Sponsored by Black Creek Group

While individual bonds and fixed income mutual funds have historically provided diversification advantages and periodic income at regular and reliable intervals to individual investors, recent lower yields (or lower income) and the persistent threat of rising rates (in general, bond prices decline when interest rates rise), has led many investors to seek alternative sources for income.

COMMERCIAL REAL ESTATE: A New Source for Income?

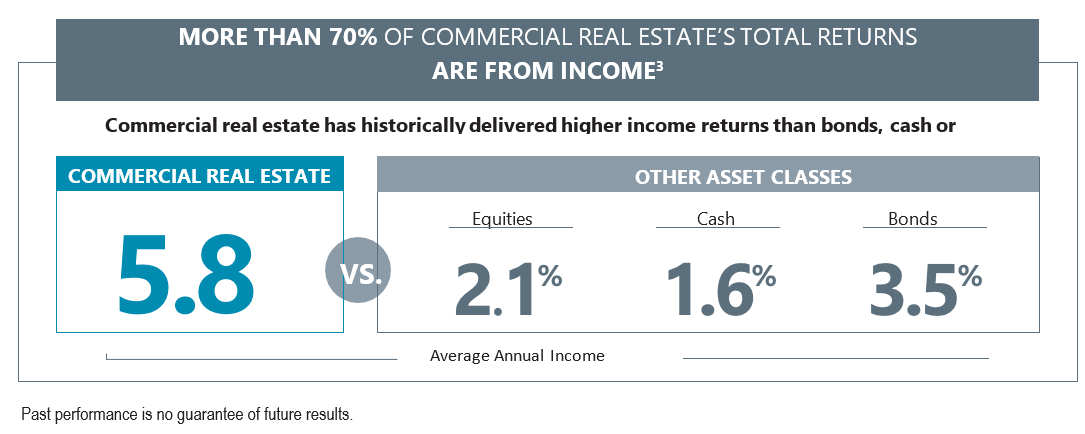

Over the last 20 years, commercial real estate has produced income-driven returns, with more than 70% of its total returns having come from income, which has made it a complement to individual bonds and fixed income mutual funds in a diversified portfolio.1 Yet, many individual investors may be under allocated to commercial real estate, while institutions have long been investing directly in commercial real estate and realizing its potential benefits.1

POTENTIAL TAX ADVANTAGES

The recently approved legislation has significant positive implications for commercial real estate investors. Individual investors can access commercial real estate by investing in a real estate investment trust (REIT). With limited exceptions, dividends from REITs are generally taxed at rates applicable to ordinary income, which will be as high as 37%, currently. Thanks to the tax legislation passed in late 2017, special rules reduce taxation of certain income earned through pass-through entities and reduce the top effective rate applicable to ordinary dividends from REITs for taxable years prior to 2026 to 29.6% (through a 20% deduction for ordinary REIT dividends received that are not “capital gain dividends” or “qualified dividend income,” subject to certain limitations). This reduced tax rate could increase the after-tax dividend distributions and thus after-tax yields for REIT investors. Distributions that exceed both the REIT’s earnings and profits and the shareholder’s adjusted tax basis in its REIT stock are not return of capital distributions and are treated as capital gain to the shareholder. Speak with a professional tax advisor regarding your specific situation.

A COMPELLING COMPLEMENT TO FIXED INCOME

Thanks to commercial real estate’s historical income returns and availability of investor-friendly shareholder structures and enhanced liquidity features, we believe commercial real estate has the potential to complement the income benefits historically provided by traditional fixed income investments in an individual investor’s diversified portfolio.

Investing in commercial real estate assets entails certain risks, including changes in: the economy, supply and demand, laws, tenant turnover, interest rates (including periods of high interest rates), availability of mortgage funds, operating expenses and cost of insurance. This investment will offer limited liquidity options to investors. There is no guarantee of any return on investment and stockholders may lose the amount they invest. Real estate investment trusts (REITs) are not suitable for all investors. This is not an all inclusive description of the risks of a REIT product and investors should read the prospectus prior to investing in any REIT.4

To learn more about Black Creek Group visit www.blackcreekgroup.com

1 Institutional investors often invest on substantially different terms and conditions than individual investors, which may include lower fees, expenses and leverage.

2 The recent global outbreak of COVID-19 (more commonly known as the Coronavirus) has disrupted economic markets and the prolonged economic impact is uncertain. Some economists and major investment banks have expressed concern that the continued spread of the virus globally could lead to a world-wide economic downturn. Customers and potential customers of the properties owned by real estate investment trusts sponsored operate in industries which could be adversely affected by the disruption to business caused by the global outbreak of the Coronavirus. This could lead to adverse impacts on the business of REITs.

3 Sources: Bloomberg; NCREIF; NAREIT. 20 years ending June 30, 2020. Commercial real estate is represented by the NCREIF Open-End Diversified Core (ODCE) Index, an equal weighted, time weighted index representing a blended portfolio of institutional-quality real estate funds reported net of management and advisory fees (with the exception of the private real estate income data shown, which is reported gross of management and advisory fees). The term core typically reflects lower risk investment strategies, utilizing low leverage and generally represented by equity ownership positions in stable U.S. operating properties. Funds are weighted equally, regardless of size. While funds used in this index have characteristics that differ from net asset value (NAV) REITs (including differing management fees), Black Creek Group’s management believes that the NCREIF ODCE Index is an appropriate and accepted index for the purpose of evaluating returns on investments in NAV REITs. Equities are represented by the S&P 500 Index, an unmanaged index of the 500 largest stocks (in terms of market value), weighted by market capitalization and considered representative of the broad stock market. Bonds are represented by the Bloomberg Barclays US Aggregate Bond Index, an index of securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. Bond income return is represented by the yield to worst of Bloomberg Barclays US Aggregate Bond Index. Cash is represented by the 3-Month Treasury Bill Rate, which is the yield received for investing in a government-issued treasury security that has a maturity of three months. Bonds and equities provide ready liquidity and are easily traded. These indices are used in comparison to the NCREIF ODCE Index in order to illustrate the differences in historical total returns generated by commercial real estate, equities and bonds. The prices of securities represented by these indices may change in response to factors including: the historical and prospective earnings of the issuer, the value of its assets, general economic conditions, interest rates and investor perceptions. All indices are unmanaged and do not include the impact of fees and expenses. An investment cannot be made directly in any index. The returns presented are not indicative of returns to be attained by NAV REITs. Diversification does not guarantee against the risk of loss. Income return is the portion of a fund’s total return that was derived from income distributions. Income returns for this time period may include return of capital. Return of capital occurs when an investor receives a portion of their original investment that is not considered income or capital gains from the investment. Note that a return of capital reduces an investor’s adjusted cost basis. Comparisons shown are for illustrative purposes only and do not represent specific investments or the performance of NAV REITs. NAV REITs have the ability to utilize higher leverage than is allowed for the funds in the NCREIF ODCE Index, which could increase a NAV REIT’s volatility relative to the NCREIF ODCE Index. An investment in a NAV REIT, such as the REITs sponsored by Black Creek Group or its affiliates, is not a direct investment in commercial real estate, but rather an investment in a REIT that owns commercial real estate. There are many material differences among commercial real estate, NAV REITs and traditional fixed income, including but not limited to, differences in fees and expenses, liquidity, safety and tax features. Investors are advised to consider the limitations of investing in commercial real estate, such as decreasing liquidity, increased volatility, and, in the case of NAV REITs, upfront selling commissions and ongoing distribution fees that will have the effect of reducing an investor’s return on his or her investment. An investment in a NAV REIT is not a direct investment in commercial real estate, but rather an investment in a REIT that owns commercial real estate. For more information on the potential risks of investing in commercial real estate or a NAV REIT, please see the “Risk Factors” section of the applicable prospectus.

Past performance is not a guarantee of future results.

4 While many REITS have enhanced liquidity features, often a REIT investment may not allow redemptions for a full year or longer, or they may limit redemptions to once per quarter or less frequently after a required investment period. Investors should read the prospectus carefully prior to investing.