Conventional wisdom indicates that a company's market share predicts its profitability—active investment strategies often use this as a key metric—but empirical research finds that there actually isn’t much of a relationship between market share and profitability.

Verdad’s Dan Rasmussen examined all U.S. and Canadian public and private firms with more than $10 million in sales across Capital IQ’s 11 sectors and 160 industries—about 6,600 firms. To control for industry effects, he compared the operating margins of the largest firm in each industry to the industry average. Market share was computed as firm revenue divided by total revenue generated by businesses within a specific industry. The chart below shows that market share is not a consistent indicator of firm performance—the average r-squared was 0.0426, and no industry correlation was above 0.25. Defying conventional wisdom, many industries even exhibited a negative relationship between market share and profitability.

Rasmussen also found that in some industries, such as retail, firms with large market shares tended to run lower margins, perhaps reflecting the fact that lower prices tend to attract more customers.

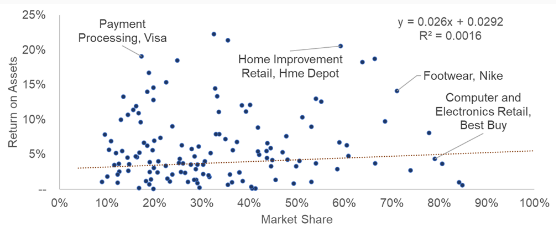

As a test of robustness, Rasmussen found that when using return on assets as the measure of profitability, the relationship with market share was even weaker—the r-squared was 0.0016.

He also found no relationship when using return on equity as the measure of profitability—the r-squared was just 0.00005.

Investor Takeaways

While the conventional wisdom is that companies exploit their market share to earn higher returns, the empirical data shows that this is generally not the case. Instead, companies earn their market share through better products, better pricing, better service and other firm-specific strategies. In fact, Rasmussen found that the majority of companies with the largest industry market share had below-market profit margins, as 56% of the industry-leading public firms had margins below the industry median.

Rasmussen’s findings not only have implications for investors but also for corporations in terms of establishing strategic objectives. Profitability has been shown to have explanatory power in the cross-section of stock returns and thus is included in the leading factor models; having a leading market share should not influence investment decisions.

Larry Swedroe has authored or co-authored 20 books on investing. All opinions expressed are solely his own and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice. Certain information may be based on third party data and may become outdated or otherwise superseded without notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SESC) nor any other federal or state agency have approved, determined the accuracy or confirmed the adequacy of this information. LSR-24-643