Why attempt to work with your clients’ children? They will be the largest-inheriting generation on record, plus many of them are high-income earners with high COI potential. Not to mention, they want and need your advice.

It’s a natural evolution of your relationship with the parents; ultimately, if you’re providing holistic wealth management, you’ll need to work directly with their children.

However … we have only so many hours in the day. Depending on the size of your client base, there may be more children than you can reasonably contact. This means you’ll need to prioritize and create a strategy. We’ll save you some legwork on this. Here’s a process we’ve seen work with magical results:

1. Profile Your Top 100 Clients

Make a list of your top 100 clients. This might be very simple for some of you, more difficult for others. We suggest ranking them not just by their assets but also by other factors like advocacy, willingness to take your advice and potential for upgrade as well. Beside each top-100 client’s name, list their children’s names and ages.

2. Score Their Children

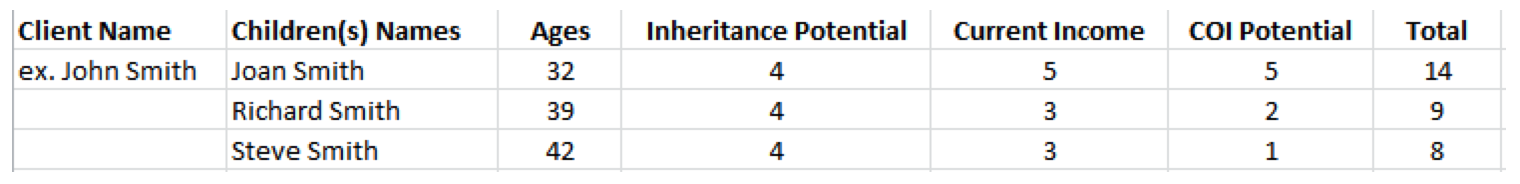

Take your list of clients’ children and create the following spreadsheet:

Scoring Criteria (1-5 scale; 5 highest):

- Inheritance Potential – this is a measure of the child’s (term used loosely; some are middle-aged) inheritance potential. The factors in this are the parents’ assets, number of heirs and spending habits. Reserve a 5 score for those who stand to inherit serious money and 1 for those who may inherit nothing.

- Current Income—some of your clients’ children are high-income earners already. There is a little guesswork involved here. Sidebar—LinkedIn is a tremendous tool for finding client family members and viewing their job title.

- COI Potential—assessing their current ability to connect you with potential clients.

This exercise may take a little effort, but you’ll be glad you did it. You’ll have much better knowledge of your clients’ families and their needs for wealth management.

3. Start to Make Contact Strategically

Work through your list in order of total points scored. In the example above, Joan Smith scores a 14, so she’d likely be near the top of your list. You have several ways to make contact; you’ll likely find value in some combination of these:

On LinkedIn— Consider sending one of the following messages to your clients’ children on LinkedIn.

- If you know the child:

Hope you are doing well! I stumbled onto your profile and thought I’d reach out. Are you still living in Charlotte? I’d love to connect. - If you don’t know the child:

I know we’ve never met before, but your parents and I go way back. We’ve worked with them for years—they are great people. I’d love to connect.

You might also go through the parents. You could say, “I was thinking about your son Stephen the other day. Seems like he’s got a lot going on with his family and at work. I’d love to reach out and connect with him. Anything I should know about him before I call?”

No matter how you slice it, millennials and Gen Xers are soon to be in dire need of financial advice. Contrary to popular belief, they’re not all going to use automated advice platforms, or so-called robo advisors. Make contact now and reap the rewards for the rest of your career. Keep us posted with your successes!

@StephenBoswell is president of The Oechsli Institute and co-author of Best Practices of Elite Advisors. @KevinANichols is chief operating officer of The Oechsli Institute and co-author of The Indispensable LinkedIn Sales Guide for Financial Advisors.