I was recently asked by the Pulmonary Hypertension Association to present a webinar on estate and financial planning for those living with pulmonary hypertension (PH). Here’s what I learned in preparing for that webinar.

You can see a recording of the webinar and the PowerPoint at www.phaclassroom.org/financialplanning and visit the organization’s primary website at www.phassociation.com.

If your client is diagnosed with PH, although it will be difficult, it’s imperative that they take quick action to address a wide range of financial, legal and estate planning matters. They must review and take steps to secure insurance benefits, as well as organize legal and financial affairs, simplifying them to the extent feasible. Help your client obtain the necessary legal documents and encourage them to discuss them with the necessary people. Getting these steps under control as early as possible will make matters easier and more secure, and enable your client to focus attention on their health challenges.

What is PH?

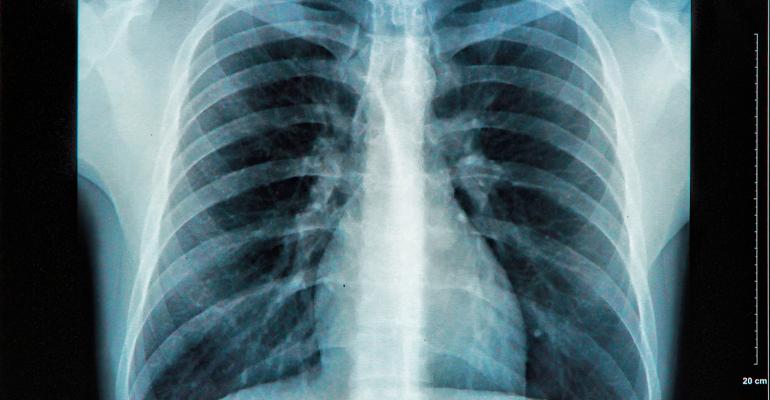

Hypertension is high blood pressure caused by constriction of arteries throughout the body. PH is a type of high blood pressure that affects the arteries in the lungs. Pulmonary arterial hypertension (PAH) is a chronic disease that causes high blood pressure in the arteries that pass from the heart to the lungs. With PAH, the arteries in the lungs become narrow and constricted. The result is that the right side of the heart has to exert greater effort to pump blood to the lungs, eventually leading to stress and damage to the heart, that is, heart failure.

The blood vessels connected to and within the lungs narrow, making it more difficult for the heart to pump blood through the lungs. A process called “fibrosis” makes the affected blood vessels become stiffer and thicker, which increases the blood pressure within the lungs and further impairs blood flow. The increased demands on the heart cause a thickening and enlargement of the right ventricle hypertrophy, reducing the heart’s ability to pump blood through the lungs. The right ventricular muscle over time doesn’t get enough oxygen to meet its needs, resulting in failure of the right side of the heart. While there are therapies to ameliorate the impact of PH and extend life expectancy, it remains incurable and is a chronic progressive disease.

Symptoms and Treatments

PH symptoms may include:

- Breathlessness

- Chest pain

- Dizziness

- Fainting

- Loss of energy

- Swelling of the arms, legs, ankles or abdomen

- Dry cough

- Raynaud’s phenomenon (discoloration and pain in the finger tips and perhaps toes that may be triggered by the cold)

- Brain damage can be a risk resulting from oxygen deprivation, resulting in forgetfulness or worse—but there’s little research on this.

As the disease progresses, the symptoms may worsen, and more moderate physical activity may trigger symptoms. For example, breathlessness that was triggered at an earlier stage from modest physical activity may occur while the patient isn’t exerting himself or herself at all.

Estate and financial planning should contemplate and prepare the patient for these potential changes to minimize the exertion needed to maintain finances and to have a safety net in place to protect the patient. Financial planning must address the impact the disease course may have on earning capabilities.

Treatments for PH depend in part on the source or cause of the disease. If someone has PH due to liver disease, the PH may improve with treatment of the liver disease. There are currently about 14 different PH treatments, with most for PAH. With chronic thromboembolic PH, blood clots in the lungs scar and harden. Some patients can be evaluated and may be candidates for surgery that scrapes out the clots from the lungs, which may resolve the problem. Some living with PH are candidates for transplant. The consequences and costs of a lung transplant are significant. Survival following a transplant may only be a few years. Some patients require both heart and lung transplant, which is more complex, costly and difficult. Treatments can be incredibly costly, from $50,000 to $250,000 per year. Financial planning must consider the costs of these treatments, what sources, insurance, family or other that may be available to apply to these costs. Estate planning must contemplate the time frames that may be involved and the significant risks associated with some PH treatments.

Who Gets PH

Almost anyone can contract PH. But there are some common risk factors.

- If two or more family members have PH or if a family member carries the PH-causing gene mutation, the risk of PH is more likely.

- Obesity and obstructive sleep apnea make PH more likely.

- Women are 2.5 times more likely than men to contract PH. Females of childbearing age are also more susceptible.

- Women after the age of puberty but before the age of menopause are the cohort most likely to be diagnosed with PH, but there isn’t significant data on other forms of PH.

- Pregnancy is a risk factor. Also, women who already have PH and become pregnant have a much higher risk of mortality.

- Living at a high altitude for years can increase the likelihood of PH.

- Other health challenges, such as congenital heart disease, lung disease, liver disease and connective tissue disorders like scleroderma and lupus, are risk factors for developing PH.

The risks and issues of pregnancy and alternative options that may be pursued (for example, adoption) should be incorporated into estate planning and documents, not only for the patient, but also, in many cases, for her family.

Mortality and PH

While mortality is never an easy or pleasant topic to address, your client must address it to plan properly. If your client plans for too short of a life expectancy, they may overspend, under save and run out of financial resources. If your client assumes too long a life expectancy, they may put off planning for a period that precludes proper planning or perhaps any planning. Understanding that planning, and addressing the difficult but essential issues of anticipated disease course and mortality, can empower your client. An empowered and knowledgeable client can have the most financially secure life for the years ahead, and best safeguard herself, as well as family and other loved ones. Perhaps these dramatic benefits can motivate clients to tackle these emotionally difficult issues.

While the prognosis of PH has an untreated median survival of 2.8 years from time of diagnosis, with the cause of death usually being right ventricular failure, many people can have much better results. With treatment, care and earlier diagnosis and disease management longevity can be much greater. Some survive four-to-five-plus years and some in the PH community have been living with the disease for as long as 30 years. How well an individual reacts to medications can be an important factor. Your client’s physician can assist in evaluating a likely disease course for him and estimating life expectancy based on a range of factors. This is critical to the type of financial and estate planning that’s appropriate. It’s also important that each client communicate the discourse and life expectancy to his estate and financial planning team and at periodic (ideally at least annual) meetings, apprise them of any changes.

Estate and Financial Planning Considerations

If you’re advising a client with PH, keep in mind that, generally, those living with PH should take the same steps as those living with any chronic illness, as well as consider additional steps. The goals of these additional steps are to minimize the physical effort that will be required to handle financial and legal matters and to create safeguards to minimize the risk of financial abuse as the PH progresses.

- Organize and simplify finances and record-keeping to make it easier to deal with all financial and other matters as the disease progresses.

- Obtain and sign key legal documents. These include:

- Durable power of attorney.

- Health care proxy.

- Living will (statement of health care wishes, for example, religious considerations, end-of-life decisions generally, decisions about mechanical ventilation and do-not-resuscitate status)

- Health Insurance Portability and Accountability Act release (authorizes someone to have access to patient’s medical records).

- Will (distributes assets and appoints a guardian).

- Revocable trust. In some instances, a revocable trust can address many of the functions of a power of attorney and will, providing a more robust mechanism to protect the PH patient as the disease progresses.

- Automate as many financial functions as possible to minimize the physical demands of handling routine financial matters (automatic deposits, bills automatically paid from checking account or charged to a credit card), recording a checkbook and all financial transactions on a computerized bookkeeping program like Quicken.

- Scanning as many financial and legal records as appropriate to be as paperless as possible.

- Review life, disability, health and long-term care coverage to assess what options and benefits may exist and what steps may be advisable to take to secure those benefits.

- PH often results in short life expectancy. It’s imperative that anyone diagnosed with PH begin to put their affairs in order. Many people living with a chronic illness may have no significant shortening of life expectancy. The reality of PH is that steps must be taken quickly.

- If there’s a family history of PH or the gene has been identified, your client should purchase life insurance as early as possible if feasible. Also, advise your client’s children to do the same. In many cases, it may be most economical to purchase a long-term policy, for example, 20 to 30 years depending on age that has conversion features. This will permit your client to have insurance coverage for many years that they might not be able to get if they wait until a future date to purchase coverage. The term coverage might also include rights to convert portions of the coverage from term to permanent insurance without a medical examination. This may be the only way to obtain permanent coverage if in fact it’s later than advisable to have it.

- Example: Mary Jones is 18, and three family members have PH. But for that consideration, she would likely not consider any type of insurance coverage and perhaps wait until she marries or has children. However, given the family history, she purchases a $500,000 30-year insurance policy at age 18 that has rights to convert all of it at specified future dates to permanent coverage.

- Some women with PH are advised not to become pregnant because of the increased mortality risks. Thus adoption, use of surrogates or other approaches may be more likely. If options like these are even contemplated, the provisions in the client’s will (and revocable trust if that document is used) defining “issue” should be modified to reflect the intention as to alternative methods of reproductive technology. Your clients should also speak with family members, for example a parent, encouraging them to modify their documents as well.

- Example: Mary Jones is living with PH, and her physicians have advised her not to bear children. As a result, Mary has explored adoption or contracting with a surrogate to be impregnated with her husband’s sperm. Mary’s parents’ wills provide for distribution on their deaths to their children (Mary and her siblings), but if any child (for example, Mary) predeceases, her descendants will inherit. But the form will Mary’s parent uses defines “descendants” as natural-born children or children adopted by age two. If Mary uses a surrogate or adopts a child older then age two, that child will never inherit from Mary’s parents although other grandchildren may.

- Your client should consider an organ donor card and including a provision authorizing organ donations in their living will and/or health care proxy so that scientific research into PH can be fostered.

- If your client can afford a donation to organizations serving those with PH or researching possible treatments and cures, plan for this. If your client’s estate won’t be taxable for estate tax purposes, there may be no tax benefit to making a bequest to such an organization. Instead your client can make the donation now or include a clause in their durable power of attorney permitting the agent to make a donation. In that way, an income tax benefit may be secured.