It is a somewhat accepted financial theory and best practice that diversification helps to improve the risk position of a given asset mix. And yet, the choice for variation when constructing an investment portfolio has been hard to make (even on purely academic grounds), with U.S. equities having significantly outperformed most equity “peers” in other geographies. For the 10-year period ending Aug. 31, 2017, the S&P 500 returned an annualized 7.61 percent vs. only 2.43 percent for emerging markets and 2.10 percent for international developed markets—which translate to a 10-year total return of 108.25 percent, 27.08 percent, and 23.08 percent, respectively (Source: Zephyr StyleADVISOR).

With this knowledge of the performance gap often comes the justification act, or—for better or worse—the “this time it’s different” argument (Run!). One rather common and supporting theory of why investors should ignore the “risky” allocation to international markets is based on the perception that many U.S.-listed companies operate on a global basis and, by definition, are already capturing the merits of growth in non-U.S. developed and emerging societies.

Our truth is a different one, and, in an early conclusion, it must be stated that investors forgoing a direct allocation to international markets are likely reducing their opportunity set for multiple reasons:

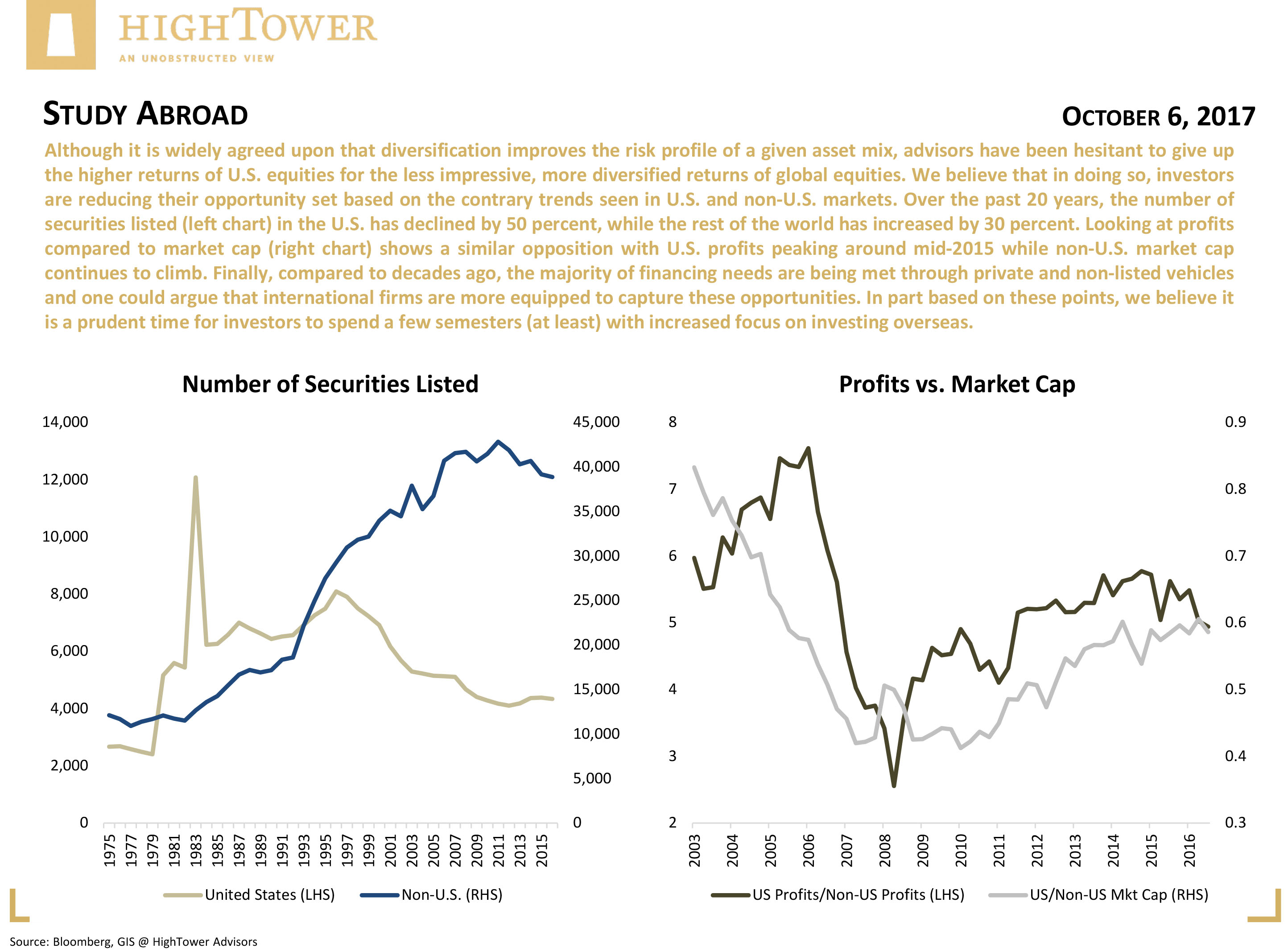

- Over the past 20 years, the number of companies listed in the U.S. has declined by nearly 50 percent, whereas listings in non-U.S. countries have increased by more than 30 percent. Considering, in this context, that emerging markets alone account for about 50 percent of global GDP, but represent only 10 percent of stock market capitalization, a “catch-up” trend is likely forming, with non-U.S. markets becoming more prominent as a capital source to fuel this growth.

- In comparing profits of U.S. over non-U.S. companies in relation to their market capitalization, U.S. profits peaked around mid-2015 and have been declining ever since. Over the same time period, the capitalization of non-U.S. markets has been relatively trending higher. Following this analysis, and assuming that markets follow earnings, U.S. market cap should decline further relative to non-U.S. markets, making investments abroad more compelling.

- A portfolio composed of U.S.-listed companies does not have the same reach into the domestic capital structure of foreign countries. As compared to decades ago, more financing needs are now being served through private, non-listed vehicles. While companies in the U.S. have matured, likely benefiting an investor’s risk position, a “regular” stock portfolio (holding only publicly traded companies) has lost an edge in capturing opportunities.

The question remaining is where to allocate capital abroad, given the current state of markets, especially considering increased geopolitical tensions. In part based on the above perspective, we believe it’s a prudent time for investors to spend a few semesters (at least) with increased focus on investing overseas.

P.S. Follow me on Twitter: @MoneyClipBlog

Matthias Paul Kuhlmey is a partner and head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to high-net- worth and ultra-high-net-worth individuals, family offices and institutions.