Motivating clients to implement estate and income tax-efficient strategies in 2025 will be challenging for those clients who perceive the election’s outcome as favorable for tax purposes. Advisors know this is a priority and struggle with many clients who become paralyzed or stuck because of all the noise and uncertainty surrounding tax legislation.

I’ll explore two lines of reasoning to consider. I believe that the most effective way to motivate gun-shy clients is to educate them and give them intellectual certainty. It puts them in a mental environment where they’re able to make informed decisions and implement solutions.

First, let’s examine the history relative to taxes and debt to help clients understand where we are, where we might go and how it will affect them personally.

Estate taxes, as we know them today, were enacted in 1917. Before that, Congress enacted an estate tax three times to raise money to fund war efforts. The first was in 1797 for an undeclared war against France, the second in 1862 for the Civil War and the third in 1898 for the Spanish-American war. Congress repealed the estate tax on all three occasions when the wars ended.

Fast-forward to 1916, when the U.S. manufacturing sector was booming, and wealth was being concentrated by a handful of individuals. Progressives weren’t happy with this wealth inequity, and the 16th Amendment was ratified, adding a federal income tax to the law. In 1917, the United States entered World War I, and Congress enacted an estate tax. When the war ended, for the first time, Congress didn’t repeal the estate tax, and it remains today.

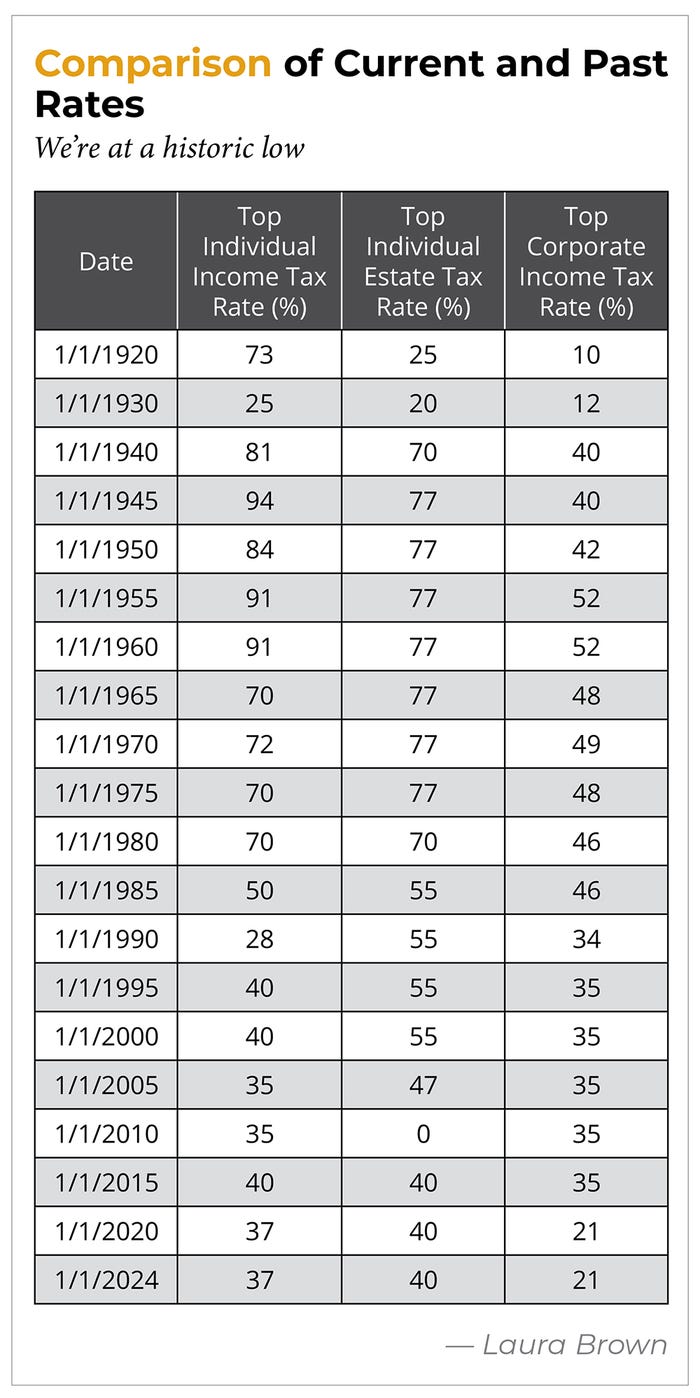

Where are our current income and estate tax rates relative to history? See “Comparison of Current and Past Rates,” p. 46.

You can see that our current tax rates are historically low. This is important for clients to understand.

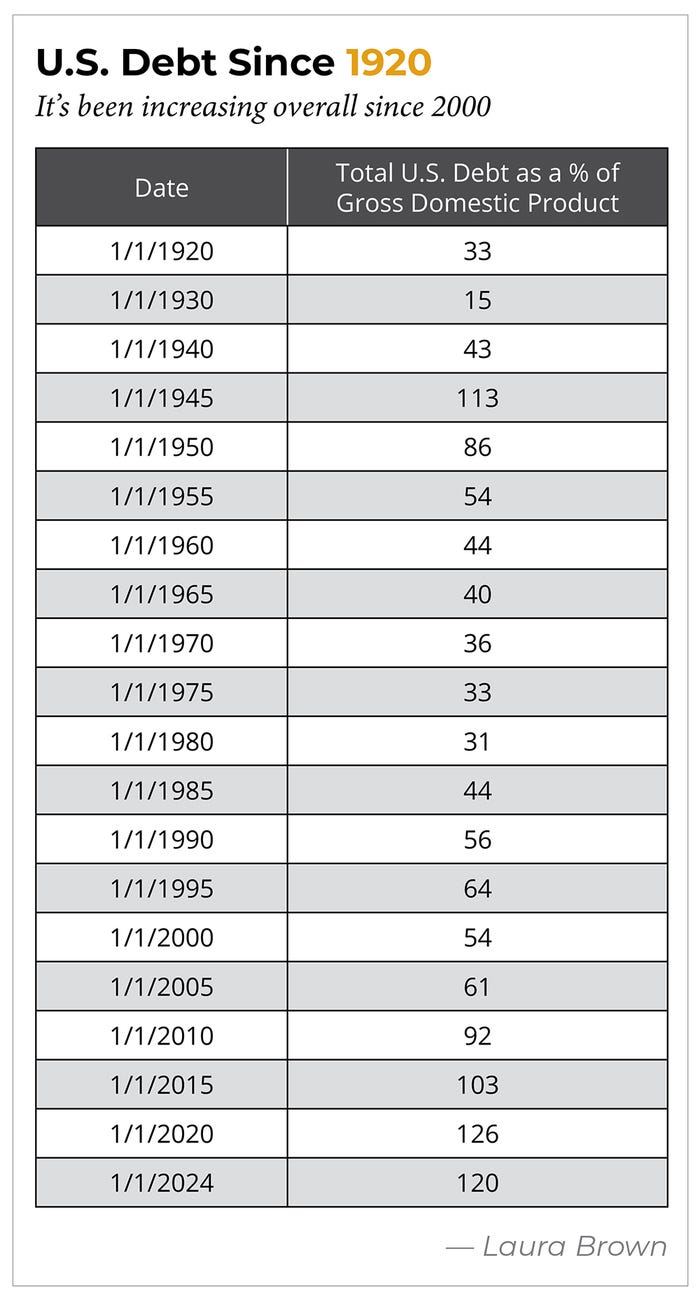

Now, let’s factor the country’s debt into this conversation. The current U.S. debt is over $36 trillion, which, as a percentage of gross domestic product (GDP), exceeds 120%. Historically, the debt the country incurred due to COVID-19 in 2020 is a record high, though the deficit overall has been increasing steadily since 2000. “See U.S. Debt Since 1920,” p. 46.

World War II is an interesting parallel to study. In 1945, the percentage of U.S. debt to GDP was 113%. Two decades later, in 1965, it had been reduced to 40%.

Look at the tax rates from 1945 to 1965. They were significantly higher than today. The United States partially reduced the deficit incurred funding World War II by heavily taxing income and estates. Therefore, it remains logical to assume that tax rates could increase today in response to the record high deficit we face.

It isn’t likely that tax rates for individuals will revert to 91% as in 1960 because there would be mutiny, but your clients need to realize the reality of today’s tax and debt conditions. Our tax rates are historically low, and debt levels are historically high.

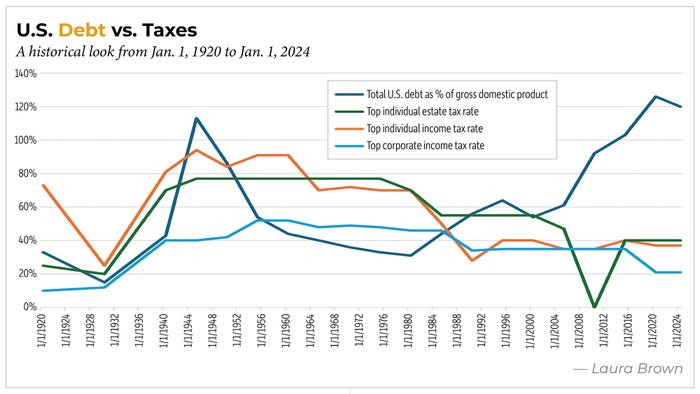

“U.S. Debt vs. Taxes,” p. 47, shows the history of U.S. debt compared to income and estate taxes. You can see that starting in 2008, the debt soared, and taxes didn’t keep up as they had in the prior years.

Based on “U.S. Debt vs. Taxes,” a logical course of action would be to go on the offense and protect assets from taxation. Cash value life insurance in and out of the estate is used to preserve growth on assets earmarked for accumulation as an income tax-efficient strategy. Fully use the current lifetime estate and gift exemption, and then beyond that, use grantor retained annuity trusts (GRATs) or sales to grantor trusts and other estate freeze, squeeze and burn techniques to remove growth of assets outside of your clients’ estates and simultaneously reduce the taxable estate.

We’re all familiar with the Democratic tax proposals floated before the election. They contained provisions that reduced the lifetime estate exemption to $3 million, raised estate taxes to 70%, taxed unrealized capital gains, increased corporate and individual tax rates and rendered GRATs, grantor trusts and discounts basically useless as effective estate-planning tools. Had the Harris administration won the election, clients would have more urgency to act. Even if the Trump administration can keep taxes where they are or even reduce them, how long can they be sustained? Perhaps the significant spending cuts they’re looking at will stop the bleeding on the spending, but will it be enough to keep taxes level and make significant progress in reducing the deficit?

If history repeats itself and numbers don’t lie, expecting taxes to increase is a reasonable conclusion.

Let’s say you walk your client through this explanation, and they agree that taxes might increase. But they’re willing to wait another four years to see what happens before implementing your recommendations.

Client Case Studies

I’ve worked with two clients in the past month with estates exceeding $100 million. Neither of these clients had implemented any gifting or insurance planning for estate tax purposes. Their stories might resonate with your client who wants to wait it out a little longer.

Case study 1. This client postponed implementing solutions presented in 2019. The client’s estate was worth $40 million then; today, it totals over

$300 million. This estate has grown 125% annually for the past five years.

The client now has a problem that can’t be completely solved with gifting or insurance. With just under $28 million available to gift in 2025, the estate can only move a mere 8.9% of the total value to an estate tax-free environment. The client can leverage those dollars and purchase life insurance totaling about $200 million, which will cover only 16% of the projected $1.2 billion estate tax liability at life expectancy.

In 2019, the lifetime exemption was $11.4 million. The client could have moved $22.8 million out of their estate, which would have grown by 125% annually for five years and would now total $232,950,000.

Instead, the $232,950,000 left in the estate will be taxed at 40%, a staggering $93,180,000 due in estate taxes today. Failing to implement sooner has cost them $93 million today and over half a billion at life expectancy. This could have been completely avoided had the client gifted to a trust before the tremendous growth in value occurred.

In fairness, maybe in 2019, the client felt that $22.8 million was too much to give away. Whether it was a control issue or a fear of running out of money, something prevented them from acting. Had they gifted even just $10 million, or some other smaller amount, they would have protected the future growth on that amount from estate tax. So many strategies successfully move future growth out of the taxable estate and give the clients a retained interest or access to income should they need it. I frequently design spousal lifetime access trusts, GRATs, sales to grantor trusts, loans to irrevocable trusts and qualified personal residence trusts, which help clients feel comfortable that they aren’t gifting their financial security away.

Case study 2. This case involved a couple who recently signed a letter of intent (LOI) for their business. They’ll have a liquidity event in 2025 of $200 million. Had they gifted the entity a year ago, the gift value would have been only $100,000. They could have captured $200 million of growth outside of their estate. The heartbreak of this case is that the entity, now worth $200 million, isn’t needed to provide any income for lifestyle, so there was no reason for them not to gift it other than they didn’t seek advice until it was too late.

Now that the LOI is signed, their estate’s value far exceeds the $28 million they can gift. They’re a new client, and there’s significant value I can bring to them through insurance for leverage, a valuation focused on maximizing discounts and other estate freeze, squeeze and burn techniques. But with earlier planning, I could have provided an even better result to the client.

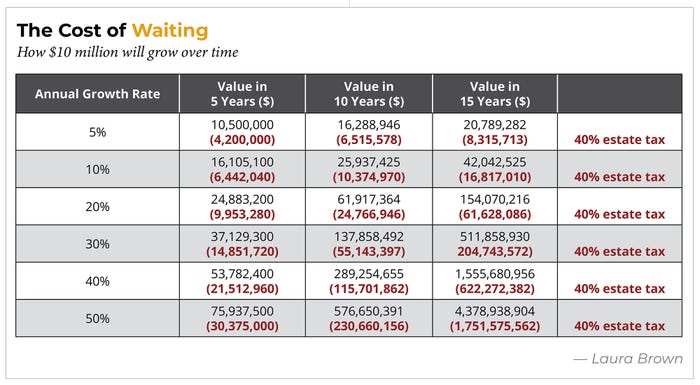

How can we quantify the cost of waiting and the negative impact that leaving a rapidly growing asset inside a client’s taxable estate can have? Let’s look at $10 million in value today growing at different growth rates over 5-, 10- and 15-year periods to determine the future estate tax cost. See “The Cost of Waiting,” this page.

Even at a modest 5% growth rate assumption, the estate tax cost in 15 years is over $8.3 million. For a client who will see a 200% return in five years on a business, the estate tax cost is $21 million.

Capturing growth outside the estate is an effective estate-planning technique clients have at their disposal. But it requires action before the growth occurs.

Your clients may choose to use the new administration as a reason to delay planning. Share with them the historical reality of taxes and debt, and help them understand that the growth of an asset inside the estate is harder to remove than an asset before it grows. Remind your clients that administrations and congressional control change often, and no law will be permanent throughout a client’s life.

You and your clients can’t control what tax rates and exemptions are or will be. However, you can control capturing growth outside the estate using today’s planning techniques. Planning causes no harm when done properly, but clients often regret not taking action until the problem is so large that it can’t be completely fixed.

About the Author

You May Also Like