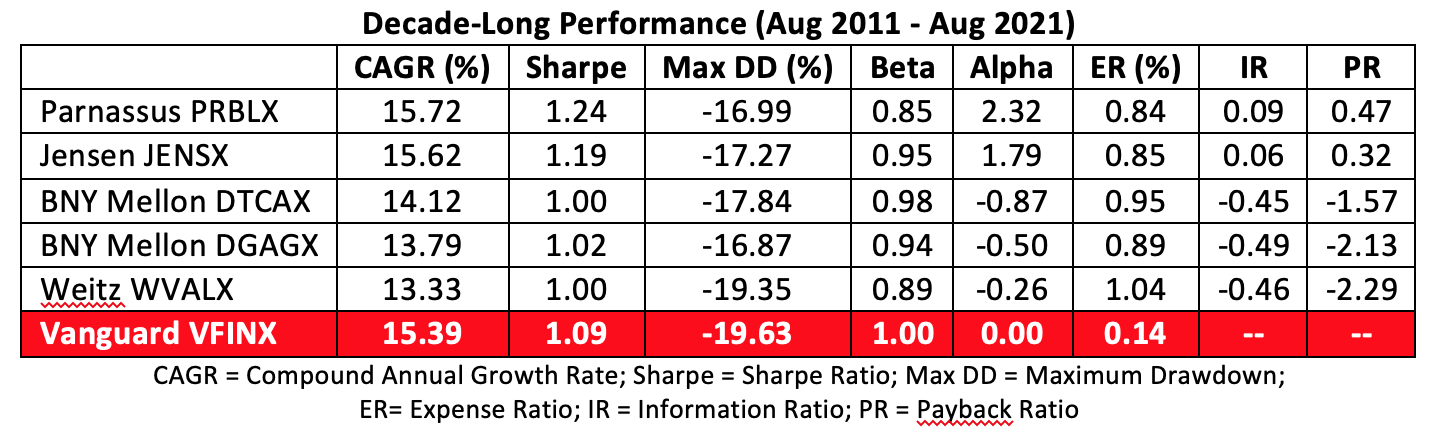

In this kind of market, many a portfolio runner can assume the mantle of genius just by laying on beta exposure. After all, despite some big hiccups over the past decade, owning the market has been a pretty safe bet. Case in point: The Vanguard 500 Index Fund (VFINX), a proxy for the S&P 500, has produced a compound annual growth rate (CAGR) of 15.39% in the 10 years ending August 31. That’s nothing to sneeze at, especially in light of its cost. VFINX can be held for only 14 basis points (0.14%) per year.

Vanguard’s founder, the late John Bogle, often decried alpha-seeking as a futile and expensive venture. For the most part, he’s been proved right over the years. It’s hard to consistently beat the market. But it’s not impossible. To wit: The Parnassus Core Equity Fund (PRBLX), a large-cap portfolio that’s beaten the performance of VFINX over 3-, 5-, 10- and 20-year timeframes. PRBLX, with assets of $31 billion, is America’s largest ESG-focused fund.

OK, I hear you say, PRBLX beats the index fund but at what cost? Among large-cap core mutual funds, the average expense ratio is 1.03%, far above the cost of the passive Vanguard product. PRBLX carries a more modest 84 basis point (0.84%) price tag. Still, one must ask if the Parnassus funds’ 70 bp excess expense is justified by its outperformance. The answer, in a word, seems to be “yes.”

Just compare how PRBLX fared against its peers and the Vanguard portfolio over the past 10 years.

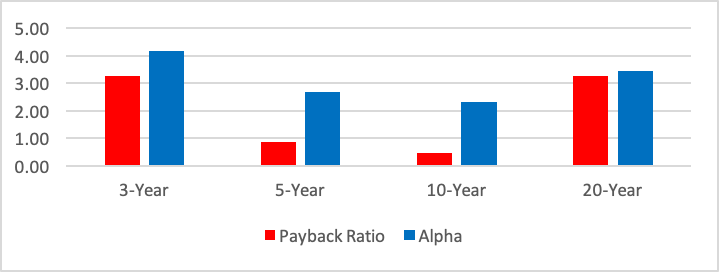

PRBLX’s annual growth rate exceeds the Vanguard index fund’s by 33 basis points. By dividing the excess growth rate by PRBLX’s excess cost you can arrive at the fund’s payback ratio, a measure of compensation for additional holding expenses. The Parnassus fund has consistently produced positive payback ratios, as well as positive alpha, over all the time frames depicted below:

PRBLX Payback Ratios and Alpha Coefficients

Todd Ahlsten, Parnassus Investment’s chief investment officer and portfolio manager of the PRBLX fund, says his fund purposefully keeps an eye on costs. “We want fees to be competitive and reasonable, and believe that we’re offering a unique value of principles and performance,” he declares. “The expense ratio is 0.84% for the Investor share class, although most advisors use the institutional share class at 0.62%.”

Ahlsten’s helmed the PRBLX fund for two decades and has had to adjust the portfolio’s course to maintain his edge. “Over the last 20 years, the stock market composition has changed to be more tech focused and less brick-and-mortar focused. That’s changed the benchmark itself and we’re actively aware of the bets we’re making,” he says. “With more government intervention and dominant secular trends, we’ve needed to become more cognizant of the broader market environment”

One way Ahlsten and co-manager Ben Allen responded is to establish sector teams that broadly examine market drivers. The result is a portfolio with decided sector tilts but that still remains highly correlated to the market. Relative to VFINX, PRBLX’s returns indicate underweights in consumer cyclicals, utilities and energy together with overweights in industrials and real estate.

“We’re predominantly a bottom-up stock-picking firm,” says Ahlsten. “To outperform over a market cycle, we’re investing in a hand-crafted basket of 40 or so high-quality companies. These companies, which we invest in after deep research, have durable competitive advantages, have increasingly relevant products and services, and are well run by well-incentivized management teams.”

“ESG has been, and will be, a key part of our investment process as well,” adds Ahlsten. “The end result is a high-conviction, high-active share, low-turnover portfolio that investors can use as the core of their portfolios. Hence the name of the fund.”

Stylewise, the Parnassus fund’s returns simulate a modest exposure to the volatility-dampening effect of long- and intermediate-term Treasurys--seemingly at the expense of the large-cap growth allocation--even though no bonds are actually held in portfolio.

“We don’t use an overly quantitative process for low volatility stocks,” says Ahlsten. “Neither do we go to high cash positions, or use derivatives. We’ve been managing volatility using the same process and philosophy we’ve used for years, including 2008 when we outperformed the S&P 500 by over 14%.”

For Ahlsten’s team, the ESG lens aids stockpicking. Ahlsten says, “It’s been a key part of our process since the inception of the fund. For us, ESG is a marker of quality. Companies that rate high on environmental, social, and governance characteristics typically have a culture of forward thinking, innovative management and labor teams. This mindset is helpful to improving enterprise value, which informs stock price.”

Significantly, ESG is also a risk management tool. Paying attention to companies mindful of their material and reputational risks tends to produce more predictable--and positive--investment outcomes, according to Ahlsten.

It’s hard to argue against the Parnassus approach.

“Investors come to us for long-term investment over a market cycle,” says Ahlsten. “Our goal is to deliver greater upside than downside. Delivering on this asymmetric return profile helps make the case for active management.”

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.