With all the major developed economies growing and many emerging markets posting good GDP numbers, flows into EPFR Global-tracked Sector Fund groups bypassed those with the most defensive reputations during the week ending May 10. Utilities, Telecoms and Gold Funds all recorded outflows while over $800 million flowed into Technology Sector Funds and Financial Sector Funds bounced back from the previous week’s outflow.

Also posting solid inflows during the week were Energy Sector Funds, with investors still hopeful that a combination of lower U.S. inventories, the start of the U.S. summer “driving season” and a possible extension of OPEC’s current production capping agreement will put a floor under energy prices during the second half of the year.

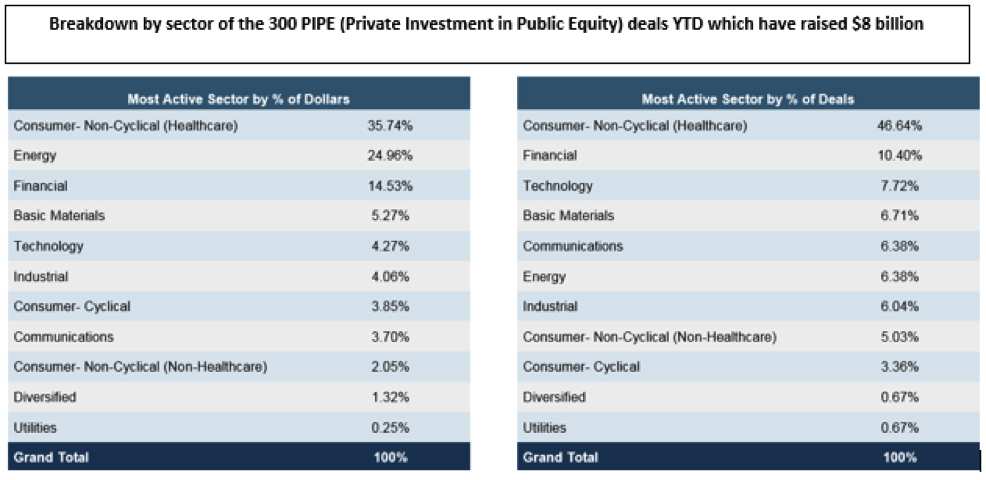

Healthcare/Biotechnology Sector Funds managed to post modest inflows despite the uncertainty created by Republican efforts to repeal and replace the reforms to the U.S. health care system enacted during Barack Obama’s administration. Pure Biotech Funds, which recorded their biggest outflow year-to-date the previous week, narrowly posted consecutive weekly outflows for the first time since mid-March. While flows to this fund group have been choppy for much of the year, data from EPFR Global sister company Placement Tracker shows that health care companies are leading the way so far this year when it comes to private placement in public equity (PIPE) deals.

Technology Sector Funds have benefited from the broad enthusiasm for technology plays, along with a string of high profile mergers and acquisitions within the sector, that have lifted the benchmark U.S. Nasdaq index to a series of record closes in recent weeks.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.