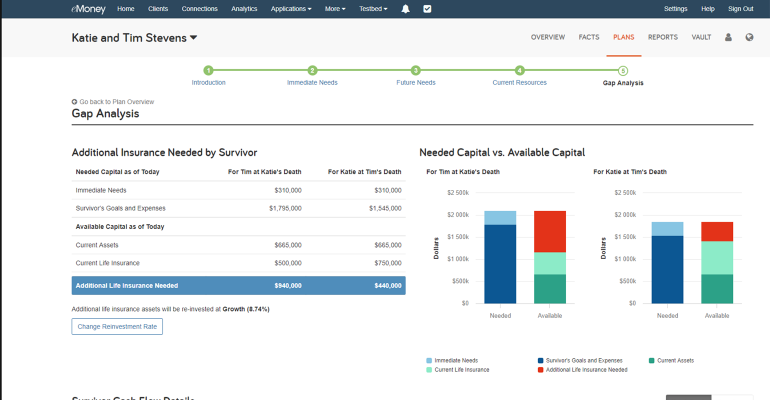

eMoney’s Foundational Planning feature is getting a new module, according to an announcement by Fidelity’s financial planning software company. Called Life Insurance Gap Analysis, the feature is intended to illustrate client insurance needs through either a modular approach or as part of a broader financial plan.

The analysis provided by the feature is a riff off an ongoing trend of more tightly incorporating insurance into financial planning and tech offerings, such as Envestnet building its Insurance Exchange and CAIS’ new consulting service. eMoney called life insurance “a fundamental starting point when building a long-term financial plan.”

“With a planning-led approach, advisors are better suited to answer difficult questions from clients such as whether or not their families will be taken care of in their absence,” said Jess Liberi, head of product at eMoney.

The new feature is a supplement to the extant insurance capabilities available in the Advanced Planning solution. Both Foundational and Advanced Planning solutions "can be used by advisors (or firms not considered large)," said a company spokesperson.