Vanguard’s ability to attract investment dollars distanced the firm from others last year, as investors continued to shift money from active to passive strategies through the end of 2016.

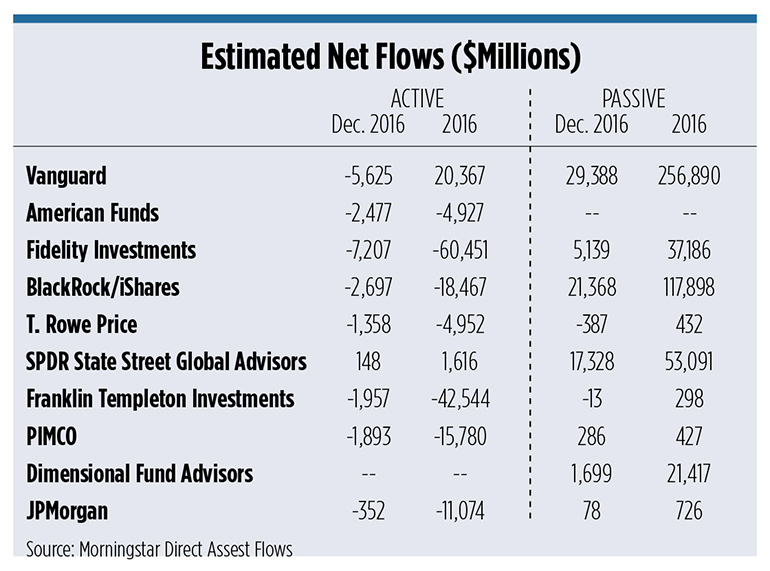

In December, the low-cost firm took in more than $29 billion in new money for passive investments—indexes, passive mutual funds and ETFs—and a total of $257 billion for passive investments in 2016, according to a Morningstar report published earlier this month.

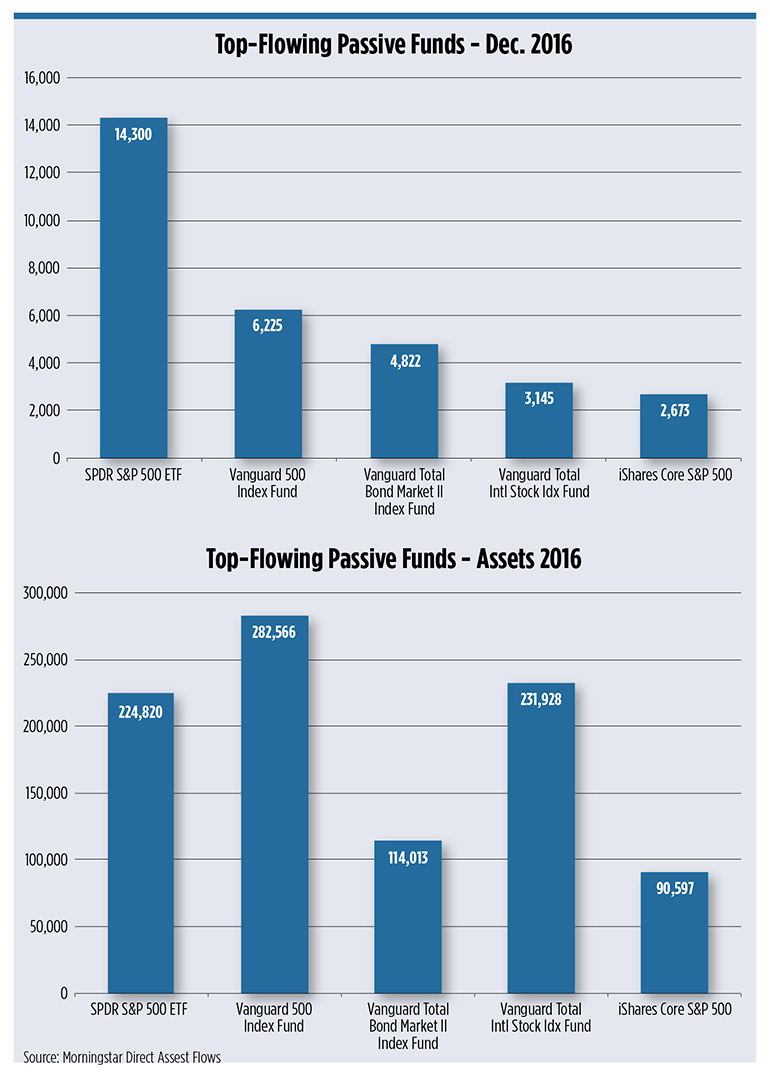

Three of Vanguard’s passive funds were among the top five with the highest estimated inflows in 2016: Vanguard 500 Index Fund, Vanguard Total Bond Market II Index Fund and Vanguard Total International Stock Index Fund. Assets in those three funds alone accounted for more than $91 billion in new money in 2016, according to the Morningstar Direct Asset Flows Commentary report.

The passive fund with the top estimated inflow was the SPDR S&P 500 ETF with $26.1 billion in new funds in 2016.

Vanguard’s passive inflow was far more than any other company, but some competing firms are faring better than others as the tides of active and passive investment dollars edge toward reversal.

BlackRock/iShares had more than $21 billion in new money flow to passive strategies in December and $118 billion in 2016. Those inflows might appear modest next to Vanguard’s, but compared to the field, BlackRock/iShares passive strategies are performing well in terms of attracting new money.

Out of the 10 companies highlighted in the Morningstar report, no others had inflows to passive strategies in 2016 near $100 billion or more.

State Street Global Advisors and Fidelity Investments attracted $53 billion and $37 billion to passive strategies respectively. Although, each company faced a very different circumstance regarding outflows of actively managed investments.

Unlike State Street Global Advisors, which took in a new $1.6 billion for active strategies, Fidelity Investments had active investment outflows of more than $60 billion in 2016.

Outflows from active strategies under Franklin Templeton Investments were less, but the firm didn’t attract passive investments like Fidelity did. While more than $42 billion in active investment dollars left Franklin Templeton Investments in 2016, the firm only gained a relatively meager $298 million in new passive investment money.