Retirement plan participants with self-directed brokerage accounts seem to benefit from working with a financial advisor, according to a recent study by Charles Schwab.

The company’s latest SDBA Indicators Report showed participants who worked with an advisor had higher balances, more diversified portfolios and less exposure to individual stocks compared to those who didn’t. SDBAs are brokerage accounts within retirement plans, including 401(k)s and other types of retirement plans, that allow participants to invest in stocks, bonds, exchange traded funds, mutual funds and other securities that are not part of their retirement plan’s core investment offerings.

Out of approximately 137,000 investors using a SDBA surveyed, only 19 percent chose to work with a financial advisor. But they reported an average balance of $449,552—nearly twice as much as the $234,643 reported by non-advised participants.

The larger balances are not an indication that the portfolios of investors working with advisors are outperforming by that margin. It's more likely that investors with higher balances were encouraged by their advisors to invest more in their SDBAs.

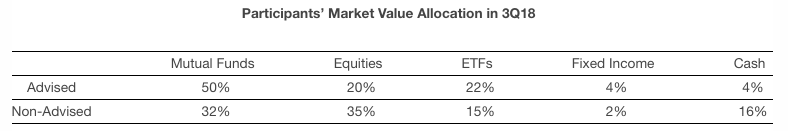

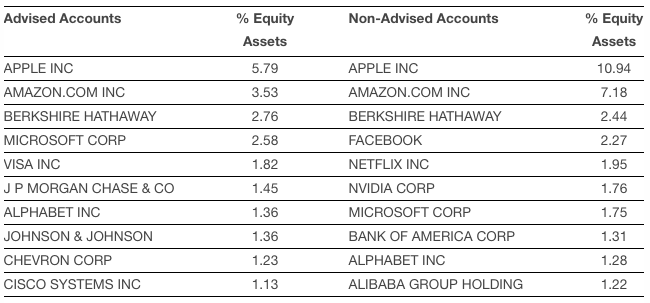

In addition to having better saving habits, investors with an advisor have benefitted from more diversified portfolios and less exposure to individual stocks. For example, investors who didn’t work with an advisor had significant exposure to two companies in particular, Apple and Amazon.

Non-advised investors also kept significantly more money in cash.