Many financial advisors and estate planning practitioners primarily focus on managing cash flow during their clients’ lives and minimizing their estate taxes. However, an ancillary planning tactic—and something that’s often overlooked—is maximizing charitable contributions with certain retirement plan assets, such as individual retirement accounts and Internal Revenue Code Section 401(k) accounts, when an individual passes away. Although such retirement plans can’t be tax-efficiently transferred to charity during an individual’s lifetime, as explained below, they may provide substantial income tax savings when transferred at death.

The effort to maximize charitable dollars isn’t new. It’s been a focus for individuals and families who are currently committed to charitable causes (including the more than 225 who have signed the Giving Pledge), as well as early wealth creators like the Carnegie and Rockefeller families (who were some of the first families subject to the estate tax when it was introduced in the early 20th century).

Families who hope to fulfill philanthropic endeavors through their estates can take advantage of this estate planning strategy that maximizes funding charitable causes while simultaneously reducing estate taxes.

Compelling Economic Benefit

When formulating an estate plan, affluent individuals often prefer to bequeath cash and its equivalents to philanthropy while assigning their spouse or children as the beneficiaries of their retirement assets, such as IRAs and 401(k)s.

Because most traditional retirement plans have yet to be subject to income taxes—and will generally not be until they’re withdrawn —they’ve often grown in value to comprise large portions of your client’s estate. Further, retirement accounts don’t receive a step-up in income tax basis to their fair market value in an estate. This means that noncharitable beneficiaries must treat distributions in the same manner as the participant would have if they were alive, that is, as ordinary income.

Charitable organizations, on the other hand, are generally exempt from income taxation, including distributions from retirement plans. These factors combined are compelling reasons to overcome the misconception that retirement assets are best used for family bequests, when in fact, it’s often best to leave retirement assets to philanthropic recipients.

Value in New York City and Non-Tax States

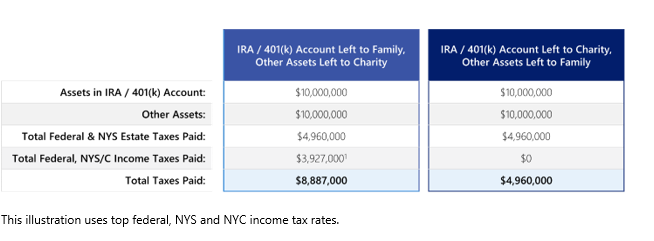

The following example demonstrates the magnitude of “flipping the script” for an individual with a gross estate that far exceeds their lifetime exemption amount and assumes no growth and income in the retirement account after the client has passed away. In a scenario in which both the decedent and the inheritor live in New York City, where the retirement account will be subject to both estate and income tax, gifting a retirement account to charity saves close to $4 million on a retirement account of $10 million.

The above analysis shows that estate and income taxes on a $10 million retirement account would be $8.9 million, leaving the inheritor barely more than $1 million. Given that the entire $10 million could be given to charity with $0 estate and income taxes, consider a philanthropic allocation.

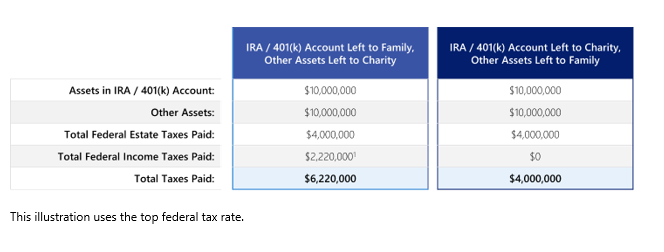

For clients residing in non-tax states, such as Florida, the financial impact isn’t as great but still yields a meaningful economic outcome. The example below demonstrates the incremental amount of taxes by providing a $10 million retirement account to a family member would be $2.2 million (as opposed to the $3.9 million in the example above).

Roth IRAs

Unlike traditional IRAs and 401(k)s, Roth IRAs won’t be subject to income taxes when distributed to beneficiaries. Accordingly, Roth IRAs are absolutely worth considering for family bequests.

Designating Various Beneficiaries

All retirement accounts require a beneficiary designation, which identifies where the funds in the account will go when the account owner passes away, be that to individuals or charitable institutions. More than one beneficiary can be identified to receive portions of the account.

Accordingly, allocating all or a portion of the account balance to charity is as simple as changing the beneficiary designation on file with the financial institution. It’s not only possible to change the allocation, which often occurs as an individual’s wealth evolves, but also there’s no limit on the number of parties that can be identified or the frequency of changes that can be made. In comparison, making a similar change of beneficiary in your client’s will is more complicated.

We’ve also seen families change their allocations to empower their younger generations to oversee future philanthropic activities and have even seeded family foundations in advance to start the process sooner.

Three Options

To implement a charitable beneficiary designation (full or partial), it is imperative to consider the options. There are generally three options, including a combination of the three. Here’s a quick summary of these options:

- Private family foundation: Ideal for those who wish to create a legacy to ensure their name, charitable mission and philanthropic goals live on. Investment income is taxed at only 1.39%, and annual gifting of 5% of the value of the PF’s assets is required.

- Donor-advised fund: Preferable for those who don’t want to take on the administrative responsibilities a PF requires and may want to donate anonymously. DAFs, taxed as public charities, aren’t subject to the 1.39% investment income tax and don’t require annual gifting.

- Direct donation to public charity: Best for those with a clear understanding of the exact organizations they’d like to support.

No Laughing Matter

The sheer stakes ensure that this is no laughing matter because the sums involved are substantial. According to one recent study of the affluent, retirement accounts comprise over half of overall wealth alone. Another survey, meanwhile, showed that ultra-high-net-worth individuals are now responsible for almost 40% of all individual charitable giving, which can be done efficiently with traditional retirement plans while eliminating their inherent income tax liabilities.

Mark Rubin is Managing Director, Head of Tax, Geller Tax, and Laura Williams is Tax Director, Geller Tax