By Suzanne Barlyn and Tim McLaughlin

NEW YORK/BOSTON, Nov 16 (Reuters) - State securities regulators say they will try to fill any void in policing banks and finance companies that break the rules if President-elect Donald Trump and a Republican-controlled congress roll back reforms introduced after the financial crisis.

Trump has pledged to dismantle Dodd-Frank, a sweeping Democrat-led reform of Wall Street designed to protect Main Street investors. On the campaign trail, Trump characterized Dodd-Frank, which became law in 2010, as sprawling, bureaucratic and an impediment to economic growth.

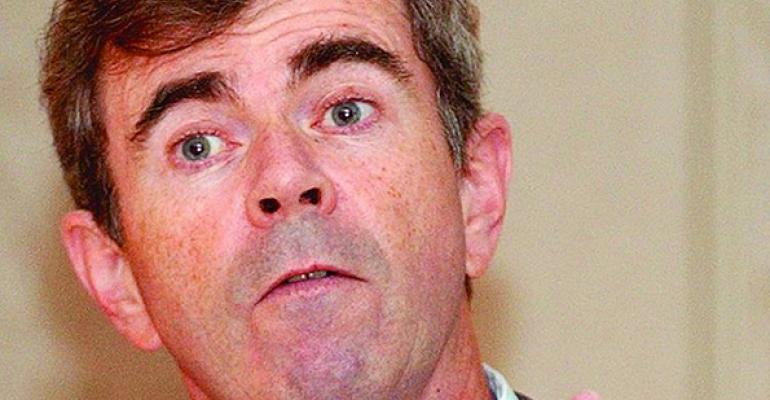

"It sounds like we're going to be under the same type of problems there were prior to the Great Recession, with securities and financial services being 'lightly regulated,'" said William Galvin, the top securities regulator in Massachusetts. "I think that's a problem."

Regulatory powers can be uneven and limited from state to state, frustrating local authorities if the U.S. Securities and Exchange Commission becomes weaker during the Trump administration.

Nevertheless, some state regulators have been first to ferret out major market abuses that later have been recognized as national problems. One example was the mutual fund industry's market timing scandal in 2003, when it was revealed some funds were involved in illegal after-hours trading.

"We may be back to that," said Galvin, secretary of state for Massachusetts, who is credited with shining a light on late trading at mutual funds.

Mary Jo White's plan to step down as head of the Securities and Exchange Commission in January will enable Trump to appoint a successor with huge influence over the regulation of Wall Street trading.

"I think the biggest impact on state regulators will come from the choice of the leadership at the Securities and Exchange Commission," said Jay Brown, a professor at the University of Denver Sturm College of Law.

Brown said an SEC leadership that favors deregulation of Rule 506, for example, could make it more difficult for state regulators to investigate fraudulent private placements.

New York has the Martin Act, the envy of securities regulators nationwide, including at the SEC. It allows an attorney general or the Manhattan District Attorney to bring civil and criminal cases without having to prove a defendant's intent or knowledge of wrongdoing. Prosecutors need only to establish that a misrepresentation or omission of a material fact occurred when promoting a security, for example.

Several white collar defense attorneys in New York said they expect to see the Martin Act used more often during the Trump presidency.

"Every time there has been a noticeable drop in SEC enforcement, New York prosecutors and regulators have used the Martin Act to great effect to police the securities market," said Michael Miller, a white collar defense lawyer for Steptoe & Johnson LLP in New York.

Former New York Attorney General Eliot Spitzer became known as the "Sheriff of Wall Street" using the Martin Act as a cudgel against investment banks. Ten of them agreed to pay more than $1 billion in 2003 to settle claims they misled investors with biased stock research.

More recently, current New York Attorney General Eric Schneiderman sued Barclays, accusing the bank of misleading investors about the presence of high-frequency traders on a stock trading platform.

Only a few states - Alabama, Kansas and New Mexico - have authority to bring criminal cases, according to the North American Securities Administrators Association.

Galvin said that while states can and have been a driving force on financial regulation, a strong national regulator is better.

"You need a national regulator; and if they can't, the states need to do the job and should," he said. (Reporting by Tim McLaughlin in Boston and Suzanne Barlyn in New York. Editing by Carmel Crimmins and David Gregorio)