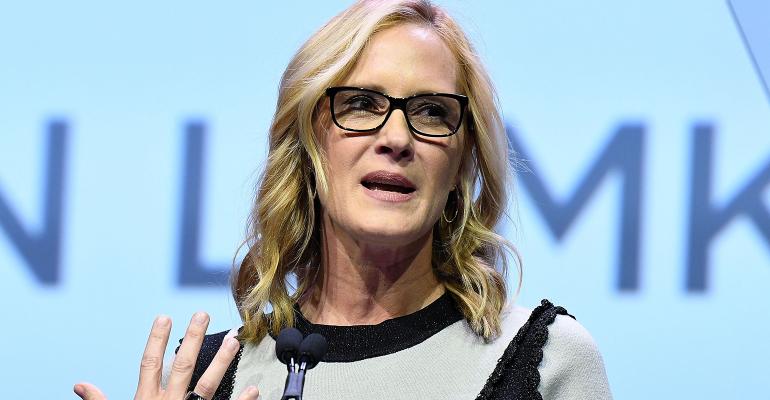

J.P. Morgan Wealth Management CEO Kristin Lemkau called J.P. Morgan’s recently announced $30 billion five-year initiative to confront systemic issues causing and exacerbating the country’s racial wealth gap “sizable and measurable” during a discussion at SIFMA’s annual conference held earlier this month. She noted the initiative included $14 billion for new housing loans for Black and Latinx households, $8 billion to boost affordable housing, as well as $4 billion for mortgage refinancing and $2 billion in small business lending.

Lemkau said that there were no easy answers on closing the gap but stressed to Derek T. Dingle, a senior vice president with Black Enterprise and the moderator for the Q&A, that it was nevertheless important to get started.

“There’s a moment where you have to throw your hat over the wall even if you don’t have all the answers figured out, and ensure you’re going to put the kind of business focus and capital you need toward fixing it,” she said.

J.P. Morgan Wealth Management CEO Kristin Lemkau spoke to Derek T. Dingle at SIFMA's virtual annual conference.

But what role is the institution’s wealth management division set to play? Kira Forbes, the inclusive investing program manager at J.P. Morgan Wealth Management, will be helping to manage the division’s position in the broader effort. She said the division would begin hosting educational seminars on financial investing in Black communities to promote wealth literacy. These seminars will likely start online due to the COVID-19 pandemic but will be held in branches when safe to do so.

Forbes said the division was in the beginning stages of developing how the seminars would be executed.

“We want to leverage research and marketing campaigns to understand the unique challenges of the Black and Latinx communities,” she said. “There’s a wealth gap showing Black and Latinx families are not participating as long-term investors. We want to understand the unique challenges and be more targeted in our approach.”

Kira Forbes

The wealth management division will also work with historically Black colleges and universities (HBCUs) to bolster financial planning curricula and programming at the schools, and strengthen mentorship opportunities and provide scholarships for students in those schools seeking to pursue a career in financial planning. In doing so, the division also wants to create a pipeline of diverse advisor candidates through the relationships between the company and financial and Certified Financial Planner programs at these schools.

The net worth of a typical Black family is as much as 10 times lower than the average white family, according to research from the Brookings Institution. During her conversation at SIFMA’s conference, Lemkau noted that a third of Black households owned stock in 2019 compared with 60% of white households, while a third of Black families had retirement plans compared with two-thirds of white families. Dingle stressed that these gaps could be exacerbated by crisis; between 2007 and 2013, during the 2008 crash and subsequent recession, Black wealth went down 44.3% compared with 26.1% of white wealth.

Forbes said J.P. Morgan Wealth Management’s self-directed offerings and automated advice platform, or so-called robo advisor, opportunities could be attractive to first-time investors. At the seminars, Forbes said J.P. Morgan will offer people financial incentives to adopt self-directed digital investing approaches.

“Within wealth management, we’re focused on the investing wealth gap. The typical black family has less than $13 in wealth for $100 (of a white family), according to the Federal Reserve, and participation in the market and investments are a piece of that,” she said. “Being able to build up that trust within these communities who have not participated in the market and develop that financial literacy will help to close the gap.”

Lemkau stressed that the new initiative represented an opportunity for J.P. Morgan, as well as a chance to play a role in closing the wealth gap. She compared the highly competitive wealth management industry to “hand-to-hand combat” in terms of finding and winning clients, and hiring and retaining advisors. But those individuals and families not currently investing could be future J.P. Morgan customers.

“This was not a philanthropy-driven announcement,” she said. “This was a business-driven announcement, cause this is a business opportunity and opportunity for the country."