By Ben Bain and Rob Urban

(Bloomberg) --The next step in the bitcoin revolution will take a bit longer than some anticipated.

The U.S. Securities and Exchange Commission has slammed the brakes on a dozen bitcoin exchange-traded funds and two cryptocurrency mutual funds since Jan. 8, making the week a watershed for Washington pushing back on the investment craze of the moment.

The regulator’s concerns include the safety of tying frequently traded ETFs to potentially illiquid assets and whether funds can be accurately valued when prices for digital coins are all over the map, said people with knowledge of the matter.

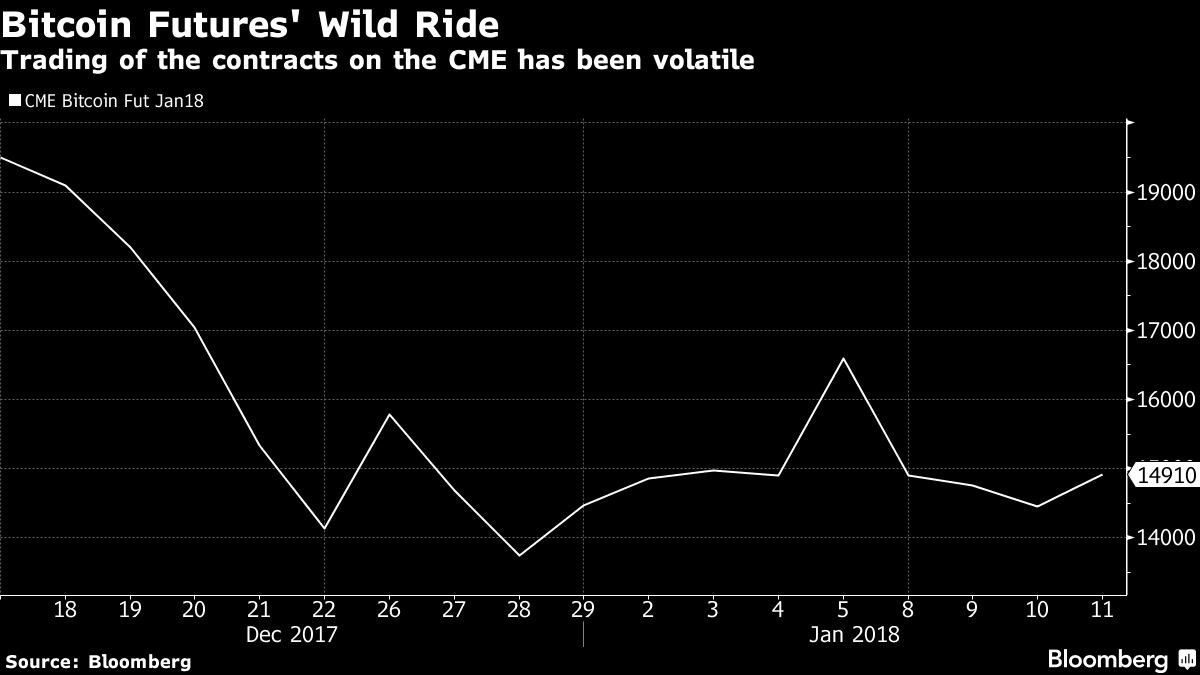

The go-slow approach isn’t what financial firms expected. When bitcoin futures started trading last month on CME Group Inc. and Cboe Global Markets Inc. exchanges, it triggered speculation that there would soon be a range of crypto ETF and mutual fund offerings. That in turn would draw hordes of new investors and lift bitcoin even higher after it surged more than 1,400 percent last year.

“This is not business as usual, it’s brand new terrain,” said Javier Paz, a senior analyst at consultancy Aite Group. “The SEC’s approach is prudent and a sign of the times. Somebody needs to be the grown-up in the room, to feel comfortable about handing out the keys to the ETF world.”

An SEC spokeswoman didn’t respond to a request for comment.

Several fund companies were told by the SEC to pull their applications after the regulator’s staff said it was worried about protecting investors, said the people who asked not to be named in discussing private conversations. The agency also wants more time to review whether the proposed funds actually comply with U.S. securities laws, considering that some investment vehicles would have been based on futures, while others would directly trade bitcoin, which is bought and sold on lightly regulated exchanges.

This week’s withdrawals included four ProShares proposed ETFs and one from VanEck, according to SEC filings. A mutual fund sponsored by the Cboe also pulled its registration. In announcing its plans to withdraw Jan. 8, Direxion Shares ETF Trust said the SEC “expressed concerns regarding the liquidity and valuation of the underlying instruments” the fund planned to invest in.

Winklevoss Rejection

Last March, the SEC rejected a proposal to list an ETF backed by the Winklevoss twins, Tyler and Cameron, who are founders of Gemini, a bitcoin exchange. At the time, the regulator raised concerns that exchanges wouldn’t be able to conduct adequate surveillance of the underlying market. Another issue was worries that hedging would be close to impossible because of the lack of bitcoin derivatives.

Many traders had assumed that the existence of CME and Cboe futures contracts would resolve the hedging problem. But in recent meetings with financial industry representatives, SEC staff has indicated that bitcoin futures themselves don’t guarantee it will green-light ETFs based on the cryptocurrency, according to one person familiar with the discussions.

The SEC has never developed comprehensive policies for approving ETFs, which are similar to mutual funds but trade like stocks. Firms that want to get into the business apply and wait for the agency to give them the all clear. Once companies get the SEC’s sign off, they’re able to list ETFs tied to all sorts of assets and indexes without going through a protracted application process each time.

Still, SEC staff told financial firms that the truncated process, which allows funds to go live after 75 days with little ability for the agency to stand in the way, wasn’t appropriate for bitcoin-related funds, said the people. That’s largely because of the legal questions raised by such untested products. The funds could ultimately still start trading if they allay the regulator’s concerns.

When the SEC rejected the Winklevoss’s proposal, officials said they wanted to see a robust, regulated derivatives market, David Shillman, an associate director in the SEC division that oversees exchanges, said at in industry conference in November.

Trading on CME and Cboe thus far hasn’t been particularly robust. Many brokers have been reluctant to participate or give access to their clients because of concerns about the mostly unregulated spot markets for bitcoin and those that have gotten involved have set extremely high margin requirements.

So far in 2018, combined daily trading of Cboe and CME’s futures contracts have ranged between $106 million and $181 million worth of bitcoin, according to data compiled by Bloomberg. There was a burst of activity on Dec. 22, with more than $360 million traded.

That’s pretty good for products born a month ago, but nothing compared with established contracts. S&P 500 Index futures trading routinely exceeds $150 billion a day, for instance.

“The futures market is aiming to tap into the popularity of bitcoin and institutionalize that demand, but institutions are still tiptoeing into the market and much of the initial impetus remains retail-driven,” said Aite Group’s Paz. “The volumes are very, very light. The large houses aren’t facilitating the clearing or trading of bitcoin futures for their clients. So that closes an important door for the vibrancy of bitcoin futures.”

To contact the reporters on this story: Ben Bain in Washington at [email protected] ;Rob Urban in New York at [email protected] To contact the editors responsible for this story: Jesse Westbrook at [email protected] David Scheer