The week ending May 3 saw eight of the 11 major Sector Fund groups tracked by EPFR Global record outflows as the latest corporate earnings season begins to wind down and investors weigh another Fed rate hike in June into their outlooks for the year. Energy, Technology and Consumer Goods Sector Funds were the only groups to post inflows for the week while Real Estate Sector Funds posted their fourth straight outflow and nearly $500 million flowed out of Commodities Sector Funds.

With reform of the U.S. health care system back in play, and a slew of earnings reports to digest, Healthcare/Biotechnology Sector Funds posted their biggest outflow since late January. The redemptions from dedicated Biotechnology Funds accounted for over half the overall number and were the largest since early December.

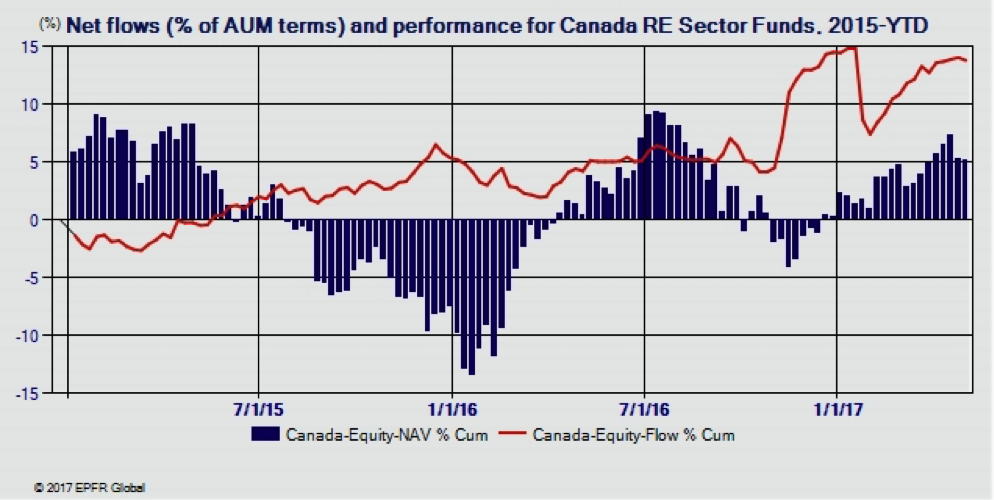

While the U.S. real estate market is digesting higher borrowing costs, Canada’s is dealing with a drop in foreign support thanks to new taxes in some cities aimed at overseas buyers and the struggles of a major alternative mortgage lender. Both flows and performance for Canada Real Estate Sector Funds have rolled over in recent weeks.

Energy Sector Funds posted their third largest inflow since mid-November, as investors penciled on supply cuts later this year — either by way of continued production curbs by OPEC or by political shifts in key producers such as Venezuela, Iran and Nigeria.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.