Forecast 2002:

Estate Planning After EGTRRA and Sept. 11

Two Affairs to Remember

By Roy M. Adams

Partner, Kirkland & EllisNew York, New York

As I sit down to write a column predicting what will happen in 2002 and beyond in our industry, two dates from 2001 are seared into my memory: June 7, and September 11. The events which occurred on those dates will shape the estate-planning professional in 2002 and for the rest of the decade.

The magazine Consumer Reports estimated in 1998, that based upon Federal Reserve Board data, seven out of ten Americans do not have Wills. Or, put another way, they lack estate plans. That should change in the future based on 9/11/01 alone. Thousands of surviving relatives petition the courts in New York, which function courageously and sympathetically to help people put their lives back together again, too often without documents to do so. Whether their actions end up quite contrary to what the victims would have desired, we'll never know. I am reminded of a sign in a dentist's office: "I cannot do as your dentist anything to repair the damage which you have caused by doing nothing."

I would predict that, given 9/11/01, and the war on terrorism in which we are now involved, and the threats within the United States the number of people without Wills or estate plans is going to drop. More Americans should care about having their affairs in order and more should and will be encouraged by estate planning professionals to take the necessary steps in order to protect themselves and provide for and assist those whom they love when they are no longer here to do so. Estate planning is, in significant part, something you do for someone else.

In our profession, June 7, 2001 — the day the new tax law was signed — ushered in a new day. I see ahead the massive need to redo documents now in effect and certainly make changes in the way we draft new documents and in the way we think through estate planning.

Restating marital gifts by formulas or otherwise, or transferring assets to be certain that the increased applicable exclusion amounts are fully utilized will become important. Coordinating the effects of uncoordinated gift, estate, and generation-skipping tax exclusions needs urgent and sophisticated attention.

Planning for more than one scenario is vital, so that when the year 2010 comes, the documents in effect for an individual do not cause the loss of the $1.3 million or the $3 million basis step-ups without defeating important objectives if deaths occur in 2009 or earlier. I’ve heard too many estate planners who say that they will address the needs of their clients or customers when the tax laws "settle down and inevitable multiple changes occur." There are bound to be changes, no doubt. We cannot, however, adopt the approach just quoted. We must plan now to take the laws which now exist into account. We can change when and if the law changes.

Meanwhile, there's another major trend for our profession to watch in 2002: Multidisciplinary estate planning is emerging with great speed and force. The state of New York now allows affiliation among lawyers and non-lawyers, with lawyers sharing in the non-lawyer fees. Professor Gazur at the University of Colorado at Boulder, Colorado, said in a study that only six percent of estate planners bill $5,000 or more for their services (28 percent charge $1,000 or less). I see the New York ethical change on fee sharing as, in part, a wise and insightful attempt to help put our profession on a strong financial footing, notwithstanding understandable apprehension about what many regard as the compromise of attorney loyalty and other complications. But the trend is clear: Twelve or 13 other states have already announced that they will follow New York’s lead.

We all know with the phase-out of the State death tax credit, and the unlimited deduction from the Federal estate tax beginning in 2005 and ending in 2009 for any State death taxes enacted during that period will now make planning for State death taxes a significant item on the estate planner’s menu and present unique and compelling problems to be solved.

Studies say that 44 percent of an estate planner’s time is now spent on non-tax matters, such as selection of trustees, creation of living trusts, inclusion of spendthrift and incentive trust provisions, preparing health care powers, powers of attorney and living Wills. This trend will continue in estates of all sizes and requires the professional estate planner to act as counselor as well as tax planner under what will be more demanding circumstances.

What does 2002 hold in store? We will see more demand for planning because of 9/11/01 and its aftermath, the enormous complexity and broad-reaching impact of the June 7, 2001 legislation with its long phase-in period. We also need to get our profession on a firm financial footing by using innovations such as the multi-disciplinary approach. As I look into my murky crystal ball, I see these issues in 2002 and beyond, and many, many others this column does not permit space to analyze.

American Values in a Changed World

By Jeffrey W. Comfort

Georgetown University

Washington, DC

What will be the state of the philanthropic union through the year 2002?

"All questions rely on the present for their solution. Time measures nothing but itself."

These timeless words from philosopher, author, and naturalist, Henry David Thoreau in 1849, could have been said this morning. The term " poor visibility" has received ample press recently from corporations asked to project their earnings. It seems to fit well in any attempt to peer into the state of philanthropy for the year ahead, 2002.

The world changed on September 11, 2001, and continues to change almost daily. As of this writing, Congress is still in session and one of the largest charitable tax incentive bills in recent history is still pending. Not knowing the status of the President’s Armies of Compassion legislation, anecdotal evidence suggests that many in the field of charitable giving have muted expectations for philanthropy this year. These muted expectations are based on the ambiguity and the myriad of questions about various macro trends.

Questions, questions, questions: the economy, the markets, the 2001 Tax Act, geopolitics, the war on terrorism. The list could go on. Areas such as these are often the first to be examined in considering the environment for philanthropy and charitable giving.

Too much focus on these areas in their current state could lead to a gloomy forecast, or at best a murky outlook, for philanthropy through 2002. There is a great deal of uncertainty in the strength or direction of our current economy, the permanence of the new tax laws, and the destiny and consequences of geopolitics and the war on terrorism. Nothing can put major gifts on hold more than uncertainty. Yet, in the face of this uncertainty there is plausible evidence to suggest that there has been a rebirth of the great force of American values. This rebirth of American values should balance and offset or even overpower the potential damaging impact of this uncertainty on philanthropy. Just look to the extraordinary generosity of Americans to the recent disaster relief efforts (over $1 billion raised in just six weeks) as a prime example.

As for the economy, are we in recession or recovery? The National Bureau of Economic Research recently declared that the longest expansion in U.S. history ended last March with the advent of our first recession in a decade. When asked to comment on this declaration, Paul O’Neill, the US treasury secretary, said, "But I think we’re poised for a recovery, yes." This brings to mind Harry Truman’s words, that he favored one-arm economists, because of economists’ custom of saying, "On the one hand…."

Will 2002 be a year of recession or recovery? Surely the final answer will influence the markets, but what will the upshot portend for charitable giving? A look back in history may provide our best clues for an informed response.

"[F]or all practical purposes the recession continues… People are unemployed, people are hurting, the economy is very slow." If you think this sounds like a current quote, think again. This statement was made a week before the Christmas Holidays in 1991 by then White House spokesman Marlin Fitzwater. Eminent economists and other experts testifying before the House Ways & Means Committee then concluded that very little could be done by adjusting interest rates and fiscal policy and that the economy would just have to be allowed to "right itself."

As you consider the potential impact of this year’s economy, good or bad, on charitable giving, bear in mind that through that 1990-91 recession, and all other recent recessions, Americans have increased their charitable giving in terms of dollar amounts. In fact, statistics show that overall charitable giving trended upward even during the Depression.

As for the 2001 Tax Act, so much has been written since its passage last year that it almost seems out of place in a forecast for this year. However, this Tax Act will continue to have its place in philanthropic planning throughout this year and for as long as it is the law of the land. The real trick here would be to forecast just how long this Act will be the law of the land; December 31, 2010? The bottom line for charitable giving is this: The changes in income, gift, and estate taxes mean that the amount of taxes paid by most Americans will be significantly reduced. As a result, many will have more to spend, save, and give to loved ones and charity.

Geopolitics and the war on terrorism may be the real wild card in the deck for 2002. The attacks last September caught our nation and the world by surprise. Who among us could second guess the minds of terrorists and predict what may lie ahead? Could the fog of the war on terrorism cloud philanthropy? While the circumstances differ dramatically, historical data demonstrate a large increase in charitable giving through World War II.

The world has changed though because of the events of September 11, 2001, and, herein may lie the most important question for philanthropy for the days, months and even years ahead. The question is not one being asked of us in the charitable gift and financial planning field. Rather, the question is one that we should be asking of donors and clients.

The horrible and despicable acts of terrorism, for many, brought our human mortality, values, and priorities to the forefront. This process has refocused our nation in many ways, including a renewed appreciation for our national treasure of nonprofit institutions. Sensing and articulating this phenomenon, Robert Sharpe, Jr. renowned gift planning expert and president of Robert F. Sharpe and Company, Inc. recently wrote, "Americans stand ready to make charitable gifts at levels unprecedented in the history of the world. Many of us will have the honor and privilege to help make this happen in visible and not so visible ways."

This year will see a continued increase in the numbers of Americans drafting new, or reviewing and reworking their prior estate plans. The new gift and estate tax law sparked this initiative. The certainty of our mortality was brought into focus after September 11th and has furthered this trend. The reawakening of American values and the importance of our country’s nonprofit sector should be brought to the forefront as we work with donors and clients this year.

The real question for philanthropy in this new era may be, "What are your charitable interests and how would you like to support them?" Donors and clients of charitable gift, financial and estate planning services increasingly will be asking themselves this question. And it will be our job to help them find ways to accomplish their goals from the answers given.

How to Play the Current Downtown — and Plan for a Decade of Evolving Estate-Tax Rules

By Al W. King III

Trust Consultant

New York City

The recent downturn in the economy has provided many individuals with a great opportunity for gifting. Publicly traded stocks, non-voting minority positions in family businesses, real estate etc… have all been great assets for gifting as a result of their depressed values. These lower valuations along with the availability of several creative estate planning vehicles have provided many individuals with a great way to leverage their gift tax exemption (i.e. $1,000,000 as of 2002). The newer of these vehicles are the "Walton" GRAT and the Home Security Trust. Additionally, the "defective" Dynasty Trust continues to be the corner stone of a wealthy family's estate plan for the purpose of shifting growth out of one’s estate. The "defective" Dynasty Trust also provides families with the opportunity to structure the "Walton" GRAT so that the remainder interest of the GRAT can be sold to the "defective" Dynasty Trust. The Charitable Lead Trust also remains popular for shifting growth.

If the gift, estate and generation skipping tax provisions of the "Economic Growth and Tax Relief Reconciliation Act of 2001" (the 2001 Act) remain unchanged or even in the event of a change (i.e. settling on some indexed estate tax exemption amount prior to repeal in 2010), the planning vehicles referenced above will still be useful in accomplishing their goal.

Consequently, the 2001 Act forces individuals to plan for three scenarios:

(1) the phase-out of the estate and generation skipping tax between 2002-2009;

(2) the repeal of both the estate and generation skipping tax in 2010; and,

(3) the possible "Sunset" of the 2001 Act allowing the pre-2001 Act estate and generation skipping tax to return.

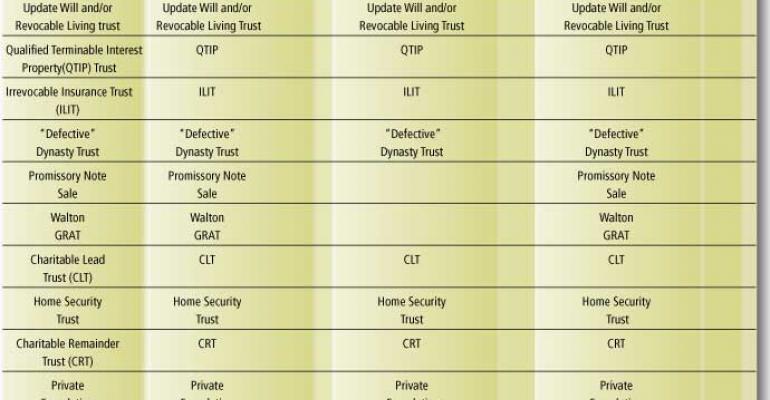

Flexibility is more important than ever. Individuals need to update their Will, revocable trusts and estate plans to take into account the three phases previously mentioned and need to plan for three possible scenarios: 1) The estate tax may be repealed, but they may die first, 2) the repeal of the estate tax will not happen (i.e. a compromise will be needed), or 3) pursuant to the "Sunset" provision repeal will only last one year (i.e. 2010). Estate planning documents and strategies should accommodate all three scenarios. Chart 1 points out that many of the more common estate planning vehicles which will be useful during all phases:

Chart 1 further indicates the importance of the "defective" Dynasty Trust as the corner stone to a wealthy families estate plan for both tax and non-tax reasons. Most of the other estate planning vehicles also involve the Dynasty Trust. All these vehicles involve the transfer of growth from one’s estate, as previously indicated. As of the writing of this article there were 15 dynasty jurisdictions with unlimited durations: Alaska, Arizona, Colorado, Delaware, Idaho, Illinois, Maine, Maryland, Missouri, New Jersey, Ohio, Rhode Island, South Dakota, Virginia and Wisconsin. Florida limits its trust duration to 360 years and Washington to 150 years. Additionally, in the event that the estate tax is repealed in 2010, the carry over basis rules will also provide other estate planning opportunities with the chantable remainder trusts and other similar planning vehicles. However, many people feel that the repeal of the estate and generation skipping tax will not happen as a result of the future need for tax revenue as well as the negative impact the repeal may have on charitable giving and state death tax revenue (i.e. 35 soak-up states). Additionally, the estate and generation skipping tax is mainly a tax for the wealthy and as many people argue is "voluntary".

Several budgetary studies indicate that the 2001 Act provides the wealthiest 4500 estates in the U.S. with the same tax relief as the bottom 142 million taxable estates. The average net worth of the Forbes 400 is now $2.4 billion. There are 590,000 people with net worths of $5,000,000 and this group is projected to grow at a rate of 46 percent over the next five years. There are 7.2 million millionaires. Chart 2, based upon 1999 statistics released by the U.S. Treasury Department, further emphasizes the point:

These statistics indicate that the estate tax is definitely a tax for the wealthiest 1-2 precent of the population, thus could be one of the first sources of tax revenue; if needed, as has previously been the case. Mainly as a result of our country being involved with a war.

Consequently, the ever changing economy and tax laws make flexible planning more important than ever. Combine this with the fact that most families want to maintain social and fiscal responsibility in their families forever (i.e. allowing family values to pass down with their inheritance), along with asset protection and trusts remain and will remain a very important planning tool now and in the future for generations.

Long and Wrong?

By Michael E. Lewitt

Harch Capital Management, Inc.

Boca Raton, Florida

Confirming our reputation as a leading authority on where the stock market is not going (at least in the short term), the Dow Jones Industrial Average traded above 10,000 and the Nasdaq blew past 2,000 during the first week of December. Investors have again shown themselves willing to ignore warning signs for the economy and corporate earnings in pursuit of stock market riches.

Maybe we are just stubborn, but we do not believe current trading levels are justified based on the outlook for the economy or corporate profits. Recent stock market moves can be attributed to a combination of the innate optimism of investors (cheered on by Wall Street analysts and the media) and the pursuit of benchmarked performance. Heading into the end of a dismal year, many managers were fearful of missing out on the much-hyped recovery. For a money manager today, the only thing worse than losing money is falling short of a benchmark.

A remarkable example of the "benchmark obsession" is the recently settled lawsuit by Unilever’s pension fund against Merrill Lynch Asset Management. This lawsuit did not claim that Merrill Lynch acted wrongfully and lost money for the pension fund. In fact, the pension fund earned a return of better than 20 percent in the period in question under Merrill Lynch’s management. The lawsuit, however, claimed that Merrill’s performance lagged a performance benchmark by 8 percentage points, and that this "failure" was due to inadequate risk controls. While this may best be understood as a contract dispute, in which Unilever claimed that its money manager violated terms of its engagement agreement, it is hard to ignore the fact that the manager being sued produced a very strong 20 percent return. From a practical standpoint, we don’t know which is more laughable – the fact that Unilever sued, or that Merrill Lynch settled. But the real point is that in a benchmarked world, relative performance is the only thing that matters. In our view, that is a very dangerous precedent that is exacerbating the momentum-based and increasingly volatile nature of today’s financial markets.

The year-end 2001 rally is a benchmark rally. It is driven by technology stocks, which in our view remain objects of rank speculation. Valuations remain stretched by historical standards even before taking into account the unique characteristics of the recession that officially began in March 2001. As of November 30 (before a further run-up in stock prices), the S&P 500 was trading at 27x trailing operating earnings and 40x trailing reported earnings. Even before considering the questionable accounting practices that are likely inflating reported earnings1, these levels are far in excess of historical norms. Are future prospects for the economy sufficiently compelling to justify such levels? We think not.

Our concern about the sustainability of the year-end rally is based on our view that we are not experiencing a garden-variety recession but rather a deflationary unwinding of bubbles in both the equity and debt markets. There is virtually no chance for a leveraged company’s capital structure to survive intact in a deflationary environment. The inability to raise prices, competition from unleveraged competitors, dependence on the kindness of strangers (the capital markets) – all limit the operating and financing flexibility of leveraged companies in the current environment.

One of the factors that most market observers appear to be downplaying or ignoring is the potentially devastating effect of debt liquidation. In the face of global competition, overcapacity and a lack of pricing power, an increasing number of leveraged companies are being forced into bankruptcy or out-of-court debt restructurings that are accompanied by job losses, plant closings, and inventory liquidations. The wholesale liquidation of debt is, if anything, picking up steam as the global economy lurches deeper into recession. We think too little attention is being paid to the slow-motion credit unwinding we are witnessing around the world – whether it is U.S. corporates (Enron), countries (Argentina), European corporates (Kvaerner, Swiss Air) or Japanese financial institutions (Japan’s insurance collapses). Debt liquidation is highly deflationary as well as psychologically damaging to consumers and businesses whose future spending will revive the economy.

Debt investors appear to be as oblivious to risk as equity investors. Here are some of the key credit statistics for Revlon Inc., a company that sold an oversubscribed bond offering at a yield of 13-1/8 percent during the first week of December: Pro forma for the offering, the company has $1.61 billion of debt, $1.35 million of revenues, and $194.5 million of EBITDA (operating cash flow); as recently as 1997, the Company had less debt ($1.47 billion), significantly higher revenues ($2.24 billion) and EBITDA ($312.8 million). Debt/capitalization currently stands at 404.7 percent versus 145.2 percent in 1997. The credit was rated CCC+ by Standard & Poors and Caa1 by Moodys before the offering, yet a mere three days after the bonds were sold Standard & Poors further reduced its rating to CCC (raising a host of questions). More than 40 percent of all bonds rated CCC+ or lower default within 8 years of issuance, according to Moody’s bond mortality studies. We must be out of the mainstream, however, because instead of being treated as a clearly deteriorating credit, the offering was too hot to pass up, and the underwriters were compelled to increase its initial size in order to meet demand.

The appetite for risk is alive and well in the financial markets. Whether it is justified is quite another question.u

ENDNOTE

1. Some commentators would point to the fact that reported earnings are currently depressed due to the recession. We would respond by pointing to the fact that reported earnings are inflated by accounting rules (and their abuse) that do not reflect economic reality (for example, the treatment of stock options).