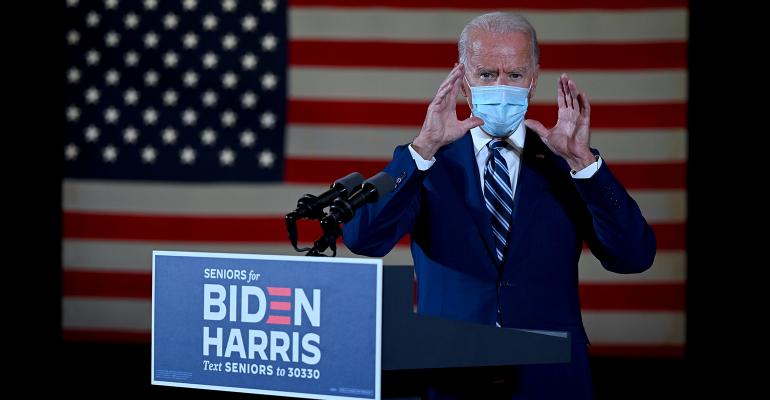

With a contentious election less than a month away amid an unprecedented pandemic, are clients prepared for the major tax changes likely to come alongside a Biden presidency (not to mention the possibility of a Congress controlled by Democrats)?

Presidential candidate and former Vice President Joe Biden’s proposed tax plans are no secret, with potentially massive tax hikes and reform on the horizon. Especially of concern is the $11.58 million gift and estate tax exclusion amount that was introduced under the Tax Cuts and Jobs Act, set to sunset at the end of 2025, but which Biden plans to undo much sooner. If so, this change could potentially be made retroactive to 2021.

Other changes, if passed, include reverting the individual income tax rate back to 39.7% (from 27%) raising taxes on long-term capital gains and doing away with step-up in basis.

Although an increase in business toward the year’s end is nothing new for wealth advisors, most estate planners I reached out to are experiencing an influx of clients, many of whom are looking to revisit their estate plans, more so than at any other time, as the election looms closer.

“We’ve seen at least a 200% increase in client and new client inquiries about using planning techniques in preparation of the election. Clients are concerned about how the market will respond and everyone is assuming that, if Biden is elected, the current exemptions may evaporate,” says Frank D. Paolini, counsel at Dentons in Chicago. “We speculate that, different from prior elections, the Democrats will be especially pressured to make more symbolic and intense bookends to tax planning schemes. So, we certainly have our work cut out for us this yearend!” he adds.

Kelsey Brock, a partner at The Blum Firm P.C. in Dallas, also says that “this is the busiest I have ever been in terms of new work coming in the door. Clients are increasingly concerned that we will see a Democratic sweep that cuts the estate tax exemption in half (at best), possibly even retroactive back to Jan. 1, 2021.” As a result, she adds, many clients are rushing to create trusts and lock in as much of their exemption as possible.

Wait and See?

But some planners, though definitely on standby for an influx of work, are also seeing clients taking the wait-and-see approach. Turney P. Berry, a partner at Wyatt Tarrant & Combs LLP in Louisville, Ky., explains that “clients are very tuned in to the risk of estate tax increases and are standing by to make gifts by year end if need be.”

Louis S. Harrison, a partner at Harrison & Held, LLP in Chicago, is bracing himself for the long hours ahead. “2020 appears to be a repeat of 2012, where planners were rushing year end to use the credit that was expiring, and crafting spousal lifetime access trusts (SLATs), primarily the generation-skipping transfer variety,” says Harrison. “It will be worse this year, however, because in those eight years, we’ve learned how to do these SLATs creatively, avoiding reciprocal trust concerns and retaining a bit more flexibility than before. Add to that the COVID-19 crisis, which already increased business for planners, increased estate administration and domicile changes.”

Beth L. Fox, an attorney at Harrison & Held LLP in Chicago, agrees, saying that “clients are mainly waiting to see the election results and preparing to scramble accordingly. There are some clients executing SLATs now, but if Biden wins, we’ll see a flurry of planning for G2s and G3s.”

While the opportunity to create trusts and make large charitable gifts right now is certainly there, some clients are understandably hesitant given the uncertainty, especially because trusts, such as SLATs, which use lifetime exemptions are difficult to later unwind.