The number of investment advisors registered with the SEC continues to grow, as well as the assets they oversee, according to a long-running study.

The Investment Advisors Association (IAA), a trade group that represents the interests of RIAs, published its annual Evolution Revolution study on Tuesday. Accuity’s National Regulatory Services (NRS) partnered with the group to perform the study, which found trends over previous years continued. Among those, the industry continues to grow.

There were 12,172 RIAs in 2017, a modest net increase of 2.7 percent, according to the study. But aggregate client assets managed by these firms reached a record $70.7 trillion, up 5.8 percent from $66.8 trillion in 2016. Although, a large part of the growth can be attributed to the stock market’s performance from late 2016 through this summer.

At the same time, advisor fees have remained unchanged.

The vast majority of SEC-registered advisors are small businesses. In 2017, 56.8 percent (6,911 firms) reported employing 10 or fewer employees, and 87.9 percent (10,641 firms) reported employing 50 or fewer. The median number of employees, including administrative and support staff, was only nine.

Advisers reported a total of 778,002 non-clerical employees in 2017—relatively flat from 2016. But the nature of those roles has changed. Out of that number, 400,163 provide investment advisory services (such as research), up 13,631 professionals since 2016.

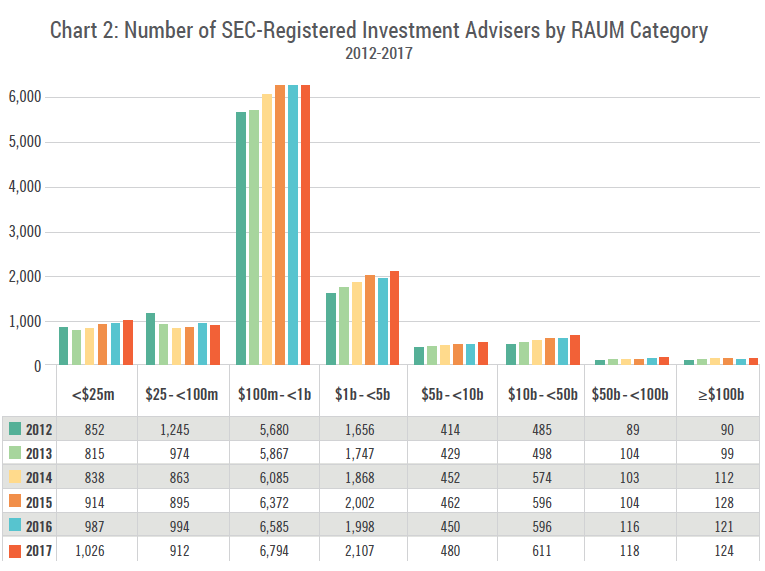

One reason for this could be that advisory firms are attracting more assets and more higher-net-worth clients that require more-complex portfolios. Over the last four years, more SEC-registered firms are overseeing at least $1 billion in client assets.

The largest advisory firms manage more than half of the assets in the space; more than 54 percent of all assets are managed by only 124 firms, each with at least $100 billion AUM.

A typical advisory business, according to the study, services mostly individual clients and is highly likely to have at least one pension/profit-sharing plan as a client. The average RIA had about $333 million in client AUM across anywhere from 26 to 100 clients. They also exercised discretionary authority over most of their clients’ accounts.