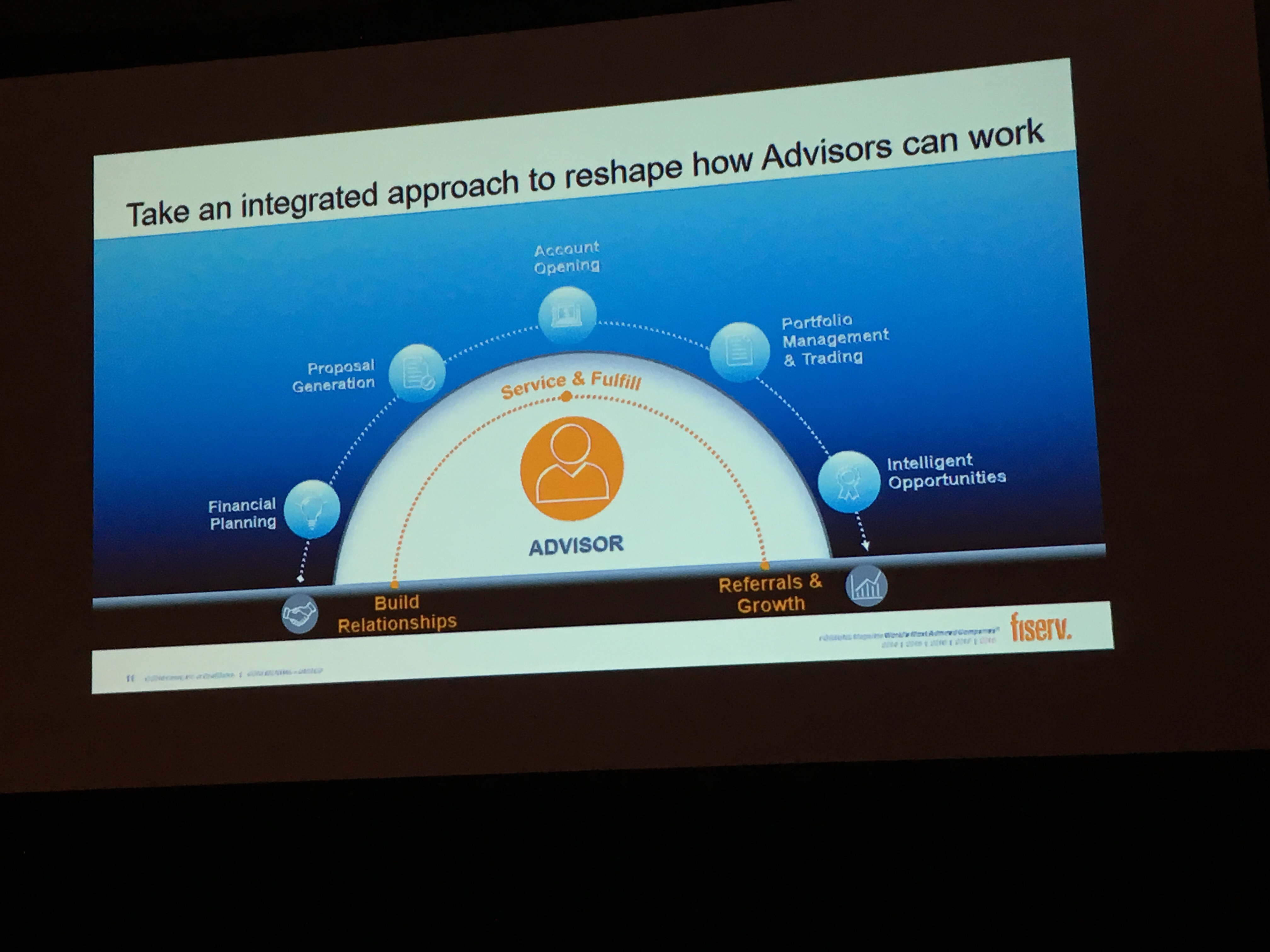

Fiserv is digging into the financial planning game, presenting a toolkit built from in-house development and acquisitions at the T3 Conference in Las Vegas. The kit, referred to as Financial Advice Management, allows advisors to execute single goal, multi-goal and comprehensive planning. The feature is meant to connect modular systems into one platform, including API-friendly contact management that plugs into outside CRM applications, risk questionnaires, account onboarding via a data aggregator. Data also can be brought into the system manually or via text file. The tool also looks at cash flow activity and can support model portfolios imported by the advisor.

“Financial planning is not traditionally what we’re known for,” said Igor Jonjic, product manager for the financial institutions group. Given the emphasis placed on financial planning in the advisory market, as well as assessing a need for quicker, more painless financial planning that integrates with outside tools, Jonjic said the time was ripe for putting the company’s tool in the marketplace.

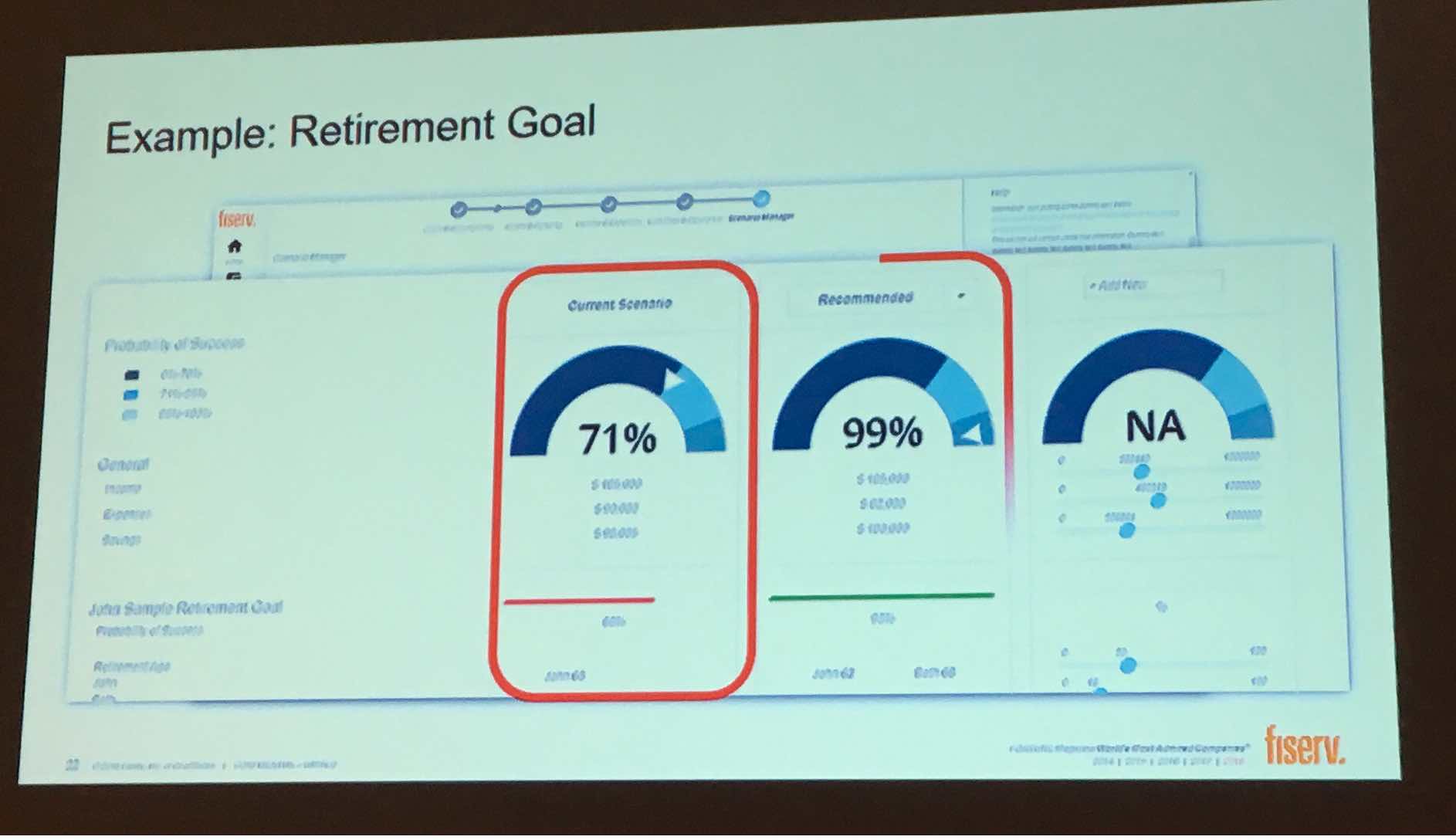

Those who are regular users of the industry’s most popular financial planning like MoneyGuidePro and eMoney might find that some of the dials and figures in Fiserv’s offering have a familiar look, but Jonjic said the goal was not to imitate. “We didn’t want to be MoneyGuidePro,” he said. Indeed Fiserv tries to take its approach further than other tools, allowing advisors to simultaneously open and monitor accounts and draft investment proposals that are immediately ready for electronic signatures. There is also a great deal of granularity in the software, for example, each goal in a client’s plan can have its own risk questionnaire.

The level of granularity could seem overwhelming and cumbersome to users, though Jonjic said an advisor can make a rough-and-dirty sketch of a client’s financial plan and fill in the details later.

The tool also promotes client-advisor interactions. Clients can see how their current financial plan might stack up to a proposed plan. Advisors can take that opportunity to connect with the client to discuss how to fill gaps in the plan, such as increasing contributions or pushing the goal further into the future. The tool is also modular, so advisors interested in specific components of the tool can get access to just those parts. Jonjic noted that the generic product-solutions backbone, which allows advisors to include generic product solutions like insurance or annuities, provides the core of a tool that could eventually be built into a product like Envestnet’s forthcoming Insurance Exchange hub.

Jonjic said the tool is a “glimpse of Fiserv’s future.” It’s a future that’s noticeably different from the bank-centric solutions the company’s most well-known for providing.