Summer barbecues are wonderful diversions. They’re opportunities to get together with neighbors to swap tales of recent adventures on the road, in the air and on the sea. In the market as well.

A knot of such folk recently formed around my grill to watch over their steaks. Mr. Rare-As-You-Can-Get-It unreeled a saga about driving through the Deep South and discovering “the cheapest gasoline in the country.” Apparently, cut-price petrol helped finance his sojourn to Civil War battlefields and museums. “South Carolina and Alabama!” he exclaims. “That’s where you find the really cheap gas. It’s a full dollar cheaper—per gallon—than the stuff we buy here.”

“Oh, yeah?” says Mr. Medium-But-Leave-A-Lotta-Pink. “Maybe that explains why my oil stocks are taking a beating this year. How do you make money selling gas for less than two bucks a gallon nowadays?”

That prompted Mr. Well-Done-But-Not-Burnt to blurt, “Wait a minute. You own oil stocks? Refiners?”

“Nope. The majors. You know, Exxon and the like,” says Mr. Medium.

Too bad for him. Exxon Mobil Corp. (NYSE: XOM) is down 12 percent on the year. In fact, it seems as if the whole petroleum sector’s been whacked. But that’s not entirely true. While the current oil glut’s slammed integrated outfits like Exxon, together with companies in the oil-services and downstream-production segments, cheap oil’s been a boon for independent refiners such as Valero Energy Corp. (NYSE: VLO). Valero’s enjoying fat-refining margins and is up 12 percent in 2017.

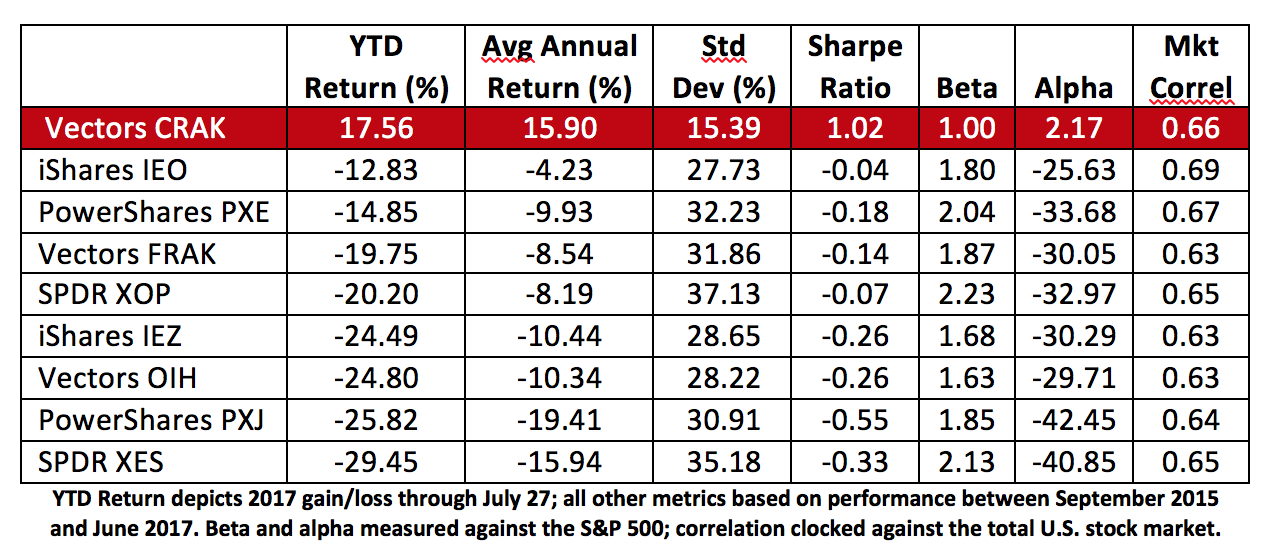

Better still has been the performance of an exchange-traded fund (ETF) made up of Valero and 2 dozen more global refiners. The VanEck Vectors Oil Refiners ETF (NYSE Arca: CRAK) has gained more than 17 percent this year, putting it at the top of the petroleum-sector ETF table.

CRAK is unique in more than one way. First, it’s the only petroleum-sector ETF making money this year. Or over the past couple years, for that matter. Second, it’s the only ETF in the sector focused on refiners. The first point is explained by the second. Ever since CRAK was introduced in 2015, the so-called “crack spread” has been priced in refiners’ favor.

The crack spread measures the gross profit obtained by distilling (“cracking”) crude oil into products like gasoline and fuel oils.

Low crude-oil input costs and relatively high proceeds from distillate sales have kept average gross refining margins plump at better than 36 percent since 2015. Compare that with the most recent S&P 500 operating profit of 10.5 percent and you can see the advantage enjoyed by refiners.

From the table above, it seems Mr. Medium could have earned a positive return with far less risk by betting on refiners rather than his “majors.”

And if he makes the switch? Perhaps next summer it’ll be me jawboning over his grill.