Every family struggles with conflict. Sibling rivalry is the norm. But, when kids get older and the fighting gets to epic proportions, that’s another story. Infighting among family members can lead to costly lawsuits. The typical response is to try to sweep it under the rug. Maybe if we ignore it, it’ll go away. News flash: The conflict doesn’t go away. It festers. Eventually, if not addressed, the volcano erupts. Vesuvius often explodes after Generation One (especially the matriarch) is gone. Fortunately, there are planning strategies your family clients can use to avoid these types of disputes.

Five Examples

Consider what happened in these five cases that all received widespread media attention.

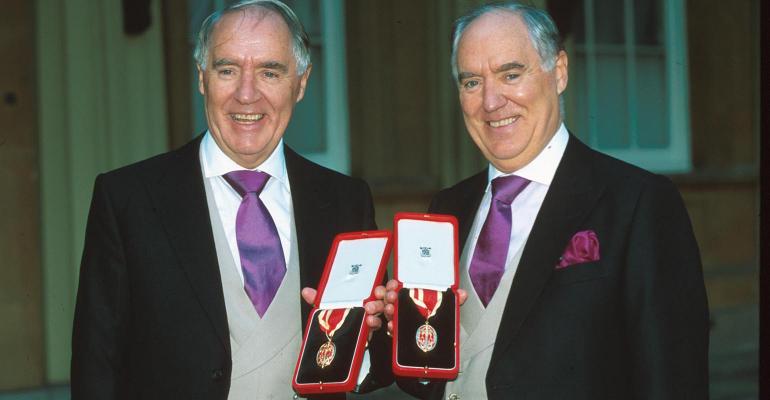

- Barclay: British billionaire twins Frederick and David Barclay owned the Ritz Hotel near Buckingham Palace. Frederick and his daughter Amanda were having private conversations to explore the sale of the hotel, but video footage caught David’s son installing a bug in Frederick’s chair. Brother David’s family captured 1,000 separate conversations Frederick had with prospective buyers, lawyers, banker, and trustees. Frederick sued David’s family for this “commercial espionage on a vast scale,” alleging that David’s sons were trying to freeze out their cousin Amanda. According to an article in Bloomberg, “The Barclays need to remember that 60% of family business failure is because of a lack of open communication and trust. Without rebuilding this, all their businesses, a large part of the family wealth, and the family bonds themselves, will be gone.”

- Feil: New York real estate mogul Louis Feil left his $7 billion dynasty to his four children (one son, Jeffrey, and three daughters) in equal shares. Jeffrey ran the business and received a sizable salary, but distributed just $300,000 per year to his sisters. The three sisters sued, alleging Jeffrey was starving them out so he could buy them out at a discounted price. The family lost its glue when the parents died. A Wall Street Journal article noted that according to Jeffrey, when his father died, “the binding of the book came loose,” and when mother Gertrude later died, “the pages fell out.” Key takeaway: A better succession plan would have provided a substantial cash flow for all four business owners.

- Angelos: Louis Angelos filed suit against his brother John, alleging John manipulated the family to take control of Baltimore Orioles baseball team and the rest of the family fortune. According to a recent article in the Baltimore Sun, “Louis Angelos’ lawsuit depicts his brother as manipulating, misleading and intimidating their mother to gain more power over the family fortune. In one instance, when Louis Angelos asks her why she puts up with John’s abuse, she allegedly replied, ‘He’ll go ballistic.’” Those are some ugly family dynamics.

- Spanos: After the death of their parents, two of the four Spanos children were named as co-trustees of a family trust owning a substantial part of the Los Angeles Chargers football team. Sister Dea filed suit seeking removal of brother Dean as a co-trustee. Dea contends that Dean’s decision to move the Chargers to Los Angeles from San Diego was financially ruinous. ESPN also says that she alleges Dean breached fiduciary duties by diverting $105 million of trust funds to various debts and borrowing $60 million “for the wasteful purchase of an airplane for Dean’s and Michael’s use that has no legitimate business justification.” Siblings Michael and Alexis are siding with brother Dean, “united in support of our parents’ and grandparents’ wishes.” A key takeaway: When creating trusts, select fiduciaries very carefully, and be especially cautious not to pit siblings against each other as co-trustees.

- Briscoe: Former Texas Gov. Dolph Briscoe’s goal was to keep his 600,000-acre ranch in the family long after his death, to be shared equally by his three children. Oldest daughter Janey died in 2018 leaving no heirs, and now the surviving siblings Cele and Chip are fighting in Uvalde County court over how to divide up Janey’s portion of the family fortune. According to an article in The Wall Street Journal, Cele and her kids accuse Chip “of manipulating his frail older sister into signing documents that disinherited them from her estate, tilting control of the Briscoe ranching fortune to him and his two sons in contravention of their grandfather’s wishes.” Chip contends that Cele “drifted away from the family business after moving to Dallas and marrying into a dynasty with a fortune of its own” and is “using the litigation to force a breakup of the family holdings.” Gov. Briscoe must be rolling over in his grave. It’s unfortunate he didn’t structure his estate plan to leave his estate to a dynasty trust, instead of relying on the hope that heirs would abide by his wishes to keep the ranch intact.

How to Avoid

These are but five examples; there are countless more. The mistakes made in each of the five above cases provide some guidance on what not to do. But here’s what your clients can do to avoid these situations: Create a thoughtful trust structure that reflects the family’s mission and values. Select fiduciaries carefully and avoid pitting siblings against each other. Hold family meetings with exercises to improve communication and trust. Ideally, conduct such activities while Generation One is still around to provide influence and family glue. Consultant Matthew Wesley asks heirs to make a “moral commitment” that they’ll never sue each other. Seek a more collaborative and private resolution. Similarly, author Mitzi Purdue’s family indoctrinates heirs early on that “quarrels stay in the family”–don’t air your dirty laundry in the courtroom. Don’t ignore the problem of sibling strife. It will come back to haunt your family.