By Rachel Evans

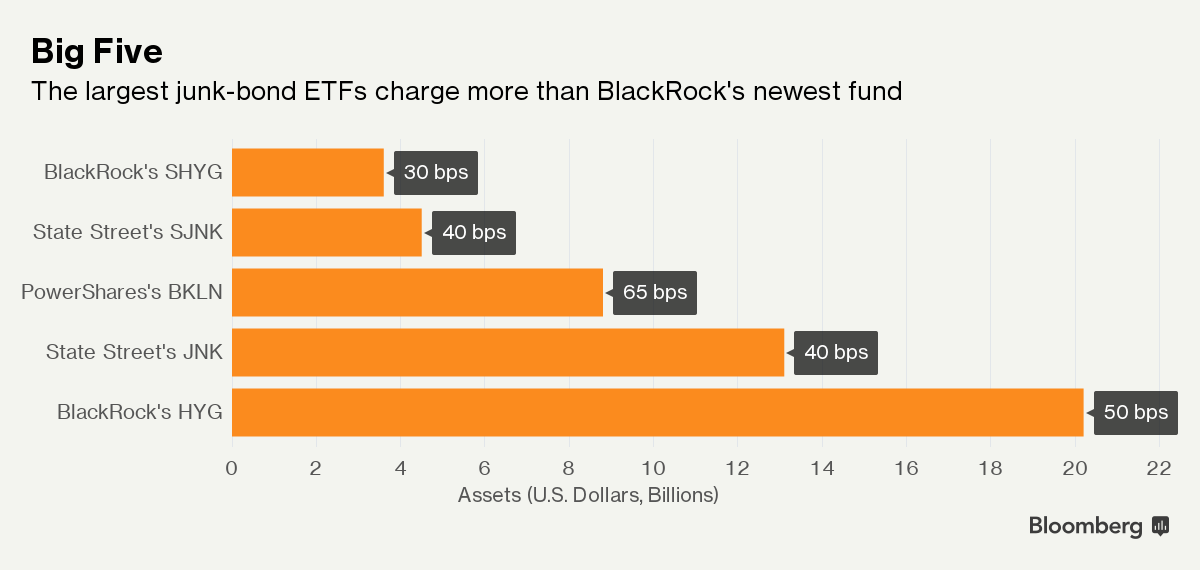

(Bloomberg) --Not content with running the world’s largest junk-bond exchange-traded fund, BlackRock Inc. is trying to entice investors with a low-cost alternative.

The iShares Broad USD High Yield Corporate Bond ETF, which comes with the ticker USHY, will give investors exposure to junk-rated debt for less than half the cost of its flagship high-yield fund, HYG, according to a statement from the company. That’s lower than any similar fund around the world, data compiled by Bloomberg show.

“Investors are increasingly looking for new ways to access bond markets through ETFs,” Steve Laipply, head of fixed-income strategy for the firm’s U.S. ETF business, said in the statement.

BlackRock’s new fund, which charges 22 basis points, supplants Deutsche Bank AG’s Xtrackers USD High Yield Corporate Bond ETF as the cheapest junk-debt ETF. That fund, which has an expense ratio of 25 basis points, has taken in almost $250 million since it started last December.

USHY is, as it’s name suggests, a broader slice of the high-yield market than some other funds. It will track the Bank of America Merrill Lynch US High Yield Constrained Index of 1,873 securities, almost twice the number of bonds included within HYG’s underlying benchmark.

To contact the reporter on this story: Rachel Evans in New York at [email protected] To contact the editors responsible for this story: Nikolaj Gammeltoft at [email protected] Eric J. Weiner, Dave Liedtka