Renewables have historically been a cornerstone of climate change investing—but there is a world of opportunity besides windmills and solar panels. A comprehensive climate strategy will look beyond power generation to energy efficiency, housing, transportation, food and recycling.

Here again, some of the most distinctive investment ideas, both from the perspective of returns and impact, focus on solving specific problems, improving existing technology or making broader adoption more feasible.

Minimizing the carbon impact of transportation, for instance, isn’t just about funding electric cars and makers of lithium-ion batteries. There are myriad companies in this space that are contributing to more eco-friendly transportation in seemingly small but immensely impactful ways.

One example is a battery-exchange kiosk company in Asia, which makes electric two-wheelers a more viable alternative with a creative answer to charging. Rather than plugging in their vehicles and waiting for them to charge, drivers use the kiosks to swap batteries. The kiosks are technology-agnostic; as new batteries come onto the market, the company simply adds them to its catalog.

Similarly, green chemistry is a category that doesn’t get the same attention as alternative energy but offers ample room for reducing the use of fossil fuel derivatives in items of everyday consumption, from packaging materials to paints and furniture polish. The same is true of new business models around recycling, compostable packaging materials, waste-to-energy generation and waste water processing.

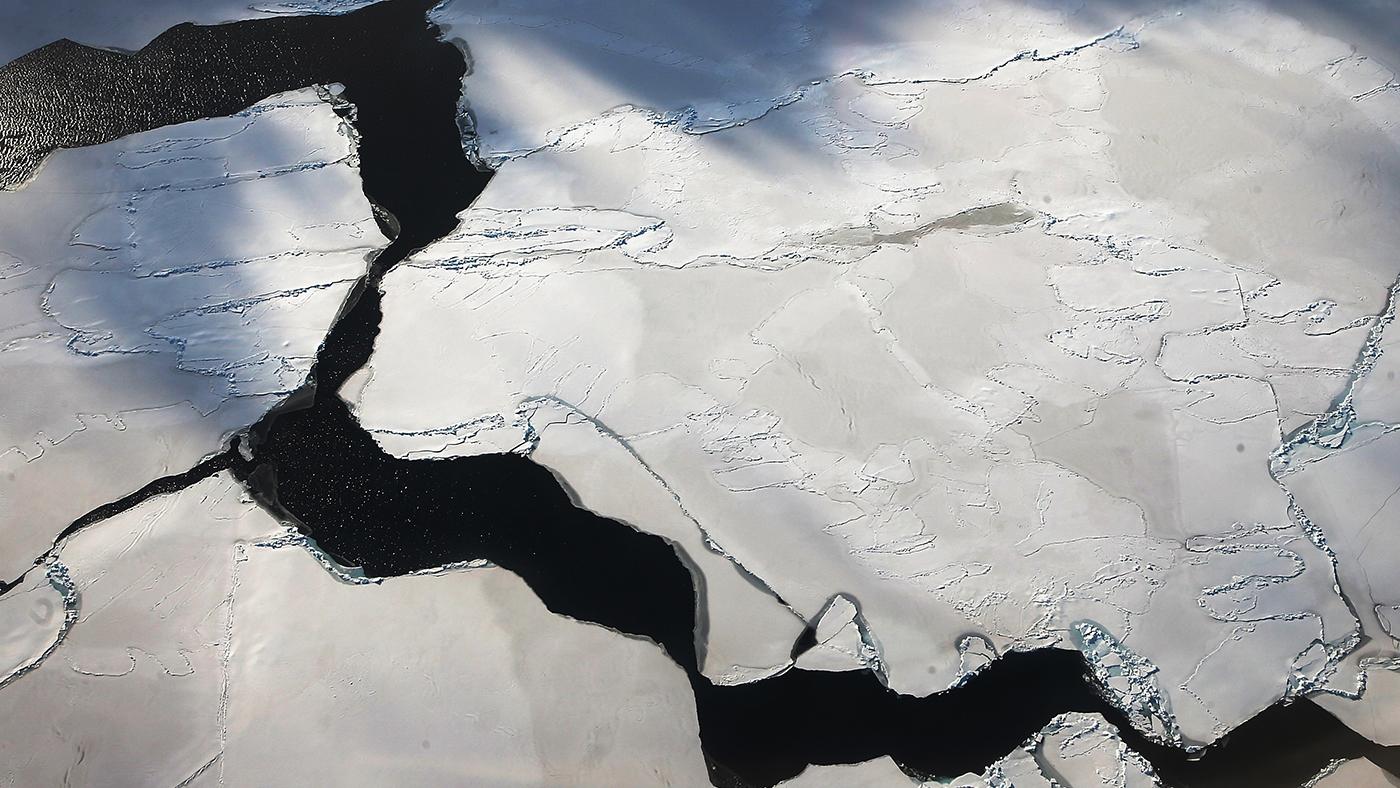

There is also a plethora of investment ideas related to food. Demand for meat protein is growing along with the world’s population and income levels. Yet, livestock is a major source of emission of the greenhouse gas methane—which is approximately 30 times worse than CO2. As such, sustainable seafood, which has a much smaller carbon footprint, presents a blue ocean of opportunity.