We continue to observe tremendous complacency on non-U.S. equities and advise contrarians to consider favoring U.S. equities now.

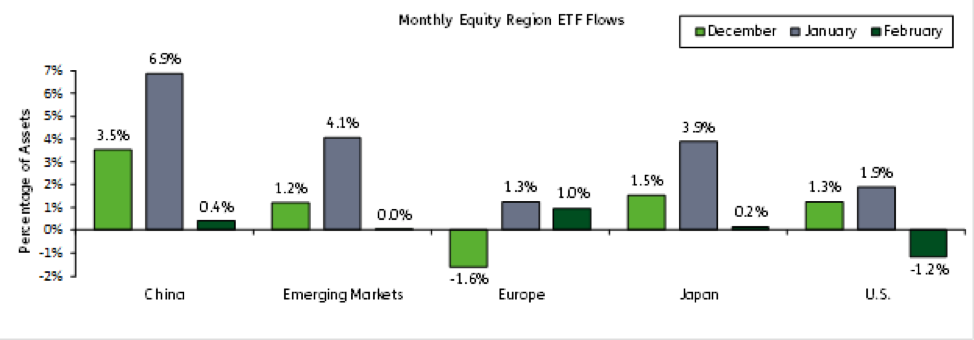

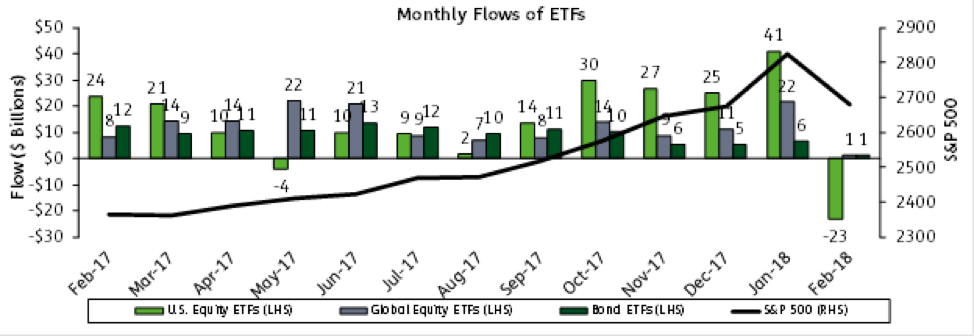

Global equity ETFs are continuing to draw big inflows despite steep losses. They issued $700 million (0.09 percent of assets) on Tuesday and $1.0 billion (0.1percent of assets) on Wednesday. On the first five trading days of February, they issued $1.2 billion (0.2 percent of assets) even though they plunged 5.5percent. Emerging markets, Europe, and Japan-focused funds all had inflows on Tuesday and Wednesday and have had positive flows month-to-date.

There is no such optimism on U.S. stocks. U.S. equity ETFs had outflows on each of the first five trading days of February totaling $23.2 billion (1.2 percent of assets), the biggest five-day outflow in our records. U.S. equity funds’ 5.4 percent loss in February is almost identical to the loss of their non-U.S.-focused counterparts.

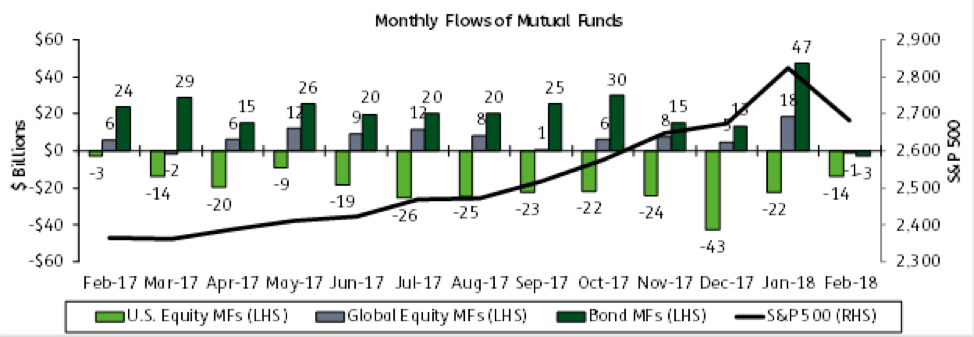

Mutual fund investors, most of whom are individual investors, have also favored non-U.S. equities over U.S. equities amid the sell-off, but this tilt is nothing new, and overall flows are not indicative of panic. We estimate, based on the funds we track daily, that U.S. equity mutual funds shed $13.9 billion on the first five trading days of February, while global equity funds lost only $1.4 billion.

David Santschi is the director of liquidity research at TrimTabs Investment Research, an Informa Financial Intelligence company.