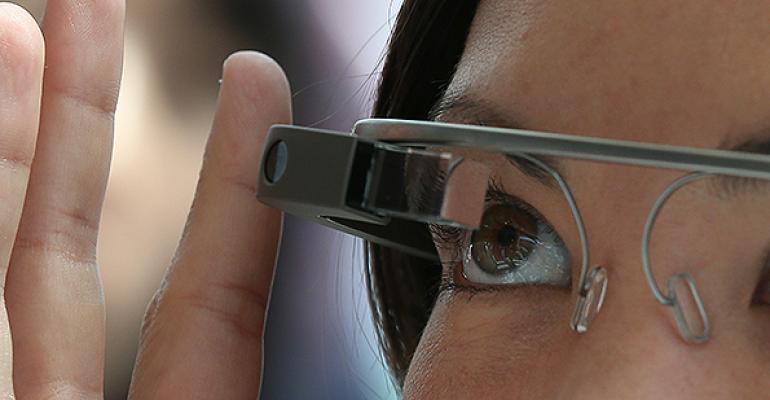

Anybody remember Google Glass? Who wouldn’t want an optical head-mounted computer, responsive to voice commands, always connected to the Internet? Well, as it turns out, two groups: Potential wearers, and everybody who interacts with them.

When the first edition of Google Glass was rolled out over five years ago, wearers in restaurants and bars were confronted by people who—shocker—weren’t enthused about being around someone who could be recording and monitoring their every word and action. Consumers bridled at the product aesthetics, while scoffing at why the average person would need such a thing.

Today, Google Glass is used in certain circumstances and professions, such as surgeons during complex operating procedures, but has failed to generate mainstream adoption.

The lesson, for technology decision-makers at wealth management firms, as well as fintech providers, is clear: Don’t let product exuberance supersede the importance of being guided by an “evolution revolution” approach that aligns market need, market demand and adoption readiness.

Evolution Revolution, More Than Just a Catchy Rhyme

At the core of the evolution revolution concept is the recognition that the most successful wealth management fintech providers improve the service experience by making existing processes more efficient, while enabling financial advisors to support a larger client base.

Technology providers that fail in the wealth management space tend to be businesses that believe they can disintermediate financial advisors, or peddle a new tech tool that might be unique, but nobody has asked for, or needs.

Why is this so? Wealth management firms are constantly under pressure to raise efficiency, more than anything else. Escalating regulatory complexities and margin compression, combined with a looming shortage of advisors caused by increased waves of retiring professionals and fewer next gen professionals make it necessary for firms and their advisors to be able to serve more clients on an increasingly cost effective basis, without skipping a beat in service quality.

And make no mistake about it, the opportunities for firms and advisors still in the game are enormous. For some individuals and households, the pandemic economy has presented new financial challenges. For others, savings and investment assets have grown more than anticipated. In all cases, financial advisors have emerged as essential sources of guidance.

When Cash Sweep Revenues Are Down, Modernization Needs Increase

So what are the next biggest challenges facing wealth management firms that CIOs and fintech providers should be keeping top of mind?

A significant problem is the current interest rate environment, and its impact on revenues across the industry. One of the single most significant revenue streams for large independent broker/dealers and corporate registered investment advisors comes from the net interest margin on the client cash balances they hold. With interest rates near zero for the foreseeable future, the budget that most firms have for investing in technology has shrunk.

In this COVID-19 environment of triaged spending, the fintech strategies with the greatest efficacy for firms—and that will resonate most with technology gatekeepers—are the ones that double down on modernization of existing functions, with an eye to accelerating cost efficiencies and scalable growth.

Think of workflow automation solutions providers that create truly end-to-end systems that are paperless and encompass all services that financial advisors rely on from their broker-dealers and custodians. Or data aggregation technologies that drive augmented opportunities for advisors to present a holistic planning experience to their clients.

Living in a Google Glass House?

Ultimately, think of what Docusign has achieved generally in digitizing existing workflows, increasing business processing efficiencies and removing legacy bottlenecks. These are the kinds of solutions that wealth management firms demand.

Indeed, the worst self-inflicted injury firms can make today is succumbing to the siren calls of providers who are touting buzzword-rich tools that are solutions in search of a problem.

In recent years, strategic initiatives around loose concepts that remain in the realm of theory versus practice, such as artificial intelligence and machine learning; or that hype technology for its own sake, without reference to any clear need, such as facial recognition software for use in client diligence discussions, consume scarce resources and distract from the vital mission of delivering an advisor-driven, exceptional service experience.

By the same token, wealth management firms and fintech providers that embrace an evolution revolution approach that embraces real world opportunities and challenges, while driving steady and significant improvements in how firms can grow on a scalable basis, will be positioned for maximum success.

Firms and fintech providers that ignore the experiences of the bold but naive Google Glass wearers at bars and restaurants five years ago could find themselves on the receiving end of the bum’s rush—and forced to be on the outside, looking in.

Adam Malamed is President & CEO of Ajax Investment Partners, a fintech incubator and strategic consultancy focused on growth planning and M&A for financial services firms.