Many investors prefer cash dividends, especially those using a cash flow approach to spending. From the perspective of classical financial theory, this behavior is an anomaly. In their 1961 paper, Dividend Policy, Growth, and the Valuation of Shares, Merton Miller and Franco Modigliani famously established that dividend policy should be irrelevant to stock returns. As they explained, at least before frictions like trading costs and taxes, investors should be indifferent to $1 in the form of a dividend (causing the stock price to drop by $1) and $1 received by selling shares. This approach must be valid unless you believe $1 isn’t worth $1. This theorem has not been challenged since, at least in the academic community.

That is why no asset pricing models include dividends as an explanatory factor in the cross-section of stock returns. The leading models include market beta, size, value, momentum, profitability and investment, but not dividends. Quality (betting against beta) is another factor that has been shown to have a premium that has been persistent, pervasive, robust and implementable. The traits of quality companies are low earnings volatility, high margins, high asset turnover, low financial leverage, low operating leverage and low stock-specific risk.

Despite not being found to be an explanatory factor, a large, passionate, vocal community of investors strongly favor dividend-paying stocks, partly because they consider dividends as income when they are not. Simply put, income increases your net worth while dividends do not (as the company’s value falls by the dividend amount). Instead of being income (except for tax purposes), they are simply a way for companies to return investor capital (versus a share buyback). For taxable investors, it’s an inefficient way to return capital as taxes must be paid on the dividend.

With that said, the fact is that high-dividend paying stocks and growing-dividend stocks have outperformed the overall market. That fact helps explain the preference. However, the reason that dividends are not in any asset pricing model is that the research has found that it is not the dividends that matter in explaining returns but the other traits of the dividend payers. For example, high-dividend paying stocks tend to be value stocks, but using price-to-dividends produces the weakest value premium—price to other metrics such as earnings, cash flow and sales all produce higher value premiums.

Latest Research

To investigate if dividends are themselves economically informative or just provide a signal, Yin Chen and Roni Israelov, authors of the study “Income Illusions: Challenging the High Yield Stock Narrative,” published in the March 2024 issue of the Journal of Asset Management, split stocks in their eligible universe into high-dividend and low-dividend groups (50% of stocks in each group) by their median dividend yield in the previous year and analyzed the impact of dividends on investment returns under two different settings. In the first setting, they compared the performance of the two other groups and tested if the high-dividend group has historically outperformed the low-dividend group. In the second setting, they applied a dividend-based portfolio adjustment to a few long-only factor portfolios to test the hypothesis that investors can benefit from restricting their selection of factor winners among high-dividend groups. Specifically, they penalized the target weight of low-dividend stocks in the portfolio regardless of their factor scores. If low-dividend stocks predict lower future returns in the factor portfolio, they should expect stronger performance under the new construction.

They analyzed market beta, size, value, profitability, investment (Ken French data library), and momentum and quality (AQR data library). Their sample covered the period January 1964 to December 2021, with data from CRSP and included the top 1,500 U.S. stocks. Here is a summary of their key findings:

The high-dividend portfolio dominated both in return and risk. It realized a 13.8% average annual return with 15.6% volatility. In comparison, the low-dividend portfolio realized lower returns (11.8%) with much higher volatility (21.9%). The higher return and lower volatility resulted in a 3.6% difference in compound annual growth rate. The high-dividend portfolio also had smaller drawdowns during market corrections. Despite the high-dividend stocks’ outperformance in the full sample, investment in a long–short portfolio lost close to 1% per year between 2003 and 2021—the last 19 years of the sample. Most positive returns came from the middle 20-year period from 1983 to 2002.

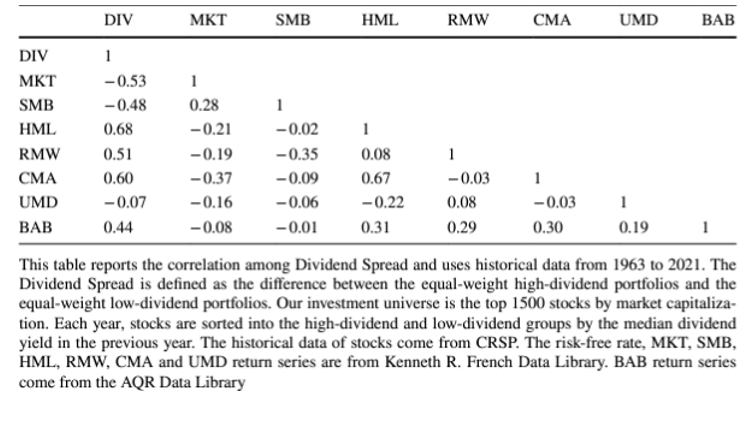

The dividend spread negatively correlated with the market beta (−0.53) and size factors (− 0.48), suggesting the high-dividend portfolio contains larger stocks with smaller market betas than those in the low-dividend portfolio. The spread was also positively correlated to the value (0.68), profitability (0.51), betting against beta (quality) factor (0.44) and investment factors (0.60). There was also a small negative correlation with momentum (-0.07). Thus, stocks without dividends tend to be growth stocks with lower profitability and more aggressive investment—stocks with those characteristics have underperformed the market.

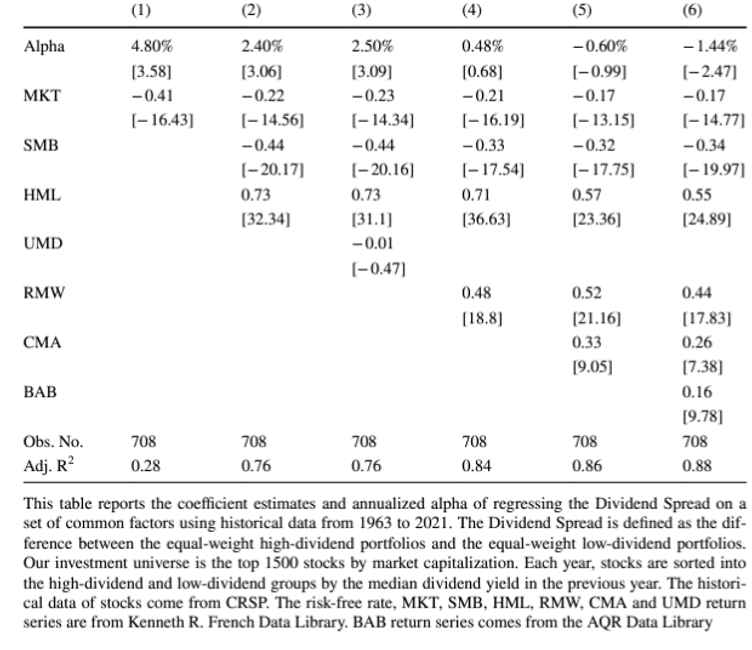

Consistent with financial theory and prior research, while the high-dividend group delivered higher returns than the low-dividend group, the outperformance was entirely explained by a set of common quantitative factors—after controlling for value, quality and defensive factors, the excess return of high-dividend over low-dividend turned negative. Compared to the single factor CAPM, the dividend spread portfolio produced a statistically significant alpha of 4.8% (perhaps explaining its popularity). Against the Fama-French three-factor model, the alpha was still an impressive 2.4%, and the explanatory power almost tripled as the r-squared increased from 0.28 to 0.76. Including momentum had virtually no impact. Including profitability, the r-squared was increased to 0.84 and the alpha was reduced to a statistically insignificant 0.48%. Including all five Fama-French factors further increased the r-squared to 0.86 while turning the alpha to a statistically insignificant negative 0.60%. And, including the betting against the beta factor further reduced the alpha to a statistically significant -1.44%.

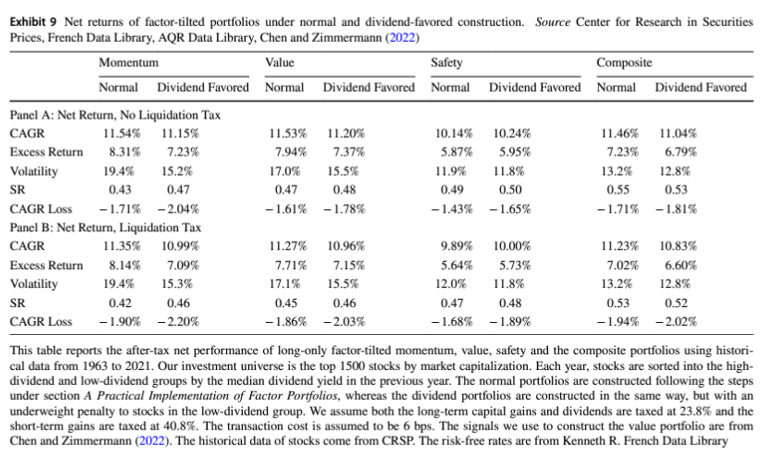

Tilting long-only factor portfolios toward high-dividend stocks had, in general, a negative effect on performance—the regression results showed that the dividend spread’s outperformance was more than completely explained by a set of well-known factors and investors could have avoided incurring the negative excess returns if they had held a combination of these factors rather than investing in the dividend-based long-short portfolio. For factors naturally correlated with dividend yield, the additional adjustment had little impact on gross performance but resulted in lower net returns due to the tax burden of dividend incomes (in taxable accounts). The dividend filter was too restrictive for the momentum factor, which is essentially uncorrelated with the dividend yield. This caused a large reduction in implementation efficiency and, hence, investment returns.

Considering the negative tax effect, the dividend-favored portfolios are even less desirable in terms of compound returns.

Their findings led Chen and Israelov to conclude: “Our analysis suggests that investors who seek to achieve alpha should invest directly in a combination of these factors instead of holding high-dividend stocks.” They added: “All things considered, the dividend yield is just a poor proxy for a value, quality and defensive-based multi-factor strategy. Our analysis demonstrates that active investors should not constrain their portfolios based on dividend yields.”

Chen and Israelov’s findings are consistent with my own research. My February 3, 2023 article for Alpha Architect, “Should investors be indifferent to dividend impact on stock returns?” showed that over the period January 1979 to October 2022, the dividend premium in the U.S. stock market has had a negative alpha against both the Fama–French five-factor model and the Fama-French five-factor model with momentum.

Investor Takeaway

Even without considering the negative tax implications of dividend-paying stocks (versus a stock that provides all of its returns in the form of capital gains), investors are better served by directly targeting factor exposures in their portfolio rather than using a dividend screen, which reduces the investable universe significantly, as only about 60% of stocks pay dividends. Thus, investors screening for dividends exclude about 40% of the eligible universe by number and about 20% of the total market capitalization. All else equal (such as factor exposures), by definition, a less diversified portfolio is less efficient.

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Partners, LLC.

For informational and educational purposes and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. The opinions expressed here are their own and may not accurately reflect those of Buckingham Strategic Wealth, LLC or Buckingham Strategic Partners, LLC, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-617