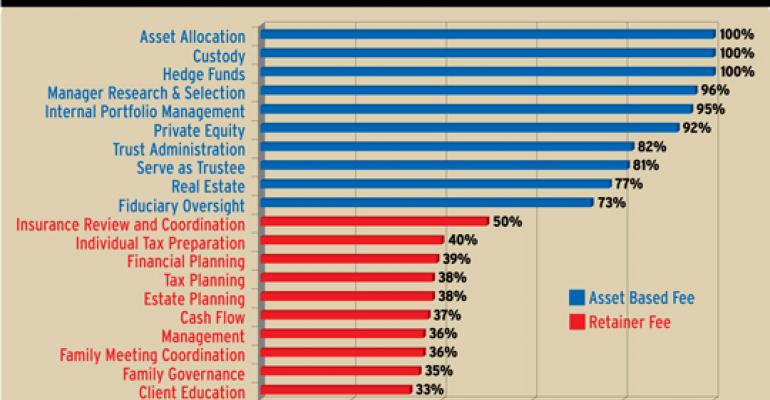

With asset-based fees providing less revenue, advisors are embracing a wider variety of pricing models these days. According to a Schwab presentation from this year's Impact conference called “Pricing Practices in Evolving Ultra-Wealth Marketplace,” 52 percent of advisors surveyed use an asset-based fee as a “primary” pricing model. Another 24 percent of respondents use both asset-based fees and retainers, while 18 percent use “other” models, such as a combination of hourly or retainer-only fees. Below, a breakdown of what kinds of fees advisors charge for different kinds of services.

0 comments

Hide comments