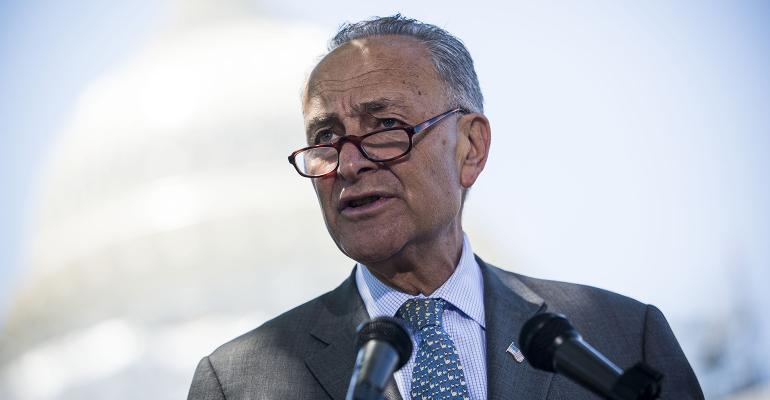

In a joint statement Thursday, Senate Minority Leader Charles E. Schumer (D-N.Y.) and Sen. Benjamin L. Cardin (D-Md.) announced that Senate Democrats will use the Congressional Review Act to force a series of votes to try to overturn a series of Trump administration regulations, including the Tax Cuts and Jobs Act, which imposed a $10,000 cap on the state and local tax (SALT) deduction and the recently issued final Treasury Regulations that put a stop to several blue states’ programs designed as a workaround to the cap. The Congressional Review Act is a law that allows Congress to vote to disapprove of regulations within 60 legislative days of their being issued.

Unfair Taxation?

Officials that oppose the SALT cap argue that it amounts to unfair double taxation of residents. The state programs were designed to essentially allow residents to be able to convert SALT into charitable contributions. Four states, including New York and Maryland, have also previously filed a lawsuit to have the SALT cap declared unconstitutional. Their lawsuit, however, was recently dismissed by a judge.

According to The Hill, it’s also unlikely that the resolution will pass. Although the resolution requires only a simple majority, Democrats don’t hold a majority of the Senate and “several Democratic senators have been regularly missing votes in recent months because they are running for president.”