Low volatility, high-income travels well

But there are ways to address the volatility issue. One is to emulate an approach well established within the US – building a portfolio of solid, stable dividend paying companies intended to be less volatile than markets overall.

The same can be applied to stocks outside the US as domestically. That, combined with the use of hedging to mitigate the impact of currency exchange rates, can have a dramatic impact on volatility.

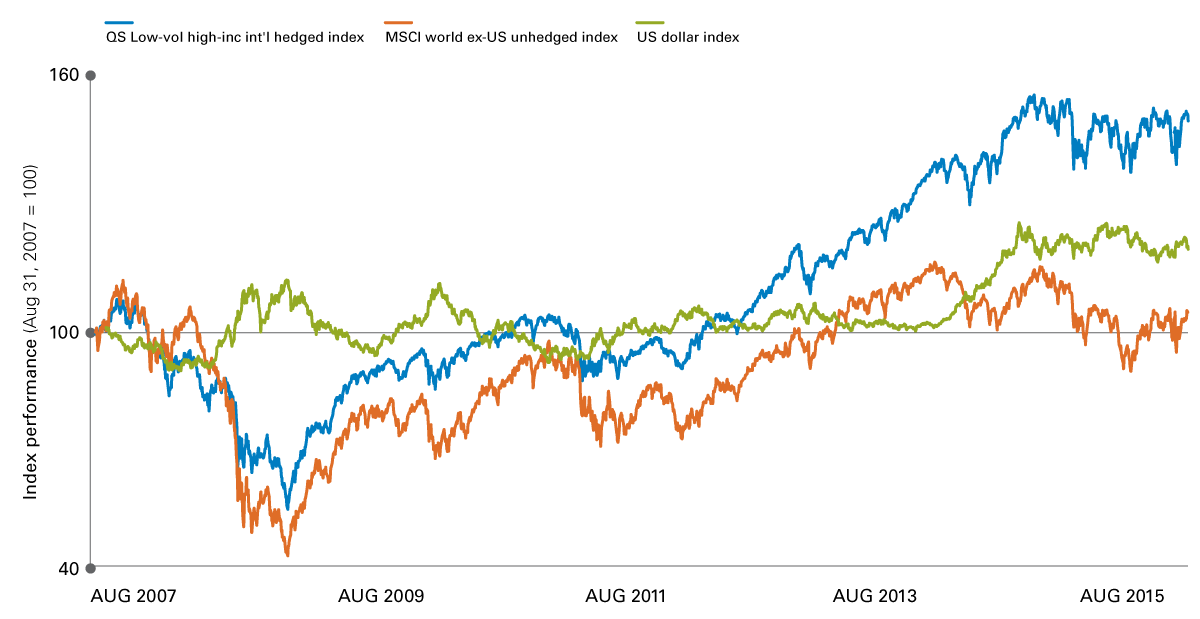

Figure 1: Non-US Stocks: Unhedged; Low-volatility high-income hedged – and the US dollar

Source: Bloomberg, as of August 1 2016. Past performance is no guarantee of future results. The QS International Low Volatility High Dividend Hedged Index seeks to provide more stable income by investing in stocks of profitable companies in developed markets outside the U.S. with relatively high dividend yields and lower price and earnings volatility across a wide range of market capitalizations, selected from the constituents of the MSCI World ex U.S. IMI Index, hedging currency risk. Please note an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

Looking at the period since the financial crisis (Figure 1), international stocks (orange) have had their ups and downs, finishing the period roughly where they began. Part of the reason has been the strength of the US dollar in recent years (green): political and economic problems abroad have driven investors worldwide toward the relative safety of the US, driving the value of the US dollar higher. That’s especially true over the past five years, when the dollar rose some 20% between August 2014 and March 2015, due in part to turmoil abroad.

By contrast, an index designed to reflect the performance of a low-volatility high-income strategy, hedged against changes in currencies vs. the US dollar (blue), has shown strength over the same period – perhaps most notably, starting in August 2014, where hedging against foreign currencies helped boost index performance well above the unhedged index.

Volatility: when less is more

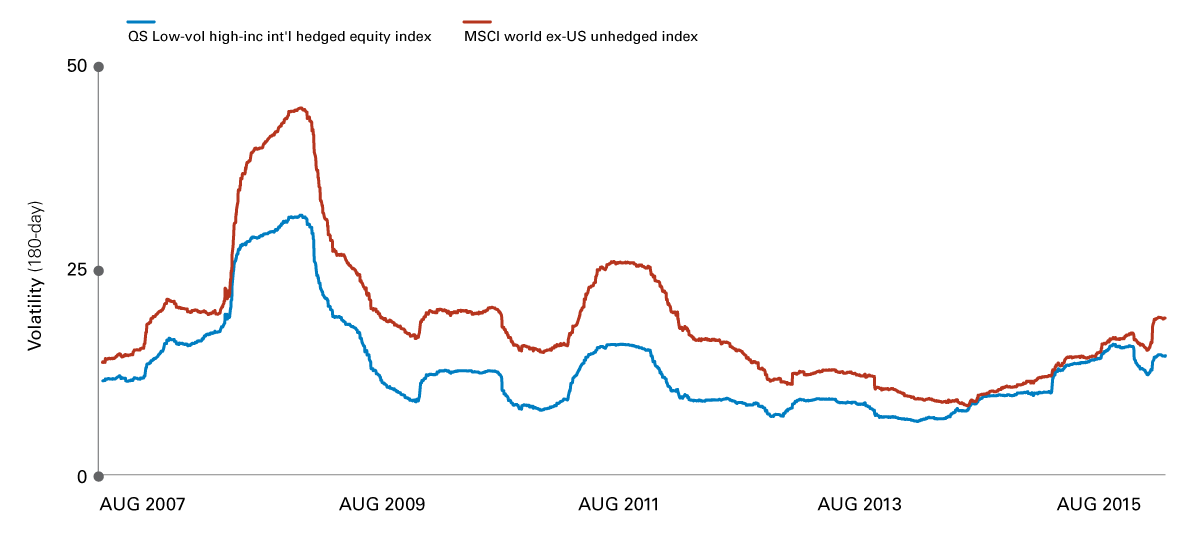

What about stock volatility, which has been surprisingly low for international stocks in recent years? Figure 2 shows that over the past decade, volatility was elevated during the 2008-9 financial crisis, as well as during the European financial crisis in 2011-2012. But the volatility of the low-vol high-income unhedged index stayed well below the more standard stock index during periods of higher tension, when volatility suppression was needed more urgently by investors.

Figure 2: Volatility: Non-US Stocks: Unhedged; Low-volatility high-income hedged

Source: Bloomberg, as of August 1 2016. Past performance is no guarantee of future results. The QS International Low Volatility High Dividend Hedged Index seeks to provide more stable income by investing in stocks of profitable companies in developed markets outside the U.S. with relatively high dividend yields and lower price and earnings volatility across a wide range of market capitalizations, selected from the constituents of the MSCI World ex U.S. IMI Index, hedging currency risk. Please note an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

Conclusion: An approach for uncertain times

With US stocks having performed well and major markets abroad stable for the time being, volatility might not be uppermost in investors' minds. But as recent years have shown, markets can misbehave precisely when the horizon seems clear. So a low-volatility approach, leavened with additional income and hedged for currency choppiness, could be appropriate for investors concerned about capital preservation.