It’s often said that a picture’s worth a thousand words. Normally, these weekly missives run 300 words, so my picture may be worth a lot less. Here it is:

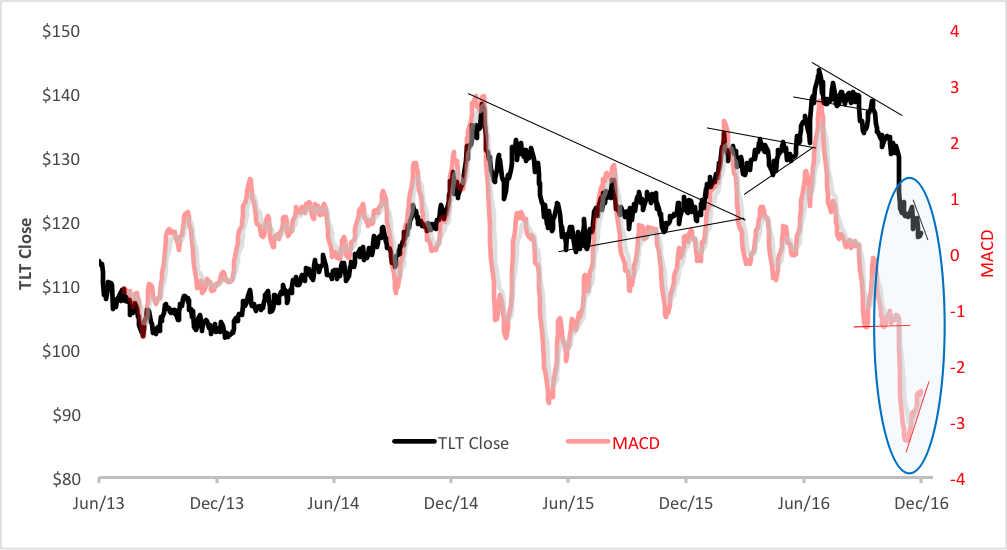

What you’re looking at is the price history of the iShares 20+ Year Treasury Bond ETF (NYSE Arca: TLT) plotted against its MACD (Moving Average Convergence/Divergence) oscillator. Not to get all nerdy on you, MACD is simply a gauge of price momentum derived from two moving averages – one short-term, the other longer-term. Subtracting the longer-term average from the shorter gives you the MACD, which fluctuates on either side of zero.

Generally, MACD — known to tech traders as “Mac-Dee” — tracks prices, but every now and then the signal diverges to flash an early warning of a trend reversal. Now’s one of those times. See the blue oval? See how TLT’s price is headed south but MACD is rising? That’s a klaxon sounding “price rebound.”

It shouldn’t be a surprise, really. MACD has been south of zero since early September, affirming the weakness in the bond ETF’s price, but the reaction to the recent election was swift and powerful, wrenching long bond yields up by more than 50 basis points and knocking TLT’s price down 9 percent.

MACD is signaling that move as too fast and too deep. We ought to expect a rebound in bond prices and an easing in yields — at least for a time.

On the long-term chart, the picture’s still negative. How negative? TLT seems to be aiming for the $97 -$101 level, potentially a further 18 percent decline. Aggressive traders are likely to use rebounds as selling opportunities.

For other investors, there’s the ProShares Short 20+ Year Treasury ETF (NYSE Arca: TBF) we mentioned in our December 2 column. The unlevered TBF portfolio offers 1x short exposure to the right side of the Treasury yield curve, complementing TLT with an r2 of 99.87.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.