(Bloomberg Opinion) --There’s been an abundance of analysis on the recent swoon in stocks, but there’s one key variable that often gets overlooked when determining whether and how fast the market rebounds: demographics. On that basis, the outlook isn’t very good.

It hardly matters that the S&P 500 Index’s 19.8 percent plunge from its record high in late September to its low on Christmas Eve failed to meet the technical definition of a bear market, which is a peak to trough decline of 20 percent. The pain is real. Despite the big rally Friday in response to a better-than-expected jobs report and some dovish comments from Federal Reserve Chairman Jerome Powell, it’s still down 13.6 percent. Even something as simple as Vanguard’s Wellesley Income Fund, cited for its conservative allocation strategy with just 37.7 percent exposure to equities and a 0.35 beta, is down about 10.4 percent.

I have no way of knowing this, but I’ll bet the average age of investors in the Wellesley Income Fund is rather higher than the average for the population. A Google search of the fund with the words “average age” will return an abundance of advice from Seeking Alpha, Motley Fool, Investopedia, Bogleheads and other web sites that this is just the sort of fund for retirees. The Wellesley Income Fund is hardly alone. There are many similar so-called balanced funds to pick on, but I’m picking on this one because, 1) I invest in it, and 2) I’m originally from Wellesley, Massachusetts.

This sort of performance for a fund highly recommended for retirees is a cautionary tale for investor behavior over the haul. Someone born in, say, 1958 was a mere 42 when the dot-com bubble burst in 2000-2001. So, they had a long runway to recover before retirement. Said person was 50 when the financial crisis hit in 2008-2009, but still had some time to recoup any losses.

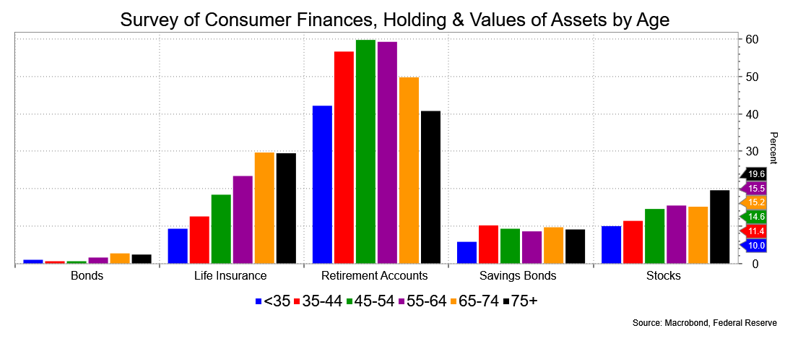

Now, said person is about to turn 61. The runway to retirement is significantly shorter, which suggests any patience with a bear market will be rather thin. Even if the next recession proves shallow, older investors, who also own the greatest percentage of equities than any other demographic cohort, will opt for more risk aversion in the decade(s) to come. Over the past four weeks, redemptions totaled $164 billion, more than 1 percent of the money in stock and bond funds, according to Investment Company Institute data.

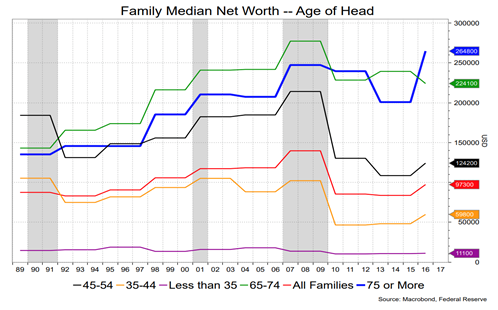

That is just logical. The closer you are to retirement, the more risk averse you tend to be. Compounding that behavioral reality is another fact: Household wealth has been essentially stagnant for decades. The only group showing much improvement has been those 75 years or older. These people are the least likely to withstand a weak equity market with patience unless they have an exaggerated optimism about life expectancy.

Also, it’s the older population groups that will liquidate retirement holdings via minimum distributions as required by tax law or by their own demand. It goes without saying that these groups are also a considerably larger share of the population. In 2001, 27.8 percent of the U.S. population was 55 or older. That figure will grow to 35.4 percent in 2019. In other words, they are the richest demographic group, own the most equity shares, are on the cusp of (or in) retirement, and tend to spend less as they age.

None of that bodes well for tolerance with volatile and declining equity holdings. The point being that equity rallies, whether in the short or intermediate term, are likely to meet with selling from this part of the population.

While the plunge in the stock market discounts the bad news it anticipates, history suggests that there’s more to come or, at least, that this is not a buying opportunity in the narrow sense. That is to say if we are going towards a recession, the soft price action can last for several quarters and, historically, the initial dip comes in advance of an actual negative quarter.

David Ader is the former chief macro strategist at Informa Financial Intelligence and held similar roles at CRT LLC and RBS/Greenwich Capital. He was the No. 1 ranked U.S. government bond strategist by Institutional Investor magazine for 11 years, and was No. 1 in technical analysis for five years.

To contact the author of this story: David Ader at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view