Although the overall stock market looks reasonably valued, there are pockets of extraordinary risk where stocks with the bubble-like valuations reminiscent of the year 2000 lurk.

Specifically, there is a “micro-bubble” in certain technology stocks, where valuations reflect expectations for future cash flows that would require unrealistically high margins, growth and market share. These expectations might not be so bubbly if not for the fact that the current margins and cash flows of these companies have been at very low, or even negative, levels for years.

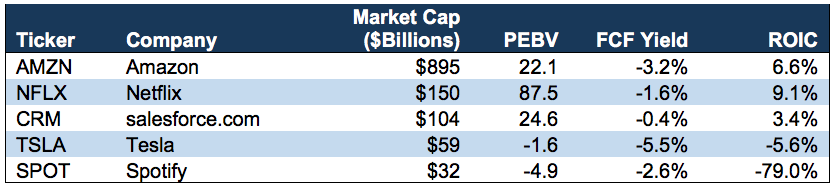

Figure 1 lists the five tech stocks we put in our first micro-bubble. They share a few key characteristics:

- Low or negative return on invested capital and free cash flow.

- Unrealistically high valuations: all 10 companies have negative book values or price-to-economic book values above 20.

- Expectations that they achieve heretofore have unseen dominant market shares.

These are five of the largest micro-bubble companies and what makes each a part of the micro-bubble:

Amazon.com

Fun fact: Amazon’s $885 billion market cap is higher that Walmart, Home Depot, Oracle and Disney combined. Investors are betting that Amazon can grow to dominate multiple industries while earning significantly higher margins than it does now.

Amazon has finally shown an ability to earn a profit, but it still must grow net operating profit after tax by 30 percent compounded annually for 19 years to justify its current valuation. See the math behind this dynamic DCF scenario. For comparison, only six companies in the S&P 500 managed to grow NOPAT by 30 percent compounded annually for the past 10 years. Maintaining that growth rate for nearly double that time frame would be an extraordinary feat.

Amazon prefers to point investors to free cash flow, but its reported free cash flow numbers are an illusion. In reality, the company continues to experience significant cash outflows. Investors who focus on understanding true cash flow and fundamentals know the disconnect between actual cash flow and the market’s expectations for future cash flows borders on the absurd.

Netflix

Felix Salmon of Slate recently published a piece titled “Netflix Can Either Become the Dominant Media Monopoly of the 21st Century or Go Bust.” The market values Netflix as if it will be that dominant monopoly when, frankly, there’s a very good chance it goes bust. Risk/reward for this stock is so bad that no investor with any respect for fundamentals can own this stock in good conscience.

Salesforce.com

Salesforce has racked up losses for years while pursuing growth at any cost. The theory behind this strategy is that the company will eventually be able to cut back heavily on its marketing and R&D costs while maintaining its recurring revenue stream.

Even if this strategy does work, which is far from certain, the company is currently valued at 10 times revenue, or double the valuation of Oracle. This hasn’t dissuaded bulls, as Salesforce generates classic tech bubble-style headlines like “Ignore Salesforce’s Valuation.” In other words, they want investors to ignore fundamentals.

Tesla

Tesla currently has a higher market cap than General Motors despite selling about 1 percent as many cars in 2017. What’s more, GM is already ahead of Tesla in self-driving technology and rapidly catching up when it comes to electric vehicle production.

Elon Musk keeps promising that Tesla will revolutionize the auto industry, but so far Tesla hasn’t shown an ability to navigate the manufacturing logistics that the established automakers figured out decades ago. The company’s valuation is blind to fundamentals and seems entirely focused on the cult of personality that has built up around Musk.

Spotify

Spotify wants to disrupt the music industry, but so far it remains beholden to the big three record labels that own 85 percent of the music streamed on its platform. The market thinks of Spotify as a trendy tech company, but as we wrote in our report on the stock, the economics of its business are more similar to the movie theater industry.

Spotify’s leverage against the record labels is further weakened by the rapid growth of competitors like Apple Music. It’s hard to see how Spotify can justify the growth expectations implied by its valuation unless it could pull off the unlikely feat of taking over ownership of its content from the labels while holding off competition from other streaming services (all without having to overspend like Netflix has).

Again, we see a company where the valuation reflects the best-case scenario with little to no tether to fundamentals.

How to Bet Against the Micro-Bubble

Investors that want to bet against these micro-bubble stocks can short them directly, but that can be expensive and risky for these momentum-driven companies. As the saying goes, the market can stay irrational longer than you can stay solvent.

Another way to profit from the busting of this micro-bubble is to invest in the incumbents from which these companies must take major chunks of market share. When these micro bubble stocks fall back to earth, a great deal of capital should be reallocated to the incumbents.

Macro Bubbles Versus Micro Bubbles

Today’s market has some micro bubbles, or smaller groups of overhyped stocks trading at ridiculous valuations. That makes it very different from the tech bubble, which was a macro bubble, a market-wide phenomenon that distorted the valuation of the entire market.

A few new features are shaping the market now which may explain why today’s bubbles are unlikely to spread to the entire market, at least for the foreseeable future:

- Politicians and Policymakers Focused on Preventing Macro Market Crashes: Today’s politicians and policymakers are heavily shaped by both the tech bubble in the late 90s and the housing bubble in the mid-2000s. They will likely do everything in their power to prevent a recurrence of such cataclysmic events on their watch.

- Rising Influence of Noise Traders: Noise traders, who make investment decisions based on noise and have no regard for fundamentals, are an increasingly influential force in today’s market. Roughly a quarter of all U.S. adults with internet access are retail online traders. That’s around 50 million investors who don’t have professional trading, much less investing, experience and might be more susceptible to buying into “story” stocks without understanding the fundamentals. There’s power in those numbers.

- Overhyping of “Transformative” Technology: The splintering of online media has led journalists to overhype nearly every new technology and trend in a relentless competition for clicks. For example, despite the “Retail Apocalypse” narrative, brick-and-mortar sales still account for 90 percent of retail sales, and Walmart earned nearly three times more revenue than Amazon last year. In reality, very few new technologies are as transformative as we like to imagine.

- Value Transfer Versus Value Creation: Too many investors overestimate the value creation opportunities for new technologies. Even when technologies are transformative, predicting who will reap the benefits of these technologies is difficult. Often, most of the value accrues to end users/consumers and not corporations. When it does accrue to a company, it’s usually at the expense of another company. During the tech bubble, bulls believed that the internet would make our economy radically more productive and allow the 5 percent GDP growth rate of the late 90s to persist for many years. When this utopian future failed to materialize, the market collapsed. By contrast, today’s micro-bubble companies compete against firmly established incumbents from which they must take large chunks of market share to survive. Instead of adding value, these companies aim to take value from existing players. Even if they succeed, we think much of that value will eventually pass to consumers.

This last point is key. In 1999, investors gave Microsoft its absurdly high valuation because they believed its software would create enormous amounts of value and growth for thousands of other companies. On the other hand, Tesla’s sky-high valuation implies that it will take market share away from General Motors and Ford, which decreases the valuation of those companies.

These modern-day, micro bubbles reflect the zero-sum nature of today’s crowded and more mature competitive landscapes.

Why We’re Not In a Macro Bubble

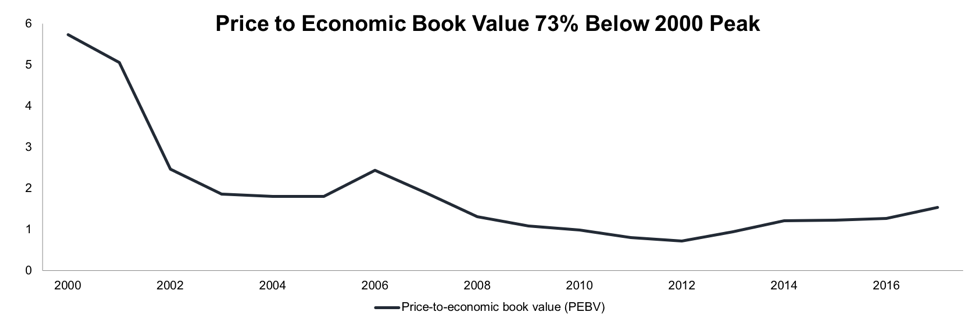

Figure 2 sums up the difference between the tech bubble and today’s market pretty clearly. It shows the price to economic book value of the largest 1,000 U.S. stocks by market cap going back to 2000. PEBV compares the current valuation of a company compared to the zero-growth value of its cash flows NOPAT, so a higher PEBV means the market expects more future cash flow growth.

While the market’s PEBV has more than doubled since 2012, from 0.7 to 1.5 percent, it’s nowhere close to its tech bubble level of 5.7.

There are definitely some outrageously valued companies out there, but those high valuations haven’t spread to the rest of the market. People forget that high valuations weren’t confined to tech stocks in the late 90s. At the height of the tech bubble, Walmart had a price-earnings ratio of 46 and a PEBV of 5.1. Currently it has a P/E of 30 (artificially inflated by a $3 billion loss on debt refinancing) and a PEBV of 0.9.

Bubble alarmists are hyping up the valuations of a subset of stocks while ignoring the rest of the market.

What’s Next

Our next report on this topic will highlight some of our favorite stocks to buy as a bet against this micro-bubble. Subsequent reports will highlight more micro-bubbles in industries such as payments, social media and real estate.

David Trainer is the founder and president of New Constructs, an independent equity research company.

Disclosure: David Trainer and co-authors Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.