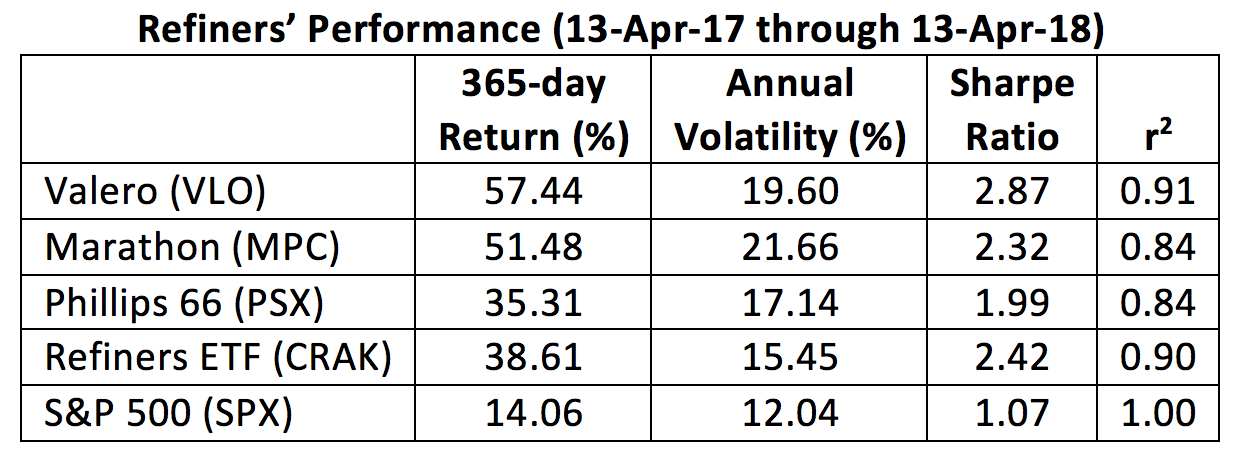

With the equity market wobbling, investors have been finding refuge, er, returns in an unlikely quarter—the oil sector. No, not integrated behemoths like ExxonMobil Corp. (NYSE: XOM) but independent refiners such as Valero Energy Corp. (NYSE: VLO). Over the last 12 months, refiners have outdone the S&P 500 Composite significantly. Here’s a picture of the bigger refiners’ recent performance:

Valero’s on the top of the heap with a 365-day gain exceeding 57 percent. Compare that to the S&P’s contemporaneous price appreciation of 14 percent. The reason Valero isn’t a refuge? Volatility. There’s plainly more price variance in the oil stocks. Among the refiners, volatility’s poster child this past year is Marathon Petroleum Corp. (NYSE: MPC), with a standard deviation of nearly 37 percent. Valero weighs in at less than 20 percent while the S&P 500 churn rate is just 12 percent.

Valero, like Marathon and Phillips 66 (NYSE: PSX), is an S&P 500 component. Over the past year, most of Valero’s price movements—represented by its r-squared (r2) coefficient—could be explained by the S&P index trajectory. That correlation seems to be loosening now.

Among the major independent oil refiners, only Valero has staged a definitive upside breakout during the S&P 500 stumble. The company’s stock price just poked above the $100 level and is now aiming for a long-term technical objective of $124. What do I mean by long term? Well, the last $24 hike in Valero’s price took just six months, but that was during the broad market’s recent euphoric run-up. It’s likely the oil refiner’s stock will need more time than that to reach its target—if it reaches its target—without the broad market at its back.

Still, the stock’s got some powerful juju now. With its forceful move out of a three-month congestion area, investors could look forward to an intermediate summertime target at the $112 level. That is, if they don’t mind a bit of a bumpy ride along the way.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.