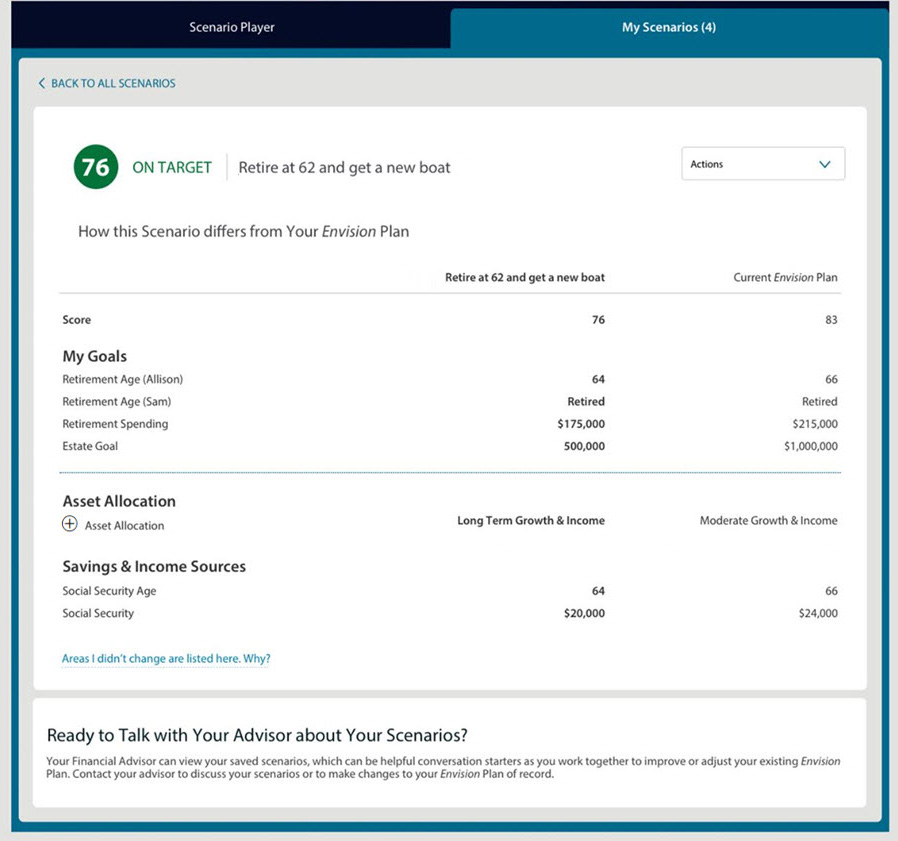

The more than 14,000 Wells Fargo Advisors have a new tool for working with clients who have created a financial plan with the firm. The online tool, Envision Scenarios, allows clients to model how hypothetical changes in their investments or investing decisions could impact their financial goals.

Many independent registered investment advisory firms that use the third-party, goals-based planning tool MoneyGuidePro have access to something similar in the form of PieTech Inc.’s introduction of the MyMoneyGuide component that allows prospects or clients to set goals and tinker with hypothetical adjustments.

Similar to the workings of MyMoneyGuide, Envision Scenarios will also notify Wells Fargo Advisors when their clients make changes. Advisors then can review the various scenarios, connect with the client to ask questions and offer advice on which elements to build into their existing plan. The hypothetical adjustments in Envision Scenarios do not alter a client’s existing financial plan.

With Envision Scenarios, clients can adjust up to four hypothetical scenarios at a time to model how various saving and investing changes could potentially alter their retirement plans and other investment goals.

The continued enhancement of the Wells Fargo Advisors platform follows an extensive redesign in 2016 and the rollout of a new digital experience in January 2017.