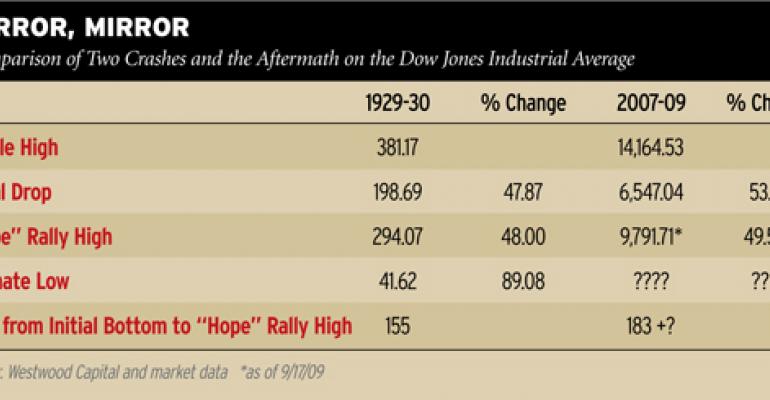

In a September report, Daniel Alpert, founder of New York-based investment bank, Westwood Capital, says the current “hope” rally is strikingly reminiscent of market moves in 1930, following the 1929 crash. He isn't forecasting another Great Depression, but it sure makes for an interesting (and scary) read.

In his paper, titled “Haven't We Been to this Show Before?” Alpert describes the mood of the market at the peak of six month rally in 1930: “Speculation that another bull market was in the offing brought anxious capital back in from previously frightened traders. Unemployment threatened to define the economic picture in a way that hadn't been seen in decades. The Federal Reserve and banks were lowering the cost of money to borrowers still able to borrow.”

Indeed, unemployment reached 15.9 percent in 1930, “nearly identical” to today's BLS' 16.3 percent U-6 figure, a more accurate measure that includes part-time workers looking for jobs, and unemployed people who have stopped looking but still want jobs, he says.