The fourth quarter of the year, when individuals are typically planning for the holidays, is also a great time for financial advisors to revisit the plans they’ve created for their clients. Year-end is a time when advisors must confirm if their clients satisfied their required minimum distributions and maxed out their retirement contributions, as well as rebalance portfolios and consider tax strategies. Below we look at the different tax strategies, investment vehicles and top managers that provide tax efficiencies.

One doesn’t have to search long for a reason why investors want to reduce their tax liabilities as much as possible, when you consider the tax ramifications of investing. Investment returns could be reduced by as much as 40 percent in any given year when factoring in federal income and capital gains, state and local taxes, and the alternative minimum tax. Helping reduce your clients’ tax liability is instrumental to growing their assets and helping them achieve their financial goals.

Tax Strategies to Consider

It’s important to understand what type of investment is most appropriate for each specific type of account. For example, due to their high taxable yields, high-yield bonds are more appropriate to be in tax-deferred or tax-exempt accounts versus taxable accounts. Conversely, equity securities that are intended to be held for a long time period are more suitable for taxable accounts, as their gains are taxed at long-term capital gains rates.

Tax-loss harvesting is a great strategy to help reduce your client’s taxable gains. Tax-loss harvesting allows your clients to offset their investment gains with their realized investment losses. We are currently in the midst of the second longest bull market in history, so it may be difficult to locate investment losses, but if your clients do have any, the timing might be right to sell them to offset the recent gains. An investor can use any remaining losses to offset up to $3,000 of ordinary income each year.

Rebalancing your client’s portfolio is vital to keeping the allocations in line with your client’s risk tolerance, however, rebalancing a portfolio can also cause taxable capital gains. There are different thoughts on how often one should rebalance a portfolio, typically, annual rebalancing provides greater potential long-term performance, less trading fees and more tax efficiencies.

Investment Vehicles to Consider

Mutual funds are required to distribute at least 90 percent of net investment income and 98 percent of net capital gains every year, which can be a tax liability for investors. Due to their low trading activity and minimal annual distributions, passive investments such as Index funds and ETFs have gained in popularity for the tax-conscious investor.

Separately managed accounts (SMA) should be considered by financial advisors when looking for a tax-efficient investment. One of the baked-in benefits of investing in an SMA is that the investor is the registered owner of the individual underlying securities, which provides additional flexibility for investors and their ability to participate in additional tax strategies. For example, harvesting losses can be easier when the investor holds the individual securities versus a pooled mutual fund.

Below are some of the top strategies listed in the PSN Global Manager Neighborhood database that might help financial advisors construct a tax-efficient portfolio for their clients.

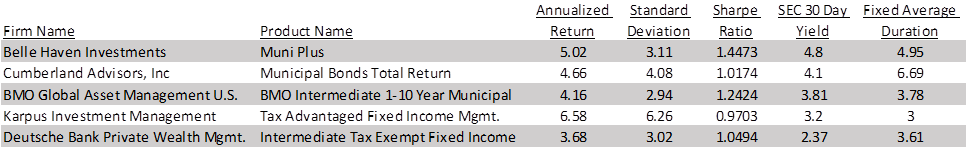

When looking for tax-efficient investments, municipal bonds are first to come to mind. Municipal bonds typically provide income that is exempt from federal taxes; additionally, if your client holds municipals specific to their state of residence, these bonds provide state tax-exempt income. Municipals provide a lower yield compared to most taxable fixed income products, so it’s important to look at the taxable-equivalent yield when comparing yields. Below are some of the top municipal bond strategies found within the PSN Global Manager Neighborhood database.

Figure 1: Source - Zephyr StyleADVISOR; July 2007 – June 2017

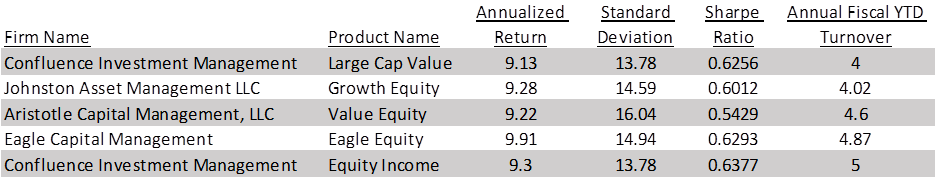

A strategy’s turnover ratio is a good indicator if the strategy is tax efficient due to its reduced trading of the underlying securities, which reduces the potential for taxable distributions. Below are some of the strategies in the PSN Global Manager Neighborhood who stand out with low turnover.

Figure 2: Source - Zephyr StyleADVISOR; July 2007 – June 2017

Some managed products’ investment objectives are to be tax efficient, while being actively managed. These products are managed in ways to reduce their taxable distributions. Some of the strategies these managers employ include reducing turnover, investing in non-dividend paying stocks, and selling less attractive stocks at a loss. These strategies provide additional options for financial advisors when constructing a well-diversified, tax-efficient portfolio. Below are some tax-managed strategies listed in the PSN Global Manager Neighborhood database.

Figure 3: Source - Zephyr StyleADVISOR; July 2007 – June 2017

Selling an investment for tax considerations is important, but one must balance the tax benefits of selling to the market opportunity of potentially selling low. When implementing tax strategies to help reduce your client’s tax liabilities, it is important to keep your client’s investment objectives in mind, and prepare a plan that best fits the needs of your client.

Ryan Nauman is a VP, Product and Market Strategist at Informa Financial Intelligence. His market analysis and commentaries are available at www.informais.com/blog.